IMARC Group, a leading market research company, has recently released a report titled "Black Gram Market Size, Share, Trends and Forecast by Region, 2025-2033." The study provides a detailed analysis of the industry, including the global black gram market size, share, trends, and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Black Gram Market Highlights:

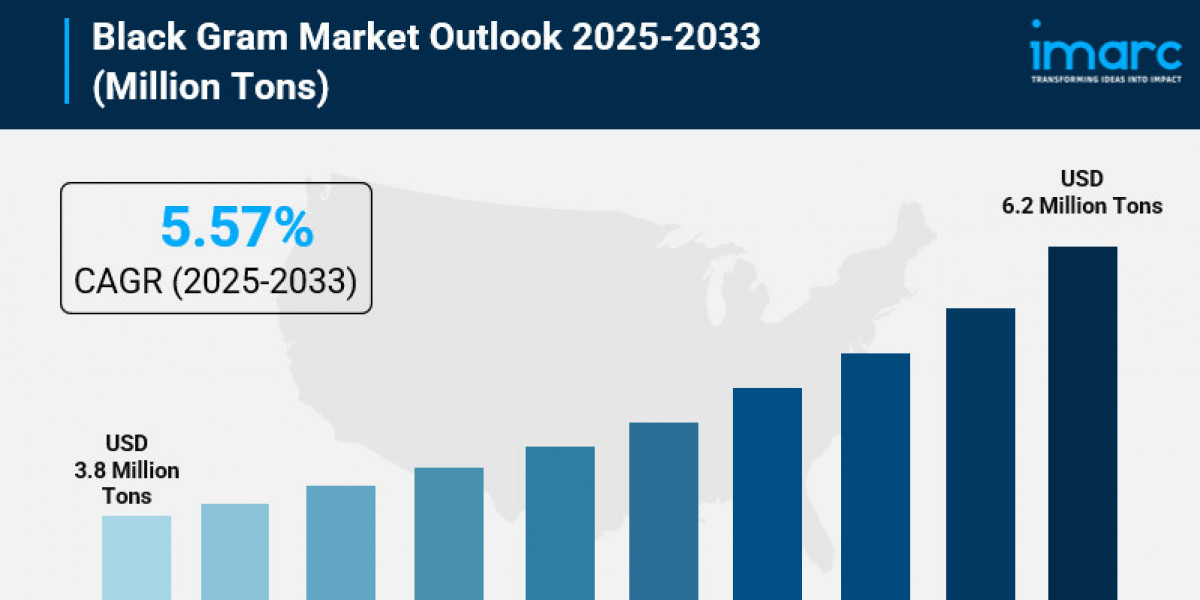

- Black Gram Market Size: Valued at 3.8 Million Tons in 2024.

- Black Gram Market Forecast: The market is expected to reach 6.2 Million Tons by 2033, growing at an impressive rate of 5.57% annually.

- Market Growth: The black gram market is experiencing steady growth driven by rising demand for plant-based proteins, expanding health awareness, and supportive agricultural policies.

- Regional Leadership: India commands the largest market share at 68.8%, fueled by extensive cultivation, significant domestic consumption, and strong cultural affinity for pulse-based diets.

- Nutritional Benefits: Rich in proteins, fiber, and minerals, black gram is becoming a preferred choice among vegetarians, vegans, and health-conscious consumers seeking sustainable food alternatives.

- Government Initiatives: Favorable policies including minimum support prices, input subsidies, and access to high-quality seeds are encouraging farmers to increase cultivation.

- E-commerce Expansion: The rise of online retailing is transforming black gram distribution, with digital platforms providing door-to-door delivery and subscription options across urban and rural areas.

- Market Challenges: Supply chain complexities, post-harvest losses, and the need for climate-resilient seed varieties present ongoing challenges.

