The Automotive Part Die Casting Market is a pivotal segment of the global automotive supply chain, driven by the automotive industry’s ongoing push toward lightweight, high-performance, cost-efficient components. Die casting is a manufacturing process in which molten metal (typically aluminum, magnesium, or zinc alloys) is injected into a steel mold under high pressure to produce components with excellent dimensional precision, surface finish, and structural integrity.

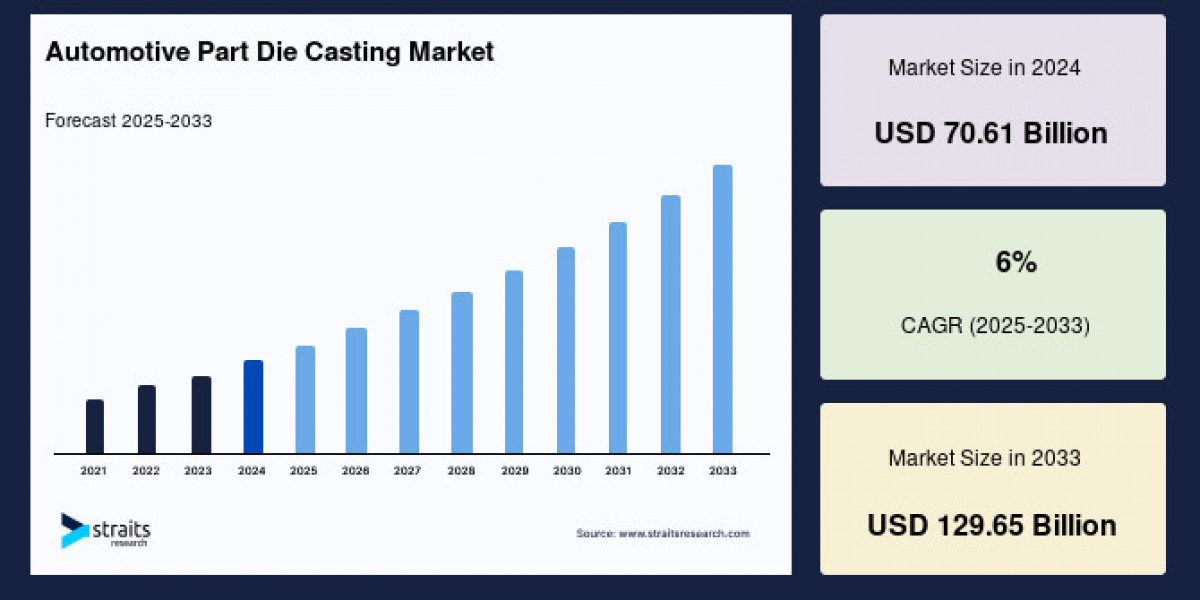

In 2024, the global automotive part die casting market was valued at around USD 70.61 billion, with projections estimating growth to USD 129.65 billion by 2033, at an approximate CAGR of 6% during 2025–2033.

This growth reflects broader automotive trends — increasing global vehicle production, rising demand for lightweight materials to improve fuel economy and reduce emissions, and rapid adoption of advanced manufacturing technologies such as simulation-based casting and automation.

Download Your Sample Report Now https://straitsresearch.com/report/automotive-part-die-casting-market/request-sample

Market Restraints

Despite the healthy growth trajectory, the automotive die casting industry faces several key challenges:

1. Raw Material Price Volatility

The cost of aluminum, magnesium and zinc — the principal metals used in die casting — is prone to significant price fluctuations. These changes are linked to global supply-demand imbalances, geopolitical dynamics, tariffs and trade policy shifts. Such volatility increases production costs and reduces profit margins for die casting manufacturers.

2. Supply Chain Disruptions

Disruptions due to natural disasters, geopolitical tensions and logistical bottlenecks can lead to material shortages. Because automotive manufacturers often follow just-in-time (JIT) production models, even short supply chain interruptions can halt assembly lines and delay deliveries — negatively impacting die casting demand.

3. Material Limitations

Certain advanced automotive components require materials with specific mechanical or thermal properties that some die casting alloys cannot always deliver. For example, high-stress powertrain or battery structural components may necessitate composites or forging methods over die casting, limiting market expansion in these niches.

