Market Overview:

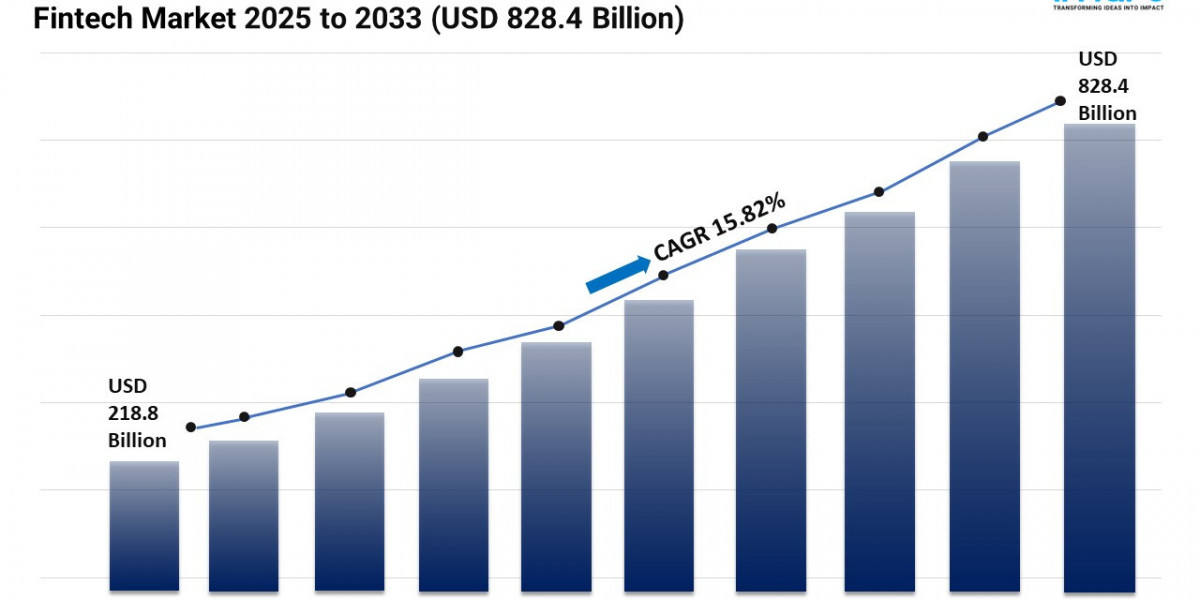

The fintech market is experiencing rapid growth, driven by digital transformation imperative, regulatory landscape evolution, and unmet financial needs. According to IMARC Group’s latest research publication, “Fintech Market : Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033”, The global fintech market size was valued at USD 218.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 828.4 Billion by 2033, exhibiting a CAGR of 15.82% from 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/fintech-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends And Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in Growth of the Fintech Market:

- Digital Transformation Imperative

The fintech space was growing quickly. With mobile banking, in the US population, mobile applications have been used for the fast transfer of small sums of money, and the use of digital wallets is helping to support payments in Europe. Social networks (i.e. Twitter) are informing the public of new types of digital finance systems to reach a younger and more technologically adept population. Urban centers tend to be faster to adopt digital systems. There is no right to internet provision in the countryside. With easy to use services, people are able to handle money on the internet, opening an increasing market to online financial services. In Asia, low-cost investing robo-advisors were also popular. During COVID, contactless payment was further popularized in Australia, where transactions for everyday purchases have been made faster and more secure. Digital lending institutions acquire clients via social media marketing.

- Regulatory Landscape Evolution

As a result, many fintech companies are growing at a rapid pace, as a result of the more developed and transparent financial regulation. Open banking in Europe is encouraging financial institutions to share their information in order to allow new companies to enter the market. The US has created a regulatory sandbox, allowing companies to test their fintech products under the watch of the regulators, so that new entrants can be innovative and yet remain safe. The changers and makers in the industry are being called up by websites like LinkedIn. Fintech enterprises tend to be quite compliant with the rules in the cities but smaller firms in the countryside need assistance to be compliant with the regulations. The clear rules and regulations give people and investors confidence of digital usage. For example, Japan has made changes to its law to add trust through regulation, and the Australian open financial movement allows greater sharing of financial service-related information.

