The global Ethernet Adapter Market is poised for significant expansion as enterprises and data centers accelerate digital transformation, driven by rising demand for high-speed connectivity, cloud computing, and edge networking solutions. Ethernet adapters enable reliable, low-latency network interfaces for servers, workstations, and specialized equipment, supporting applications from virtualization to real-time analytics.

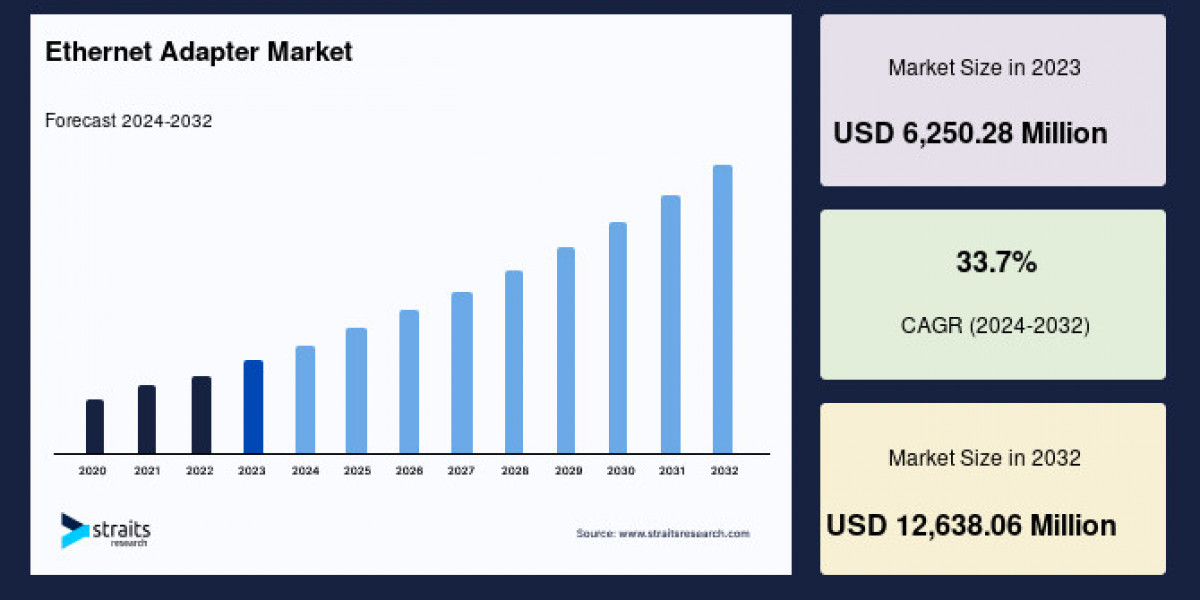

Market Size 2023 – USD 6,250.28 million

Market Size 2024 – USD 8,361.62 million

Market Size 2032 – USD 12,638.06 million

CAGR (2024–2032) – 33.7%

For comprehensive market insights and detailed forecasts, request a sample report here: https://straitsresearch.com/report/ethernet-adapter-market/request-sample

Market Drivers

The surge in cloud adoption and data center expansion is a primary driver, as organizations require high-throughput, scalable network interfaces to manage increasing data traffic. Virtualization, hyper-converged infrastructure, and Software-Defined Networking (SDN) demand adapters that support offloading tasks such as TCP/IP processing and remote direct memory access (RDMA) to improve CPU efficiency and overall system performance.

5G network rollouts and the proliferation of Internet of Things (IoT) devices also contribute to market growth by requiring robust network interfaces at the network edge. Enterprises in manufacturing, healthcare, and finance seek low-latency, high-reliability connectivity to power real-time monitoring, telemedicine, and high-frequency trading applications.

