The global business ecosystem is increasingly exposed to uncertainties, from financial risks and regulatory compliance to cyber threats and operational disruptions. In this environment, risk analytics has become an indispensable tool for organizations seeking to minimize exposure and maximize resilience. By leveraging advanced data analytics, artificial intelligence (AI), and predictive modeling, risk analytics empowers enterprises to make informed decisions and maintain stability in volatile markets.

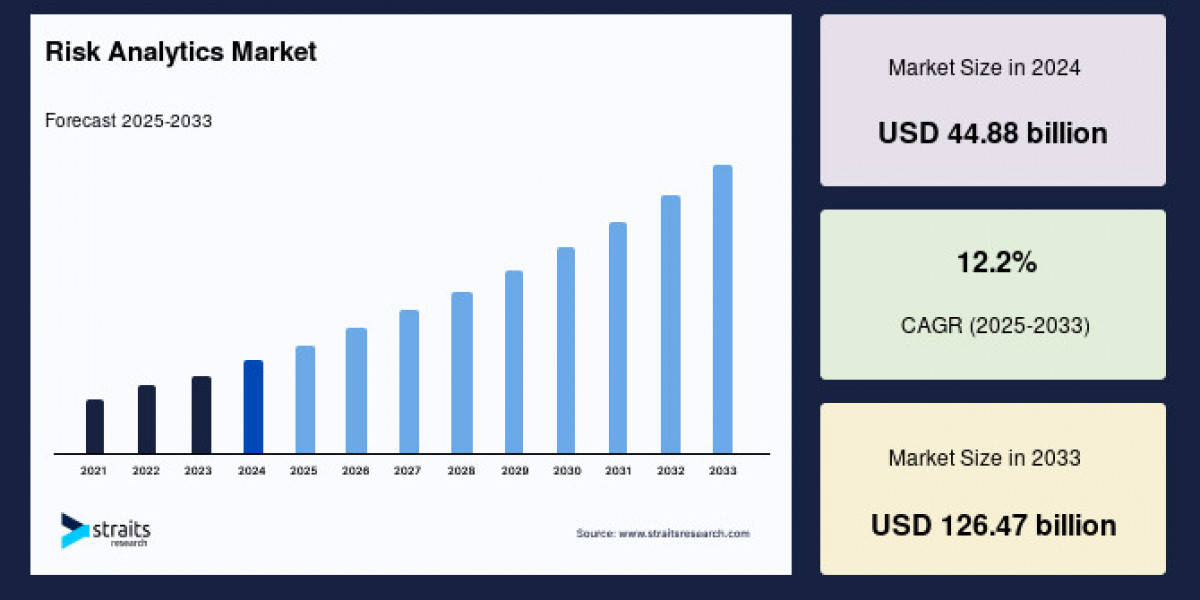

Market Size 2024 – USD 44.88 Billion

Market Size 2025 – USD 50.36 Billion

Market Size 2033 – USD 126.47 Billion

CAGR (2025–2033) – 12.2%

- Get request sample here: https://straitsresearch.com/report/risk-analytics-market/request-sample

Market Drivers

Rising Cybersecurity Threats – The proliferation of digital platforms has heightened exposure to cyber risks, making risk analytics essential in identifying vulnerabilities and preventing financial or reputational losses.

Stringent Regulatory Compliance – Regulatory frameworks across banking, healthcare, and insurance demand robust risk assessment, creating strong adoption opportunities.

Growing Complexity of Business Models – As enterprises expand globally, they face supply chain disruptions, operational risks, and cross-border financial uncertainties, fueling demand for risk analytics solutions.

Adoption of Big Data and AI – Integration of advanced analytics and machine learning models enables organizations to detect hidden patterns, predict risks, and strengthen resilience.

Market Challenges

High Implementation Costs – Deploying advanced risk analytics platforms requires significant investments in infrastructure and expertise, limiting adoption among smaller firms.

Data Privacy Concerns – Growing concerns over the handling of sensitive data present regulatory and reputational challenges.

