The global online on-demand home services market is experiencing a dynamic surge, reshaping how individuals approach home maintenance, repairs, and personal care. As digital platforms proliferate and urban living accelerates, more households are turning to app-based solutions offering cleaning, appliance repair, plumbing, grooming, and wellness services right at their doorstep. Modern life’s time constraints, increased hygiene concerns post-pandemic, and the rise of dual-income households have propelled the rapid expansion of these services, integrating convenience and professional expertise into every facet of daily living.

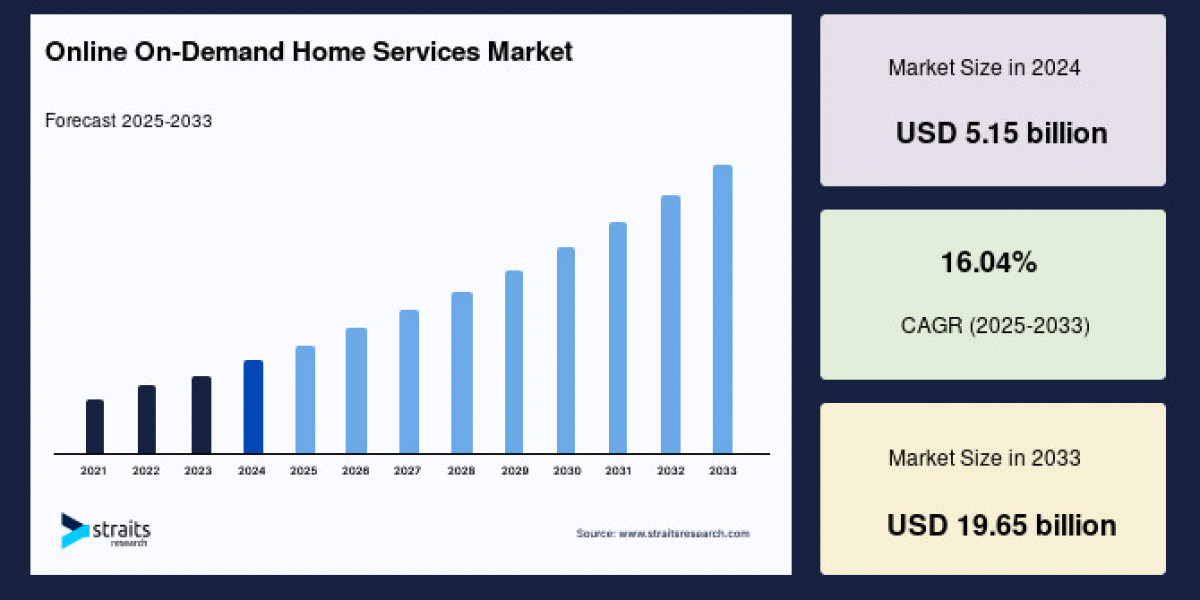

Market Size 2024 – USD 5.15 billion.

Market Size 2025 – USD 5.97 billion.

Market Size 2033 – USD 19.65 billion.

CAGR (2025–2033) – 16.04%.

Request Sample: https://straitsresearch.com/report/online-on-demand-home-services-market/request-sample

Market Drivers

Urbanization and dual-income households have drastically increased demand for quick, trustworthy home services, as people have less time for chores and repairs.

The gig economy enables platforms to rapidly scale offerings using a flexible, on-demand workforce. This model minimizes costs and maximizes service diversity.

Post-COVID-19 hygiene standards are fueling demand for professional cleaning and wellness services, raising consumer reliance on trusted, vetted providers.

Rapid adoption of smartphones and widespread internet connectivity makes it easier for users to access service platforms and book instant appointments.

Market Challenges

Ensuring consistent service quality and reliability is challenging due to the use of multiple freelancers and contractors with varied skills and professionalism.

High operational costs arise from implementing thorough vetting, training, and review systems to maintain quality and user trust.

Limited regulatory oversight in some regions leads to difficulties in standardizing certifications and assuring service excellence.

Language diversity and tech accessibility present hurdles; platforms must invest in multilingual support and user-friendly interfaces for broader market penetration.

Detailed Market Segmentation

By Service Type

Home Cleaning: Dominant service, ranging from routine cleaning to specialized deep-cleaning and disinfection. Increased hygiene awareness and customizable packages drive this segment’s growth.

