UAE Online Grocery Market Overview

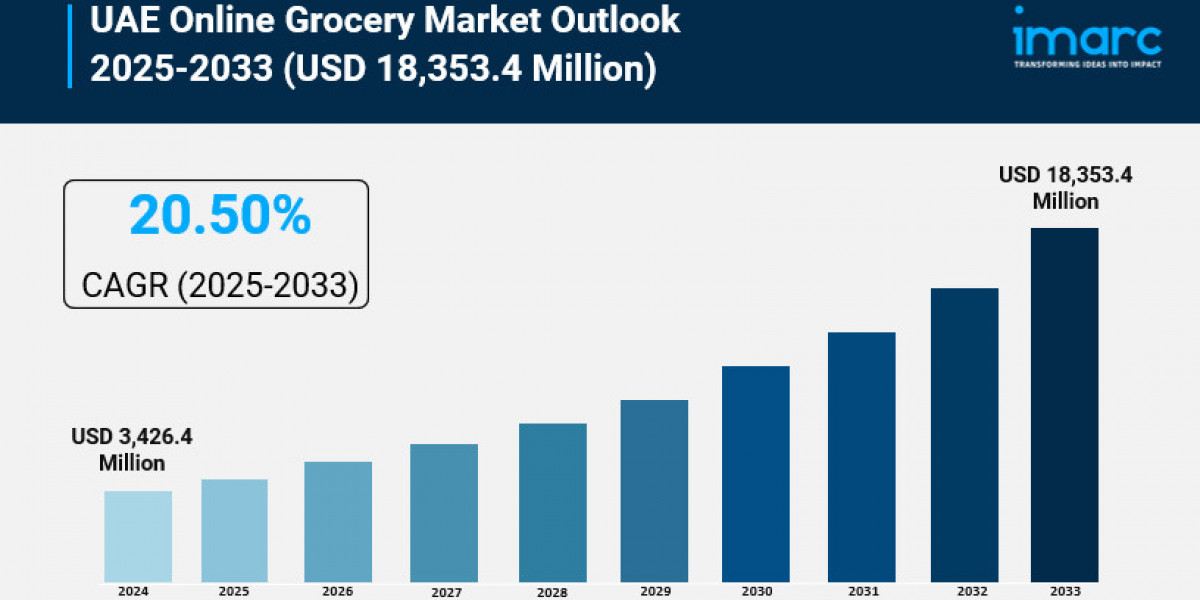

Market Size in 2024: USD 3,426.4 Million

Market Size in 2033: USD 18,353.4 Million

Market Growth Rate 2025-2033: 20.50%

According to IMARC Group’s latest research publication, “UAE Online Grocery Market Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033," the UAE online grocery market size reached USD 3,426.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 18,353.4 Million by 2033, exhibiting a growth rate (CAGR) of 20.50% during 2025-2033.

How AI is Reshaping the Future of UAE Online Grocery Market

- AI-Powered Personalization: AI algorithms on platforms like Noon Grocery in Dubai analyze shopping habits to recommend tailored products, boosting basket sizes by 25% amid UAE's $2.97 billion online grocery market.

- Predictive Inventory Management: Machine learning forecasts demand for fresh produce at Carrefour UAE, reducing waste by 20% and ensuring 95% stock availability during peak Expo 2030 tourism surges.

- Chatbot-Enhanced Customer Service: AI chatbots handle 60% of queries on Talabat Mart, cutting response times by 40% and improving satisfaction for 65% of UAE's mobile shoppers.

- Dynamic Pricing Optimization: AI tools adjust prices in real-time based on supply and demand, increasing margins by 15% for organic items in Abu Dhabi's health-focused retail segment.

- Supply Chain Automation: AI-driven logistics at Instashop streamline deliveries, shortening times by 30% across the Emirates, aligning with the 29.18% CAGR growth to $6.87 billion by 2032.

Grab a sample PDF of this report: https://www.imarcgroup.com/uae-online-grocery-market/requestsample

UAE Online Grocery Market Trends & Drivers:

Digital platforms propel 40% of UAE online grocery growth, with apps like Noon Grocery driving $2.97 billion in sales through AI-powered recommendations. Dubai and Abu Dhabi lead, as Expo 2030 boosts demand by 30% among expatriates. This trend enhances accessibility, cutting delivery costs by 20% for 70% of retailers, aligning with 98% mobile penetration and positioning the UAE as a hub for tech-driven grocery retail amid rising urban consumer needs.

Health-conscious and sustainable shopping fuels 35% market expansion, with UAE’s Green Agenda promoting organic and locally sourced products, reducing import reliance by 15%. Retailers like Carrefour offer eco-friendly packaging, appealing to 60% of millennials prioritizing clean labels. Government incentives, including $500 million for agri-tech, support vertical farming, fostering innovation and aligning with global wellness standards in the UAE’s $6.87 billion projected market by 2032.

Urbanization and tourism drive 30% demand surge, with the online grocery market backed by 15 million annual visitors. Dubai’s infrastructure projects and $2.8 trillion GCC wealth fuel instant delivery needs, with 65% of orders for fresh produce and ready meals, supported by 29.18% annual growth. Unified logistics policies enhance last-mile efficiency, positioning the UAE as a leader in seamless online grocery experiences for diverse populations.

UAE Online Grocery Industry Segmentation:

The report has segmented the market into the following categories:

Product Type Insights:

- Vegetables and Fruits

- Dairy Products

- Staples and Cooking Essentials

- Snacks

- Meat and Seafood

- Others

Business Model Insights:

- Pure Marketplace

- Hybrid Marketplace

- Others

Platform Insights:

- Web-based

- App-based

Purchase Type Insights:

- One-Time

- Subscription

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in UAE Online Grocery Market

- September 2025: YouGov survey reveals 40% of UAE shoppers prioritizing wellness products online weekly, boosting platforms like Noon Grocery amid health-focused e-commerce trends.

- June 2025: IMARC Group projects UAE online grocery market to grow at 20.5% CAGR through 2033, driven by convenience demands and digital adoption among 8.2 million urban consumers.

- April 2025: Deliveroo UAE reports 25% surge in on-demand grocery orders, expanding partnerships with local suppliers to meet rising demand for fresh produce in Dubai and Abu Dhabi.

- January 2025: Capillary Tech highlights online grocery sales reaching 30% of e-commerce revenue, fueled by AI personalization and hybrid shopping models in UAE's competitive retail landscape.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St., Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302