Integration with Legacy Systems – Many enterprises still rely on outdated IT frameworks, making integration of modern risk analytics solutions challenging.

Lack of Skilled Professionals – The shortage of experts in advanced analytics and risk modeling can hinder the effective deployment of these solutions.

Market Segmentation

According to Straits Research, the global risk analytics market is segmented as follows:

By Component

Software – Includes risk assessment platforms, governance tools, and analytics applications.

Services – Encompasses consulting, integration, support, and managed services to enhance adoption and performance.

By Risk Type

Strategic Risk – Addresses long-term organizational goals and planning.

Operational Risk – Focuses on day-to-day business processes and supply chains.

Financial Risk – Covers investment risks, credit assessments, and fraud detection.

Compliance Risk – Ensures adherence to industry standards and regulatory laws.

By Deployment

On-Premises – Preferred by organizations requiring high data security and control.

Cloud-Based – Rapidly growing due to cost-efficiency, scalability, and real-time updates.

By Industry Vertical

Banking, Financial Services, and Insurance (BFSI) – Leading adopter driven by compliance and fraud prevention needs.

Healthcare – Ensures patient safety, regulatory compliance, and operational efficiency.

IT and Telecom – Strengthens data security and mitigates operational risks.

Manufacturing, Retail, Government, and Others – Growing adoption across sectors to manage dynamic risks.

Top Players Analysis

Straits Research highlights several leading companies shaping the global risk analytics market:

IBM Corporation – Offers AI-powered risk and compliance analytics solutions tailored for finance, healthcare, and IT.

SAS Institute Inc. – Specializes in predictive risk modeling and fraud detection, with strong BFSI adoption.

Oracle Corporation – Provides cloud-based governance and risk management tools for global enterprises.

Moody’s Analytics, Inc. – Renowned for credit risk assessment, financial modeling, and economic forecasting.

SAP SE – Integrates risk management with enterprise resource planning (ERP) systems.

FICO (Fair Isaac Corporation) – Known for advanced analytics in fraud detection and credit scoring.

Verisk Analytics, Inc. – Offers data-driven solutions across insurance and energy sectors.

Riskturn – Provides risk analysis software for scenario planning and decision-making.

Provenir – Focuses on AI-driven risk decisioning for financial services.

MetricStream Inc. – Leading provider of governance, risk, and compliance (GRC) solutions.

- Buy the report now: https://straitsresearch.com/buy-now/risk-analytics-market

Conclusion

The global risk analytics market is on a trajectory of rapid growth, driven by increasing cyber threats, compliance needs, and the growing complexity of modern businesses. With advanced solutions powered by AI and big data, organizations across BFSI, healthcare, telecom, and government sectors are investing heavily in risk management frameworks. Despite challenges such as high costs and integration hurdles, risk analytics remains essential for enterprises aiming to stay resilient in the face of uncertainties.

About Us

Straits Research is a market intelligence company providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision-makers. Straits Research Pvt. Ltd. provides actionable market research data, especially designed and presented for decision making and ROI.

FAQ's

Q1. What is the global market size of the risk analytics market?

The global risk analytics market size was valued at USD 44.88 Billion in 2024 and is projected to reach USD 126.47 Billion by 2033.

Q2. What is the growth rate (CAGR) of the risk analytics market?

The market is expected to grow at a CAGR of 12.2% during the forecast period 2025–2033.

Q3. Which industries are the key adopters of risk analytics?

Banking, financial services, insurance (BFSI), healthcare, IT and telecom, manufacturing, and government are the major adopters.

Q4. What are the major drivers of the risk analytics market?

The key drivers include rising cybersecurity threats, compliance requirements, business complexities, and adoption of AI and big data technologies.

Q5. Who are the top players in the risk analytics market?

Some of the leading companies include IBM, SAS, Oracle, Moody’s Analytics, SAP, FICO, Verisk, Riskturn, Provenir, and MetricStream.