Repairs & Maintenance: Appliance repair, handyman services, plumbing, and electrical fixes remain essential as homes become more digitally equipped.

Beauty & Wellness: In-home grooming and spa services are gaining traction, offering convenience while addressing lifestyle needs.

Other On-Demand Services: Includes pest control, elderly care, babysitting, laundry, and gardening.

By Platform

Mobile Applications: The fastest-growing channel, favored for instant bookings, secure payments, reviews, and customer support. Intuitive interfaces and mobile-first strategies cater especially to developing markets with high smartphone penetration.

Web Portals: Remain relevant, particularly for detailed service selection and package booking.

By End User

Individual/Residential Users: The largest segment. Busy professionals and families increasingly choose outsourced solutions for cleaning, repairs, beauty, and personal wellness. Flexible recurring services and affordable pricing fuel market demand.

Commercial Clients: Businesses and property managers use these platforms for office cleaning, appliance maintenance, and bulk service contracting, although residential remains the core market focus.

By Geography

North America: The largest market, supported by high digital adoption, mature gig economy, and robust home-services platforms. Brands like TaskRabbit, Angi, and Thumbtack dominate.

Asia Pacific: Fastest-growing region, driven by urban growth, smartphone expansion, and affordable service pricing. Platforms are investing in AI-driven matchmaking and multilingual access to reach diverse consumer bases.

Europe: Market expansion is supported by a focus on sustainable, eco-friendly solutions, GDPR compliance, and smart home integration. UK and Germany are actively adopting digital home service platforms.

Top Players Analysis (Numbered)

TaskRabbit: Founded in 2008, acquired by IKEA in 2017. Operates in the U.S., Canada, UK, and France. Focuses on convenience, robust vetting, and quick access to background-checked freelancers for assembly, cleaning, and repairs.

Thumbtack: U.S.-based marketplace with extensive offerings for home repairs, cleaning, and personal wellness, trusted for its rating system and service flexibility.

Angi: A leading U.S. service provider specializing in cleaning, repairs, and maintenance with strong brand recognition and national coverage.

Urban Company: Expanding beyond India into Canada and Asia Pacific, this platform specializes in cleaning, grooming, and appliance repair, emphasizing verified professionals and high user satisfaction.

Helpling: Popular in Europe’s urban hubs like Berlin and Munich, focusing on home cleaning and maintenance with easy booking and vetted professionals.

Book A Tiger: German leader in cleaning services providing flexible appointments and digital trust features.

58 Daojia & Ayi App: Dominant in China for cleaning, childcare, and elderly care with a mobile-first approach.

Buy Now: https://straitsresearch.com/buy-now/online-on-demand-home-services-market

Conclusion

The online on-demand home services market is set for exponential growth, supported by urbanization, smartphone ubiquity, and evolving consumer standards. Leveraging gig economy dynamics, app-centric engagement, and tailored service portfolios, platforms are transforming household management and personal care. Industry leaders invest in vetting, technology, and expansion to deliver quality and convenience amid shifting demographics and post-pandemic needs.

About Us

Straits Research is a market intelligence company providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision-makers. Straits Research Pvt. Ltd. provides actionable market research data, especially designed and presented for decision making and ROI.

Frequently Asked Questions (FAQ)

What is the market size of the online on-demand home services market for 2024, 2025, and 2033?

Market Size 2024 – USD 5.15 billion.

Market Size 2025 – USD 5.97 billion.

Market Size 2033 – USD 19.65 billion.

What is the CAGR for the market during 2025–2033?

CAGR (2025–2033) – 16.04%.

Which region holds the largest share in the online on-demand home services market?

North America dominates the market, driven by high digital adoption and mature gig economy.

What service type leads the global market?

Home cleaning is the dominant service due to urban lifestyles and increased hygiene awareness.

What platforms are most popular for booking on-demand services?

Mobile apps are favored for their intuitive interfaces, convenience, and fast booking experiences.

Who are the leading players in the online on-demand home services market?

TaskRabbit, Thumbtack, Angi, Urban Company, Helpling, Book A Tiger, and 58 Daojia are key players.

What are the main drivers of market growth?

Urbanization, dual-income households, gig economy expansion, and smartphone/internet penetration fuel demand.