The global defense landscape is evolving rapidly, with maritime security becoming a top priority for naval forces worldwide. Torpedoes, one of the most crucial underwater weapons, play a vital role in strengthening naval capabilities for both offensive and defensive operations. Rising territorial conflicts, increasing defense budgets, and technological advancements are some of the primary drivers fueling the growth of the torpedo market.

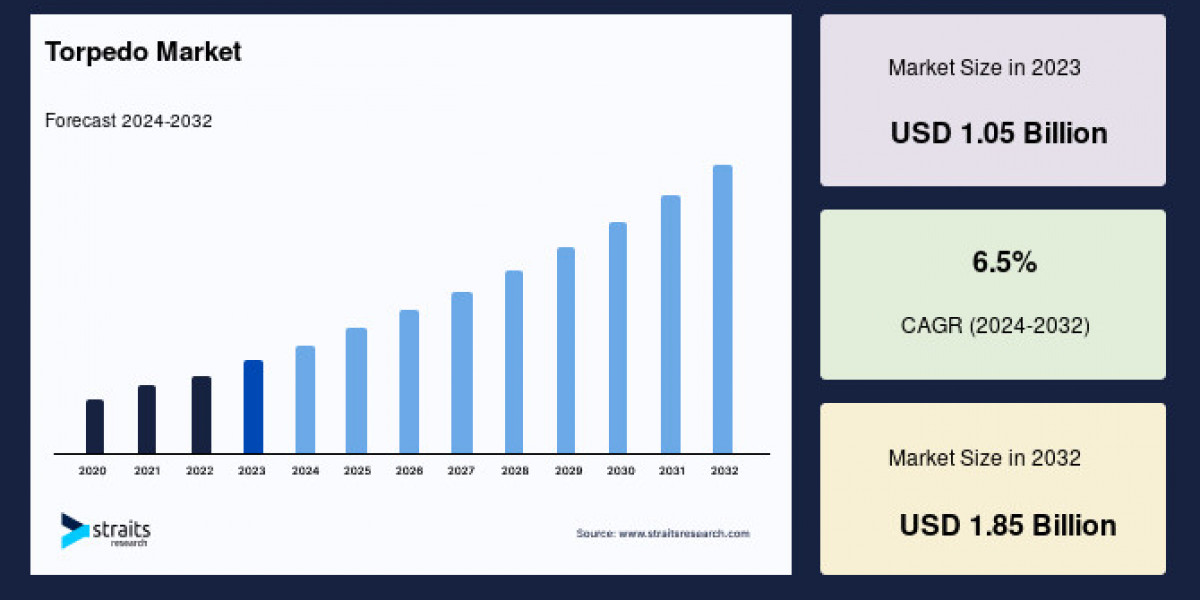

Market Size 2023 – USD 1.05 Billion

Market Size 2024 – USD 1.11 Billion

Market Size 2032 – USD 1.85 Billion

CAGR (2024–2032) – 6.50%

According to Straits Research, the torpedo market is on a steady upward trajectory, supported by the modernization of naval fleets, the integration of smart guidance systems, and the rising emphasis on anti-submarine warfare.

- For detailed segmentation, you can explore the report here: https://straitsresearch.com/report/torpedo-market/request-sample

Market Drivers

Growing Geopolitical Tensions

Territorial disputes and maritime threats are compelling governments to invest in advanced torpedo systems. Nations in the Asia-Pacific and Middle East are particularly increasing their naval expenditures, boosting market demand.Technological Advancements in Guidance Systems

Torpedoes today are increasingly equipped with advanced sonar, homing technology, and wire-guided mechanisms. These developments enhance accuracy, reduce collateral damage, and improve mission success rates.Naval Fleet Modernization Programs

Countries like the United States, India, and China are expanding and modernizing their naval fleets. The integration of modern torpedo systems with submarines, destroyers, and aircraft enhances combat readiness.

