The global Online Smartphone and Tablet Games Market is undergoing explosive growth, driven by widespread smartphone penetration, advancements in mobile technology, and increasing consumer demand for engaging, accessible entertainment. Online games available on smartphones and tablets offer immersive experiences through high-quality graphics, social interaction, and cross-platform connectivity, captivating a broad audience spanning casual gamers to esports enthusiasts.

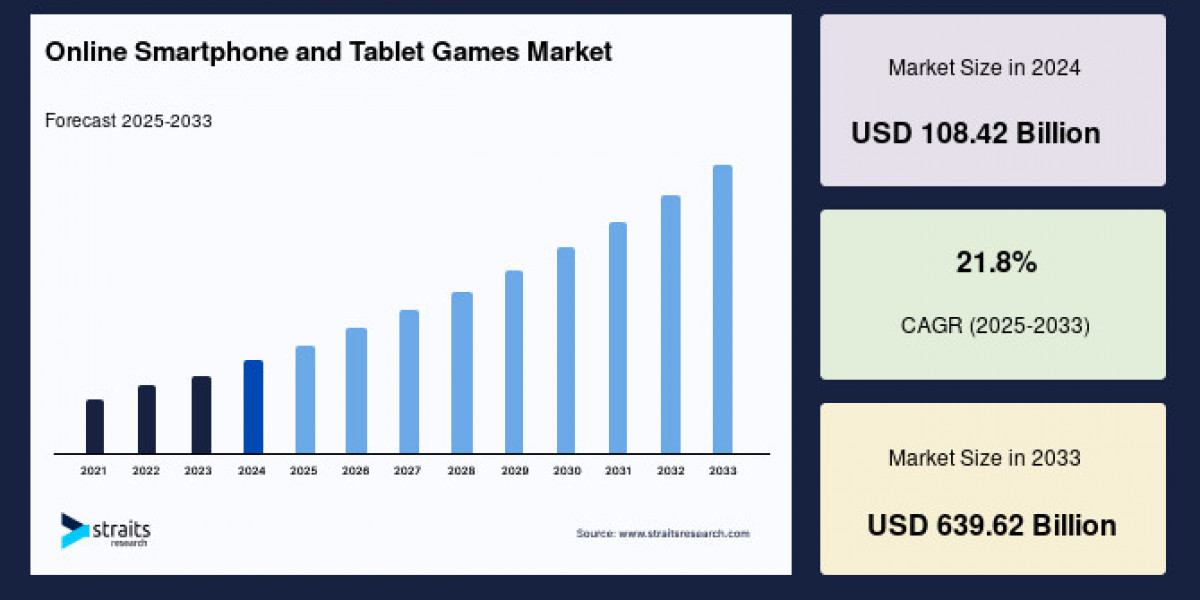

Market Size 2024 – USD 108.42 billion

Market Size 2025 – USD 132.05 billion

Market Size 2033 – USD 639.62 billion

CAGR (2025–2033) – 21.8%

For in-depth market insights and forecasts, request a sample report at: https://straitsresearch.com/report/online-smartphone-and-tablet-games-market/request-sample

Market Drivers

The surge in affordable smartphones and expanding 4G/5G network coverage worldwide democratizes access to online gaming, fostering user base expansion in emerging economies. The rise of free-to-play models, supported by in-app purchases, rewards systems, and advertisements, incentivizes user engagement and revenue growth.

Technological advancements, including augmented reality (AR), virtual reality (VR), AI-driven game personalization, and cloud gaming, enhance gameplay experiences, attracting new and returning players. Social features such as multiplayer modes, live streaming, and esports competitions strengthen community involvement and retention.

Mobile game publishers increasingly adopt data analytics and machine learning to optimize game design, player monetization, and marketing strategies. This data-centric approach elevates user experience and financial returns.

Market Challenges

High competition among game developers leads to market saturation, making visibility and user acquisition increasingly costly. User retention is challenging due to changing preferences and the abundance of alternatives.

Monetization strategies must balance revenue generation with player satisfaction to avoid backlash and regulatory scrutiny, particularly regarding loot boxes and in-app purchases affecting younger audiences.

Privacy concerns related to data collection and compliance with global regulations like GDPR and CCPA require robust data governance frameworks.

Fragmented device ecosystems with varying screen sizes, hardware capabilities, and operating systems complicate game development and quality assurance.

Market Segmentation

By Game Type

Action & Adventure: Largest segment due to broad appeal and dynamic gameplay.

Puzzle & Arcade: Popular for casual users and short, engaging sessions.

Strategy & Simulation: Growing interest linked to esports and competitive gaming.

Sports & Racing: Attracts fans through realism and licensed teams or vehicles.

Others: Educational, RPG, and casino games.

By Revenue Model

In-App Purchases: Dominates revenue generation with microtransactions and consumables.

Subscription: Emerging model for premium, ad-free experiences and exclusive content.

Advertising: Includes rewarded ads and banners in free-to-play games.

By Region

Asia Pacific: Largest and fastest-growing market led by China, India, Japan, and Southeast Asia.

North America: Mature market with high revenue per user and advanced technology adoption.

Europe: Strong growth supported by diverse player base and mobile infrastructure.

Latin America, Middle East & Africa: Emerging regions benefitting from increasing smartphone penetration.

For comprehensive segmentation and data, visit: https://straitsresearch.com/buy-now/online-smartphone-and-tablet-games-market

Top Players Analysis

Leading companies dominating the online smartphone and tablet games market include:

Tencent Holdings Ltd.

NetEase, Inc.

Activision Blizzard, Inc.

Electronic Arts Inc.

Zynga Inc.

Supercell Oy

Ubisoft Entertainment SA

Niantic, Inc.

King Digital Entertainment (Activision Blizzard)

Glu Mobile Inc.

These companies invest heavily in innovative game development, user acquisition, and expanding monetization avenues. Partnerships, acquisitions, and collaborations with telecom operators fuel market penetration. R&D targets AR/VR integration, cloud gaming scalability, and AI-enhanced gameplay personalization.

Conclusion

The online smartphone and tablet games market is on a trajectory of rapid expansion, propelled by technological innovation and evolving consumer behaviors. Balancing monetization, user experience, and privacy will be vital for sustaining growth. Emerging trends such as cloud gaming and augmented reality promise to redefine the mobile gaming landscape.

About Us

Straits Research is a market intelligence company providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision-makers. Straits Research Pvt. Ltd. provides actionable market research data, especially designed and presented for decision making and ROI.

Frequently Asked Questions (FAQs)

What is the size of the global online smartphone and tablet games market in 2024 and its forecast for 2033?

Market Size 2024 – USD 108.42 billion

Market Size 2025 – USD 132.05 billion

Market Size 2033 – USD 639.62 billion

CAGR (2025–2033) – 21.8%

What factors drive market growth?

Smartphone penetration, 4G/5G expansion, free-to-play models, AR/VR tech, and social gaming trends.

Which game type dominates the market?

Action & Adventure games lead with the broadest user base.

What revenue model generates most income?

In-app purchases dominate monetization strategies.

Which region leads market size?

Asia Pacific, due to rapidly growing mobile gaming communities.