Digital signage solutions are transforming how brands communicate with audiences by delivering dynamic, context-driven content across retail, corporate, transportation, and public spaces. These systems comprising hardware, software, and services enable real-time updates, interactive experiences, and targeted advertising, driving engagement and operational efficiency.

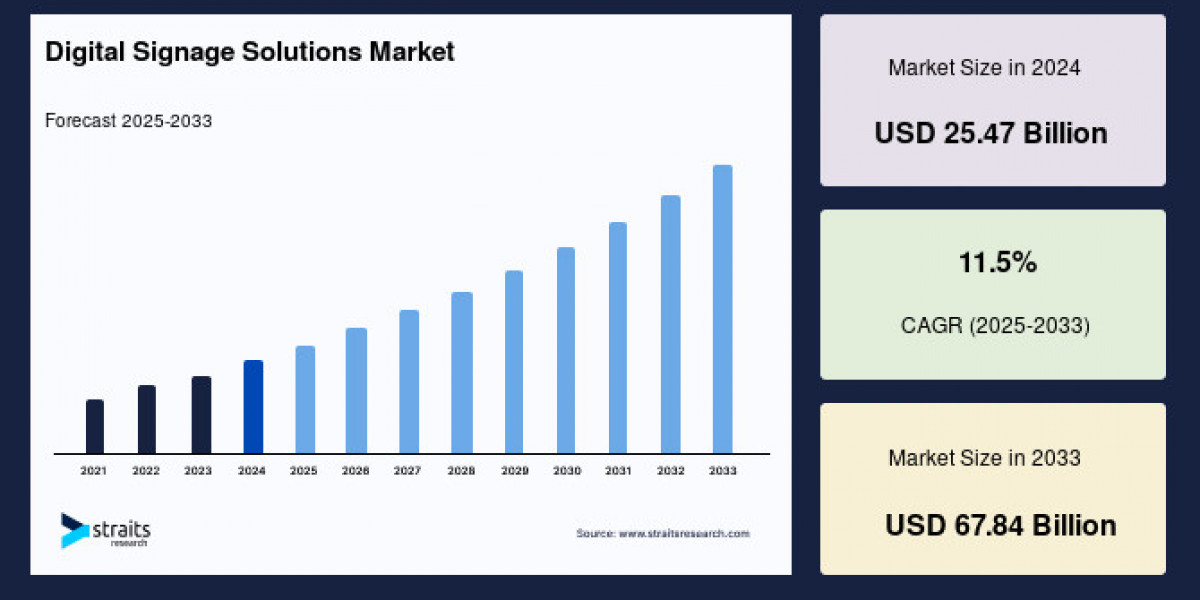

Market Size 2024 – USD 25.47 billion

Market Size 2025 – USD 28.40 billion

Market Size 2033 – USD 67.84 billion

CAGR (2025–2033) – 11.5%

- For detailed market insights and forecasts, request a sample report here: https://straitsresearch.com/report/digital-signage-solutions-market/request-sample

Market Drivers

The surge in digital signage adoption stems from growing advertising demand in public and commercial sectors. Retailers and quick-service restaurants use digital menus and promotional displays to influence purchasing decisions. Smart cities initiatives and transportation hubs leverage digital wayfinding and dynamic passenger information systems. Cloud-based solutions further lower entry barriers by enabling remote content management, reducing infrastructure costs, and offering real-time updates.

Technological advancements such as high-definition LED displays, interactive touchscreens, AI-driven content personalization, and data analytics enhance viewer engagement and campaign ROI. Edge server computing allows localized processing and offline operation, ensuring uninterrupted service. Increasing investments in infrastructure modernization in North America and Europe and rapid urbanization in Asia-Pacific propel market growth.

Market Challenges

Despite robust growth, digital signage faces challenges around cybersecurity and data privacy. Unauthorized access to content management systems risks malicious content display. Varying regulations across regions complicate compliance. In addition, high initial deployment costs particularly for LED video walls and interactive kiosks can deter small businesses. Integration complexities with existing IT and network infrastructures require specialized technical expertise.

Market Segmentation

By Software Type

Content Management System: Largest segment with 11.4% CAGR due to need for centralized, scalable content scheduling and multi-site deployment.

Edge Server Software: Fastest growing, enabling local content caching, troubleshooting, and offline playback for uninterrupted service.

By Service Type

Installation Services: Dominant segment at 10.9% CAGR, covering hardware mounting, network setup, and initial content configuration to ensure optimal performance.

Maintenance & Support Services: Fastest growing, providing remote monitoring, software updates, and on-site repairs to minimize downtime.

By Vertical

Retail: Largest segment at 11.2% CAGR, using digital signage for product promotions, wayfinding, and loyalty program engagement.

Corporate: Fastest growing, leveraging digital signage for internal communications, visitor management, and real-time performance dashboards.

BFSI: Utilizes queues management displays and interactive kiosks for customer service and financial advice.

Transportation, Education, Healthcare, Hospitality, and Others contribute through wayfinding, scheduling updates, and patient communication systems.

By Region

North America: Largest market driven by retail innovation and smart city projects.

Europe: Significant growth from public infrastructure displays and transit networks.

Asia-Pacific: Fastest growing due to rapid urbanization, rising consumer electronics adoption, and government smart city investments.

Latin America, Middle East & Africa: Emerging markets adopting digital signage for advertising and public information.

Top Players Analysis

Key companies shaping the digital signage solutions market include:

Samsung Electronics Co., Ltd.

LG Electronics Inc.

NEC Display Solutions

Philips (Signify Group)

Panasonic Corporation

Sharp NEC Display Solutions

Sony Corporation

Samsung SDS

Cisco Systems, Inc.

Four Winds Interactive

These leaders differentiate through robust hardware portfolios LED walls, interactive kiosks, video walls and software platforms offering AI-based analytics, content scheduling, and cloud management. Strategic partnerships with telecom providers and system integrators extend global reach. Investments in research and development focus on 4K/8K displays, 3D holographic signage, and integration with IoT sensors for context-aware content delivery.

- For full segmentation details and data, visit: https://straitsresearch.com/buy-now/digital-signage-solutions-market

Conclusion

Digital signage solutions are integral to modern communication strategies across industries, offering dynamic content delivery, enhanced engagement, and operational efficiencies. Strong growth prospects are underpinned by technological innovation, rising advertising demand, and smart city initiatives. Addressing cybersecurity and deployment cost challenges will be crucial as the market evolves.

About Us

Straits Research is a market intelligence company providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision-makers. Straits Research Pvt. Ltd. provides actionable market research data, especially designed and presented for decision making and ROI.

Frequently Asked Questions (FAQs)

What is the size of the digital signage solutions market in 2024 and forecast for 2033?

Market Size 2024 – USD 25.47 billion

Market Size 2025 – USD 28.40 billion

Market Size 2033 – USD 67.84 billion

CAGR (2025–2033) – 11.5%

What are the main drivers of market growth?

Advertising demand in retail and public sectors, cloud-based CMS, smart city initiatives, and display technology advances.

Which software type dominates the market?

Content management systems, due to scalability and centralized control capabilities.

Which vertical shows highest adoption?

Retail, leveraging digital signage for real-time promotions and customer engagement.

Who are the top players in the digital signage solutions market?

Samsung Electronics, LG Electronics, NEC Display Solutions, Philips, Panasonic, Sony, Cisco, and others.