Market Challenges

High Development and Maintenance Costs

Torpedoes are technologically complex and expensive to manufacture. Continuous research, testing, and maintenance lead to high costs, which can restrict adoption in low-budget defense economies.Stringent Regulations and Export Controls

Due to their military nature, torpedo exports are tightly regulated. International treaties and government restrictions limit market opportunities in certain regions.Counter-Torpedo Technologies

The advancement of countermeasures, such as anti-torpedo defense systems, poses a challenge to torpedo manufacturers by reducing their effectiveness in combat.

Market Segmentation

The torpedo market can be segmented by type, propulsion, launch platform, and geography:

By Type

Heavyweight Torpedoes: Primarily deployed from submarines and large surface ships. They dominate the market due to their long range and destructive power.

Lightweight Torpedoes: Designed for anti-submarine warfare, these are commonly deployed from helicopters, aircraft, and smaller naval vessels.

By Propulsion

Electric Propulsion: Preferred for stealth missions due to lower noise levels.

Thermal/Conventional Propulsion: Offers greater speed and range but with higher acoustic signatures.

By Launch Platform

Submarines: Major platform for heavyweight torpedoes, accounting for the largest share.

Surface Vessels: Destroyers, frigates, and corvettes rely heavily on torpedo systems for anti-submarine defense.

Aircraft & Helicopters: Lightweight torpedoes deployed from aerial platforms enhance naval flexibility.

By Region

North America: Dominates the market due to advanced naval programs and consistent defense budgets.

Europe: Strong growth driven by NATO modernization initiatives.

Asia-Pacific: Expected to witness the fastest growth due to rising maritime disputes and defense expansions by China, India, and South Korea.

Middle East & Africa: Growing demand with naval fleet upgrades and security challenges in strategic waterways.

Top Players Analysis

The torpedo market is highly competitive, with leading companies focusing on technological innovation and strategic partnerships. According to Straits Research, some of the top players include:

BAE Systems – Known for advanced underwater weapons with cutting-edge guidance technologies.

Lockheed Martin Corporation – Provides lightweight torpedo systems for naval and aerial platforms.

Raytheon Technologies – Offers advanced torpedo guidance and propulsion systems.

Saab AB – Specializes in the development of lightweight torpedoes like the Saab Torpedo 62.

Atlas Elektronik GmbH – A leader in German underwater systems, including sophisticated torpedo technologies.

Leonardo S.p.A. – Supplies advanced torpedo systems across Europe and global defense markets.

These companies are focusing on R&D investments, global partnerships, and expanding their portfolios to meet rising naval requirements.

- For purchasing the detailed competitive landscape, click here: https://straitsresearch.com/buy-now/torpedo-market

Conclusion

The torpedo market is poised for steady growth, supported by rising naval conflicts, modernization programs, and rapid technological advancements. With both heavyweight and lightweight torpedoes finding applications across submarines, surface vessels, and aircraft, the market outlook remains strong through 2032. However, challenges such as high costs and counter-torpedo systems remain barriers to expansion.

About Us

Straits Research is a market intelligence company providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision-makers. Straits Research Pvt. Ltd. provides actionable market research data, especially designed and presented for decision making and ROI.

FAQ’s

1. What is the market size of the global torpedo market in 2023?

The global torpedo market size was valued at USD 1.05 billion in 2023.

2. What is the expected growth rate of the torpedo market?

The market is expected to grow at a CAGR of 6.50% during the forecast period (2024–2032).

3. Which region dominates the torpedo market?

North America currently dominates due to strong naval programs, while Asia-Pacific is projected to grow the fastest.

4. What are the main types of torpedoes?

The market is primarily divided into heavyweight torpedoes and lightweight torpedoes, catering to different naval requirements.

5. Who are the top players in the torpedo market?

Some of the leading players include BAE Systems, Lockheed Martin, Raytheon Technologies, Saab AB, Atlas Elektronik GmbH, and Leonardo S.p.A.