Claim Your Free “Black Gram Market” Insights Sample PDF: https://www.imarcgroup.com/prefeasibility-report-black-gram-processing-plant/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Industry Trends and Drivers:

- Surging Demand for Plant-Based Protein Sources:

With the trend of vegans and vegetarians growing globally, black gram has become popular globally as a plant-based protein alternative (due to the presence of complete amino acids, fiber, and minerals) to animal-based protein sources among health-conscious consumers due to the increase in the number of vegetarian and vegan people worldwide. With the growing demand of consumers for environmentally-sensitive and sustainable food, black gram is now marketed as a staple food, health supplement and high-protein snack foods, and also as an ingredient in the ready-to-eat and high-protein food products. According to the industry report, one in three Indian restaurants today offers plant forward dining, and half of India's restaurants offer vegan, keto, or plant-based diets, which are more about health, sustainability, and local food, which in itself is driving consumption across many consumer segments.

- Strengthened Government Support and Agricultural Policies:

Government initiatives such as minimum support prices, input subsidies and provision of quality seeds, must be implemented in order to increase black gram production in key Indian markets and reduce import dependency. Encouraging area under mixed cropping and intercropping with black grams has also been a government initiative to increase the productivity of black grams in Indian markets. In January 2024, the Government of India launched a new portal for farmers to pro-actively buy Tur Dal directly. India is expected to achieve self-sufficiency in pulses in January 2028. To benefit the farmers with a minimum support price, other pulses like black gram will be added to the project. This is to increase local production of pulses. The Indian Agricultural Research Institute directed farmers to sow green gram and black gram when soil moisture allows germination in June 2025. For improved returns, farmers are encouraged to plant high-yielding varieties, including Pusa 1431 and Urd Type-9. Training programs and rural extension services help farmers with best practices. This reduces post-harvest losses and smooths supplies in the domestic market, resulting in greater incomes to farmers.

- Rapid Growth of E-commerce and Digital Distribution:

Online retail has changed the role of black gram trading. Online retailing has introduced black gram to customers and enabled greater accessibility. As per the International Trade Administration, the global B2C eCommerce revenue is expected to reach USD 5.5 Trillion by the year 2027. The Indian e-commerce market is valued at USD 63.17 Billion. Online marketplaces account for 30% of product searches in 2023. Through door-to-door delivery and subscription services, black gram has become accessible to both urban and rural consumers, improved by efficient logistics and real-time inventory management to ensure the freshness of the product. Targeted marketing is available for health-conscious consumers. Bundled products exist too. Digital marketplaces act as a platform for small producers to reach consumers directly. They contribute to transparency with reduced prices. E-commerce should grow the black gram market as online grocery shopping becomes more common.

- Expanding Applications in Food Processing and Value-Added Products:

The multipurpose use of black gram in making convenience and ready to cook food products, protein supplements, and convenience snacks makes its use attractive to manufacturers in urban centers where the population has faster turnover of meals and requirement of easily portable and ready-to-eat protein supplements and snacks. Existing customary uses in many South Asian cuisines give this pulse a defined domestic market, while increasing applications in processed foods expand appeal to modern consumers. Processing companies are now looking for improved methods to obtain refined products to meet growing opportunities in value added processed foods and the increasing demand for packaged organic pulses. Black gram's application in Ayurveda and other customary medicine for treating digestive, musculoskeletal and reproductive disorders is emerging, along with its potential medicinal applications as an antihyperglycemic agent for diabetes and antihypertensive for hypertension, due to the prevalence and rise in chronic diseases worldwide. This growing application diversification is also creating a more positive outlook for market fundamentals in the industry.

Black Gram Market Report Segmentation:

Breakup By Region:

- India

- Myanmar

- Thailand

- Others

India dominates with 68.8% market share, reflecting extensive cultivation, significant domestic consumption, and strong cultural affinity for pulse-based diets combined with favorable agro-climatic conditions.

Ask Analyst For Request Customization: https://www.imarcgroup.com/request?type=report&id=660&flag=E

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1–201971–6302