IMARC Group has recently released a new research study titled “Canada Prepaid Card Market Size, Share, Trends and Forecast by Card Type, Purpose, Vertical, and Region, 2025-2033,” which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Canada Prepaid Card Market Overview

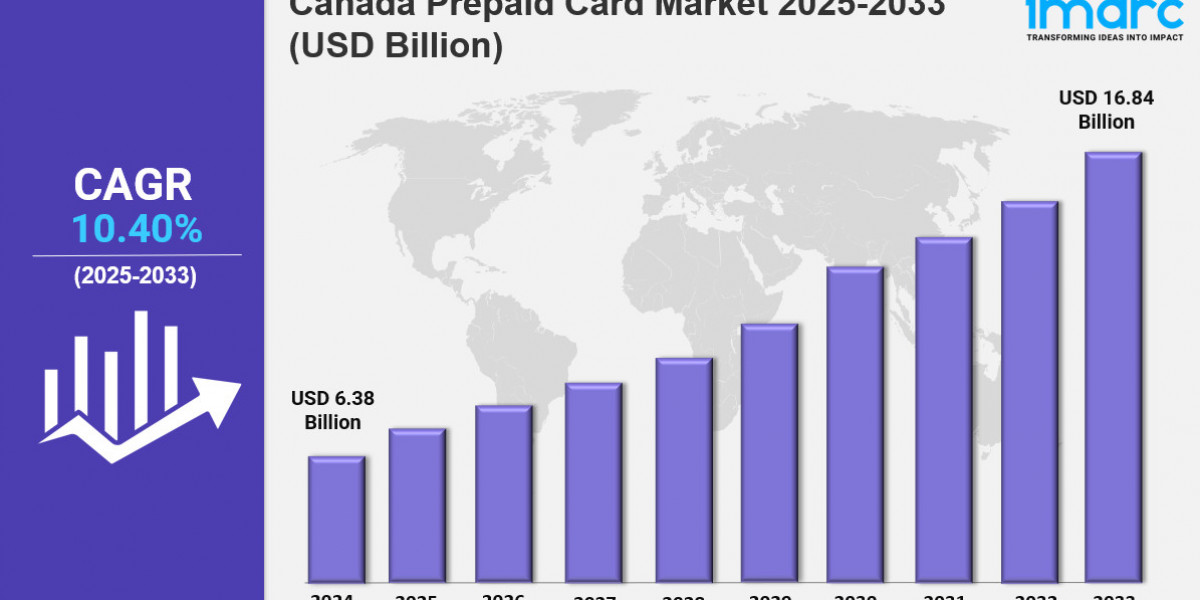

The Canada prepaid card market size reached USD 6.38 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 16.84 Billion by 2033, exhibiting a growth rate (CAGR) of 10.40% during 2025-2033.

Market Size and Growth

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 6.38 Billion

Market Forecast in 2033: USD 16.84 Billion

Market Growth Rate 2025-2033: 10.40%

Request for a sample copy of the report: https://www.imarcgroup.com/canada-prepaid-card-market/requestsample

Key Market Highlights:

✔️ Significant growth driven by the increasing shift towards cashless payment methods

✔️ Rising popularity of reloadable and gift prepaid cards among consumers

✔️ Enhanced focus on security features and integration with loyalty programs

Canada Prepaid Card Market Trends

The Canada prepaid card market is expanding rapidly as consumers increasingly seek flexible, secure, and debt-free payment options. With many Canadians moving away from traditional cash and credit cards, prepaid cards are emerging as a practical financial solution—particularly among younger generations. They offer a simple way to manage daily expenses such as groceries, bills, and online shopping while reducing the risks of overspending or falling into debt.

Rising Canada Prepaid Card Market Demand

What was once viewed as a niche financial tool has now entered the mainstream. Banks, fintech firms, and retailers are introducing more prepaid card options to meet surging Canada prepaid card market demand. Reloadable prepaid cards are especially popular among students, freelancers, and budget-conscious households, as they provide better spending control and financial transparency. By allowing users to preload funds and track transactions in real time, these products promote responsible money management and appeal to Canadians who value financial discipline.

Technology Driving Canada Prepaid Card Market Growth

Digital innovation is one of the biggest drivers of Canada prepaid card market growth. Most providers now offer mobile apps that allow users to check balances instantly, review transaction histories, and reload cards conveniently. These features enhance accessibility and user experience, appealing to a wide demographic—from young professionals managing their first paychecks to retirees budgeting on fixed pensions.

Diversification of Prepaid Card Options

The Canada prepaid card market outlook also highlights the growing variety of prepaid solutions available:

Travel prepaid cards – offering safe and convenient payments abroad.

Digital gift cards – widely adopted for retail and e-commerce.

Corporate prepaid solutions – used for employee incentives, business expenses, and loyalty programs.

This diversification not only satisfies consumer needs but also attracts businesses seeking efficient and flexible payment methods.

Future Canada Prepaid Card Market Outlook

Looking forward, the Canada prepaid card market outlook remains strong as Canadians embrace digital finance and prioritize security, convenience, and debt-free payment alternatives. With innovation, consumer trust, and corporate adoption fueling expansion, the latest forecasts suggest continued Canada prepaid card market growth in the years ahead.

As prepaid cards shift from being secondary payment tools to core financial solutions, rising Canada prepaid card market demand will cement their role in shaping Canada’s evolving financial landscape.

Canada Prepaid Card Market Segmentation:

The market report segments the market based on product type, distribution channel, and region:

Breakup by Card Type:

Closed Loop Cards

Open Loop Cards

Breakup by Purpose:

Payroll/Incentive Cards

Travel Cards

General Purpose Reloadable (GPR) Cards

Remittance Cards

Others

Breakup by Vertical:

Corporate/Organization

Retail

Government

Others

Breakup by Region:

Ontario

Quebec

Alberta

British Columbia

Others

Ask Analyst & Browse full report with TOC & List of Figures: https://www.imarcgroup.com/request?type=report&id=28971&flag=C

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Key Highlights of the Report

1. Market Performance (2019-2024)

2. Market Outlook (2025-2033)

3. COVID-19 Impact on the Market

4. Porter’s Five Forces Analysis

5. Strategic Recommendations

6. Historical, Current and Future Market Trends

7. Market Drivers and Success Factors

8. SWOT Analysis

9. Structure of the Market

10. Value Chain Analysis

11. Comprehensive Mapping of the Competitive Landscape

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91-120-433-0800

United States: +1 201971-6302