Available for purchase with detailed segment data, forecasts, and regional insights. Buy Now@ https://straitsresearch.com/buy-now/automotive-part-die-casting-market

Market Opportunities

Despite the restraints, several growth opportunities support long-term market expansion:

1. Regulatory Push for Lightweight Vehicles

Stringent global emissions targets and fuel-efficiency regulations are pressuring automakers to reduce vehicle weight. Die-cast aluminum and magnesium parts deliver high strength-to-weight ratios, making them valuable for engine components, transmission housings, structural parts and electric vehicle (EV) chassis elements.

2. Electrification & Advanced Mobility

The transition to electrified powertrains introduces new part requirements — for battery enclosures, motor housings and thermal management components — where die casting provides precision and high production rates. Simulation-based casting and advanced alloys enhance quality while reducing waste.

3. Emerging Markets Growth

Regions such as Asia-Pacific, Latin America, and Africa present expanding automotive production bases. Particularly in China and India, local demand and cost-competitive manufacturing are attracting global die casting investments, offering strong growth potential beyond traditional markets such as North America and Europe.

Market Segmentation

The automotive part die casting market is segmented by type, application and region:

🛠️ By Type

Pressure Die Casting – the dominant technology due to high production speed and precision.

Vacuum Die Casting – reduces porosity for high-quality parts.

Squeeze Die Casting – suitable for parts requiring improved mechanical properties.

Semi-solid Die Casting – offers unique microstructure benefits in specialized applications.

🚗 By Application

Transmission Parts – largest contributor due to complexity and requirement for durability.

Engine Parts – extensive use in lightweight engine components.

Body Assemblies – die-cast panels and structural pieces aid weight reduction.

🌍 By Region

Asia-Pacific – the largest market share, driven by China, India and Southeast Asia.

North America & Europe – advanced automotive sectors with strong demand for high-performance die cast parts.

Middle East, Africa & LATAM – emerging demand with increasing automotive production.

Key Players & Revenue Highlights

Major companies shaping the competitive landscape include:

Consolidated Metco Inc – integrated materials and die casting solutions.

Texas Die Casting – specialized in high-precision die cast products.

Rockman Industries Limited – major Indian automotive casting player.

Endurance Technologies Limited – global automotive component supplier.

Alcast Technologies – aluminum die casting specialist.

Alcoa Corporation – major global aluminum supplier and casting innovator.

Dynacast – precision die casting across global markets.

Ryobi Die Casting – Japanese OEM supplier with a strong global footprint.

Note: While specific annual revenue figures are proprietary, collectively these leaders contribute significant revenue streams in automotive die casting, ranging from hundreds of millions to several billions USD in global sales.

Latest Developments & Collaborations

🔹 Strategic Partnerships

ConMet eMobility entered commercial partnerships and supply agreements to expand sales of PreSet Plus eHub components for electric vehicles and commercial platforms.

🔹 Alloy Innovations

Alcoa Corporation announced advancements in alloy development and deployment aimed at stronger, lighter automotive castings with improved performance.

Such developments underscore market activity as companies innovate to address EV trends, emissions compliance and production efficiency.

Frequently Asked Questions (FAQs)

1. What was the size of the automotive part die casting market in 2024?

The market was valued at approximately USD 70.61 billion in 2024.

2. What is the expected growth rate of this market?

It is projected to grow at a CAGR of around 6% from 2025 to 2033.

3. Which segment leads the market by type?

Pressure die casting remains the largest type segment due to production efficiency and quality.

4. Which region dominates the market?

Asia-Pacific leads the global automotive part die casting market and is poised to maintain strong growth.

5. What are the key growth drivers?

The primary drivers include global automotive production growth, regulatory push for emissions reduction, lightweighting and EV adoption.

Conclusion

The Automotive Part Die Casting Market is navigating a growth trajectory grounded in automotive industry trends such as lightweighting, electrification and advanced manufacturing. Although challenges like raw material volatility and supply chain uncertainties persist, regulatory pressures and technological advancements create substantial opportunities for innovation and expansion across regions and applications.

With major players continuously evolving through partnerships, material improvements and production capabilities, this market is positioned for stable long-term growth as the automotive ecosystem transitions toward higher performance and sustainability.