The globalVirtual Cards Marketis experiencing explosive growth as digital payments become increasingly prevalent across retail, travel, healthcare, and corporate expense management sectors. Virtual cards are digital payment cards without physical form, offering enhanced security features such as unique card numbers for each transaction, limiting fraud and unauthorized use. With rising concerns about transaction safety, demand for contactless payments, and government regulations pushing for cashless economies, virtual cards have emerged as a preferred payment solution for consumers and enterprises alike.

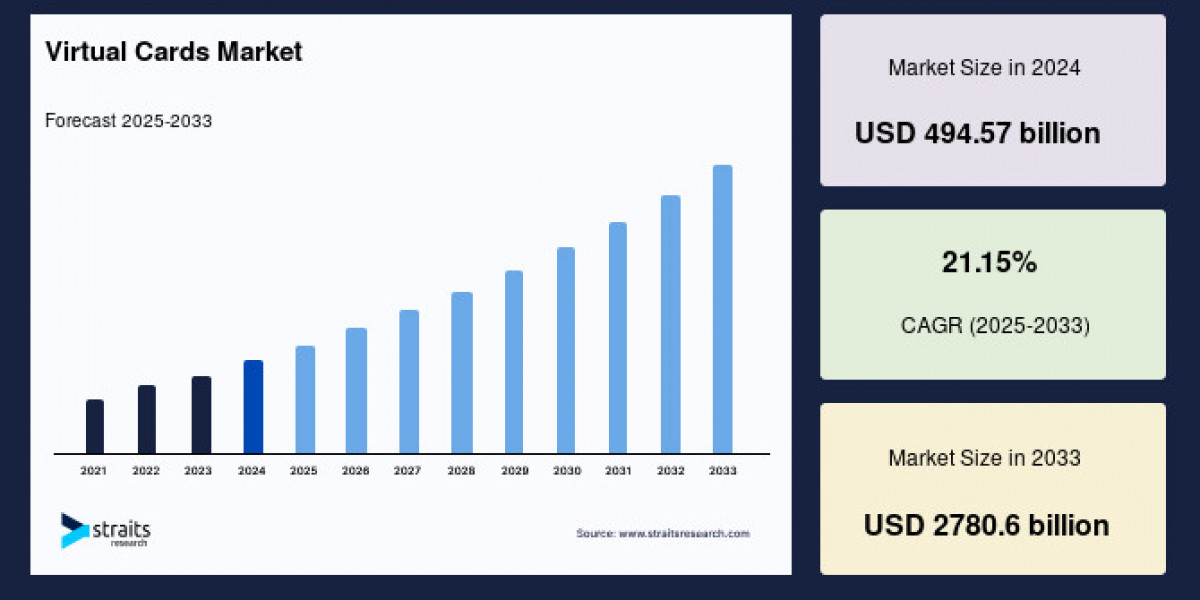

Market Size 2024 USD 494.57 billion

Market Size 2025 USD 599.17 billion

Market Size 2033 USD 2780.6 billion

CAGR 21.15% (20252033)

Request the detailed market report sample here:https://straitsresearch.com/report/virtual-cards-market/request-sample

Market Drivers

The surging adoption of e-commerce and mobile wallets drives virtual card utilization by offering seamless and secure online checkout experiences. Virtual cards eliminate the risk associated with physical card theft or loss and help prevent fraudulent transactions via dynamic CVV and one-time-use card numbers.

Enterprises increasingly use virtual cards to manage corporate expenses, travel bookings, and vendor payments more efficiently. The ability to set spending limits, restrict merchant categories, and automate reconciliation improves financial control and reduces administrative overhead.

The growing emphasis on GDPR and PCI-DSS compliance promotes virtual card deployment as a secure payment method that protects sensitive customer data. Governments push for digital payment infrastructures and financial inclusion programs further catalyze market expansion.

Emerging markets in Asia-Pacific and Africa witnessing rapid smartphone adoption and digital banking innovations offer vast growth opportunities.

Market Challenges

Integrating virtual card systems with legacy banking infrastructure poses technical hurdles, slowing adoption in some regions. Limited awareness and resistance to change among traditional merchants restrain market penetration.

Concerns about consumer data privacy and transaction transparency require robust regulatory frameworks and standardized security protocols. High costs associated with customized virtual card program implementation may deter small businesses.

Interoperability challenges between virtual cards and diverse payment gateways or point-of-sale devices necessitate collaborative partnerships across stakeholders.

Market Segmentation

By Card Type:

Single-use Virtual Cards: Offer enhanced security for one-off transactions, popular in online shopping and invoicing.

Multi-use Virtual Cards: Allow repeated use with predefined spending limits, suitable for subscription services and corporate expenses.

By End-User:

Banking and Financial Institutions: Issue virtual cards to consumers and corporate clients for secure payments.

Retail E-commerce: Adopt virtual cards for seamless online transactions and fraud reduction.

Corporate/SME: Use virtual card solutions for business expense management and procurement.

Travel and Hospitality: Benefit from virtual cards for booking and agent payments.

Others include healthcare, government, and education sectors.

By Deployment Mode:

Cloud-based: Enables rapid scalability and lower upfront costs, favored in startups and SMEs.

On-premise: Preferred by large enterprises with stringent data control requirements.

By Region:

North America: Largest market due to advanced fintech ecosystem and regulatory support.

Asia-Pacific: Fastest growing region bolstered by digital payment adoption and smartphone proliferation.

Europe: Significant market driven by robust banking sector and compliance mandates.

Latin America and Middle East Africa: Emerging markets with growing digital infrastructure investments.

For detailed segmentation breakdowns, refer to the full report athttps://straitsresearch.com/buy-now/virtual-cards-market

Top Players Analysis

Leading companies shaping the virtual cards market include:

Visa Inc.

Mastercard Incorporated

American Express Company

PayPal Holdings, Inc.

JPMorgan Chase Co.

Citi Bank

FIS Global

Adyen N.V.

Square, Inc.

Wirecard AG

These players invest heavily in improving security features, enhancing user interfaces, and expanding enterprise virtual card programs. Strategic partnerships with banks, merchants, and technology providers enable comprehensive solutions integrating mobile wallets, loyalty programs, and AI-driven fraud detection.

Conclusion

The virtual cards market is poised for transformative growth driven by the convergence of digital payment trends, security demands, and enterprise financial management needs. Market participants focusing on technological innovation, regulatory compliance, and strategic alliances will capitalize on vast opportunities globally. Overcoming integration challenges and expanding consumer acceptance remain critical for widespread adoption.

About Us

Straits Research is a market intelligence company providing global business reports and consulting services. We deliver reliable data-backed market intelligence and forecasting for strategic business decisions and ROI optimization.

Frequently Asked Questions (FAQs)

What is the global virtual cards market size and forecast?

Market Size 2024 USD 494.57 billion

Market Size 2025 USD 599.17 billion

Market Size 2033 USD 2780.6 billion

CAGR 21.15% (20252033)

What factors drive market growth?

E-commerce expansion, fraud prevention needs, corporate expense automation, and regulatory pushes.

Which card type leads the market?

Single-use virtual cards dominate due to enhanced security features.

Who primarily uses virtual cards?

Banks, retailers, corporates, and travel sectors.

Which region leads market size?

North America with mature fintech infrastructure.

Which region grows fastest?

Asia-Pacific driven by digital payment adoption.