- Unmet Financial Needs

Most people have no access to customary financial services, which is why financial technologies (fintech) play an important role in our everyday lives. In Africa, mobile apps help unbanked workers to send small amounts. New credit-scoring devices in the US also implemented in parallel give small firms easier access to their capital, and Instagram has also played a part in promoting knowledge of inclusive finance amongst excluded individuals. In rural areas, the basic requirements for the workers are the money payment and saving, whereas the users in the cities will prefer fast and timely payments. In the Asian countries, the gig economy workers and freelancers are working with immediate payments. Digital wallets with better cashflow management features are starting to make their way into the hands of self-employed Australians. Fintech advertising is selling products designed to cater to a particular community bringing users with a particular need.

Key Trends in the Fintech Market:

- Expansion of Embedded Finance

The essence of embedded finance is that it is present in most of the apps: online shops, health applications, travel can provide you with the possibility of payment, loan, or even insurance service-the customer does not need to visit a bank. An example of this is the buy at check out at online stores that offer buy-now-pay-later solutions. This lets the customer purchase more and become loyal to the brand. In a bid to offer their services where the users are, fintech companies have joined forces with such providers. This provides a painless experience for consumers and scalability for fintechs, which means that built-in finance and money tools are becoming even more common and part of everyday life. And finance is becoming a more natural conversation to have as a result.

- Advancements in AI and Automation

An important trend in fintech is artificial intelligence. AI can identify fraud, help answer customer questions, and make better financial decisions faster. Simple questions and interactions do not need to take up so much of the user or company time and can be handled automatically by a chatbot. ML can also be used to decide whether an user is credit worthy (using, for example, the history of the user's phone bills or the history of their shopping or social life). Smart investing tools allow everyone to invest and are developing quickly as they are cheaper than customary advisors (i.e. robo-advisors). Such tools allow fintechs to deliver fast, smart, and cost-efficient services to many more people and Artificial Intelligence is allowing fintech to stay on the lead by making every one of its processes faster, accurate, and more perceptive than its predecessors.

- Focus on Sustainable and Ethical Finance

Fintech operations are becoming ever more planet-friendly and ethical, and there are a growing number of apps that help customers keep track of their spending and the carbon footprint of their purchases. Other fintech apps enable green investing, creating options for building a portfolio that invests in environmentally-friendly companies. People want transparency, fairness and security in how their personal data is handled; companies are held accountable through social media and informal public discussions. So, as a result, more and more fintech companies are driving this ESG policy into their business. I think it's a win-win situation both ways and I think it will help in building relationships with users who are looking for environmentally and socially responsible actions.

Leading Companies Operating in the Global Fintech Industry:

- Adyen

- Avant, LLC

- Fidelity National Information Services, Inc.

- Fiserv, Inc.

- Klarna Bank AB

- Mastercard Inc.

- Nubank

- PayPal Holdings, Inc.

- Revolut Ltd

- Robinhood Markets, Inc.

- SoFi Technologies, Inc.

- Stripe, Inc.

Fintech Market Report Segmentation:

By Deployment Mode:

- On-premises

- Cloud-based

On-premises represented the largest segment as some financial institutions and businesses prefer to maintain control over their data and infrastructure, especially for sensitive financial transactions.

By Technology:

- Application Programming Interface

- Artificial Intelligence

- Blockchain

- Robotic Process Automation

- Data Analytics

- Others

On the basis of technology, the market has been segmented into application programming interface, artificial intelligence, blockchain, robotic process automation, data analytics, and others.

By Application:

- Payment and Fund Transfer

- Loans

- Insurance and Personal Finance

- Wealth Management

- Others

Payments and fund transfer exhibit a clear dominance in the market on account of the growing consumer demand for convenient and efficient payment solutions.

By End User:

- Banking

- Insurance

- Securities

- Others

Banking holds the largest market share as traditional banks increasingly collaborate with fintech companies to offer digital services.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America enjoys the leading position in the fintech market due to the growing number of fintech startups and financial institutions.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1–201971–6302