Market Challenges

Rapid technological obsolescence poses challenges, as Ethernet standards evolve from 10GbE to 100GbE and beyond, requiring frequent hardware upgrades. High initial costs of advanced adapters, especially those supporting RDMA over Converged Ethernet (RoCE) and NVMe over Fabrics (NVMe-oF), may deter small and medium enterprises.

Security concerns related to network offloads and firmware vulnerabilities necessitate stringent validation and update mechanisms. Integration complexities with heterogeneous hardware and software environments can increase deployment time and operational overhead.

Market Segmentation

By Data Rate

10/25/40 Gigabit Ethernet: Largest segment due to widespread adoption in enterprise and mid-tier data centers.

50/100 Gigabit Ethernet: Fastest growing, driven by hyperscale data centers and AI/ML workloads demanding extreme bandwidth.

By Adapter Type

PCIe Cards: Dominant form factor for servers and workstations, offering high throughput and offload capabilities.

OCP NICs: Increasingly adopted in cloud data centers for open compute interoperability and scalability.

USB Adapters: Growing segment for consumer and small office/home office (SOHO) applications requiring portable connectivity.

By Application

Data Centers: Largest end-use segment, leveraging high-speed network interfaces for storage, virtualization, and cloud services.

Enterprise IT: Uses adapters for desktops, workstations, and edge servers to support remote work and digital collaboration.

Telecom & Networking: Deploys adapters in network function virtualization (NFV) and edge computing nodes for 5G infrastructure.

Industrial Automation: Relies on ruggedized adapters for deterministic networking in manufacturing and energy sectors.

By Region

North America: Largest market fueled by early adoption of cloud services and advanced networking technologies.

Asia Pacific: Fastest-growing region driven by data center investments, digital infrastructure initiatives, and 5G deployments.

Europe: Significant growth from telecommunications upgrades and enterprise digitalization.

Latin America, Middle East & Africa: Emerging markets with increasing demand for IT modernization.

For complete segmentation details and data, visit: https://straitsresearch.com/buy-now/ethernet-adapter-market

Top Players Analysis

Leading companies in the Ethernet adapter market include:

Intel Corporation

Broadcom Inc.

Mellanox Technologies (NVIDIA)

Realtek Semiconductor Corporation

Microchip Technology Inc.

Marvell Technology, Inc.

Solarflare Communications (Xilinx)

QLogic (Marvell)

Cisco Systems, Inc.

Dell Technologies Inc.

These players compete through continuous innovation in data rates, offload capabilities, and form factors. Strategic acquisitions—such as NVIDIA’s acquisition of Mellanox—and partnerships with hyperscale cloud providers drive portfolio enhancements. R&D focuses on integrating advanced features like hardware-based encryption, AI offloads, and support for emerging Ethernet standards.

Conclusion

The Ethernet adapter market is positioned for remarkable growth, underpinned by expanding data center capacity, evolving networking standards, and the need for low-latency, high-throughput connectivity across industries. Addressing challenges around cost, security, and integration will be key for vendors and end users to fully leverage next-generation Ethernet technologies.

About Us

Straits Research is a market intelligence company providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision-makers. Straits Research Pvt. Ltd. provides actionable market research data, especially designed and presented for decision making and ROI.

Frequently Asked Questions (FAQs)

What is the size of the global Ethernet adapter market in 2023 and its forecast for 2032?

Market Size 2023 – USD 6,250.28 million

Market Size 2024 – USD 8,361.62 million

Market Size 2032 – USD 12,638.06 million

CAGR (2024–2032) – 33.7%

What factors drive Ethernet adapter market growth?

Cloud adoption, data center expansion, SDN, virtualization, 5G rollouts, and IoT proliferation.

Which data rate segment dominates the market?

10/25/40 Gigabit Ethernet leads due to broad enterprise and mid-tier data center deployment.

Which adapter type is fastest growing?

50/100 Gigabit Ethernet adapters driven by hyperscale data centers and AI/ML workloads.

Which region holds the largest share?

North America, backed by advanced cloud and networking infrastructure.