The global managed services market is witnessing impressive growth as businesses increasingly outsource IT operations to specialized providers, enabling enhanced operational efficiency and cost savings. Managed services encompass a wide range of outsourced IT functions, including network management, cloud services, cybersecurity, and data analytics, thereby allowing companies to focus on core business activities. The growing complexity of IT environments, digital transformation initiatives, and the proliferation of technologies like IoT and AI are accelerating demand for expert managed service providers (MSPs) across industries globally.

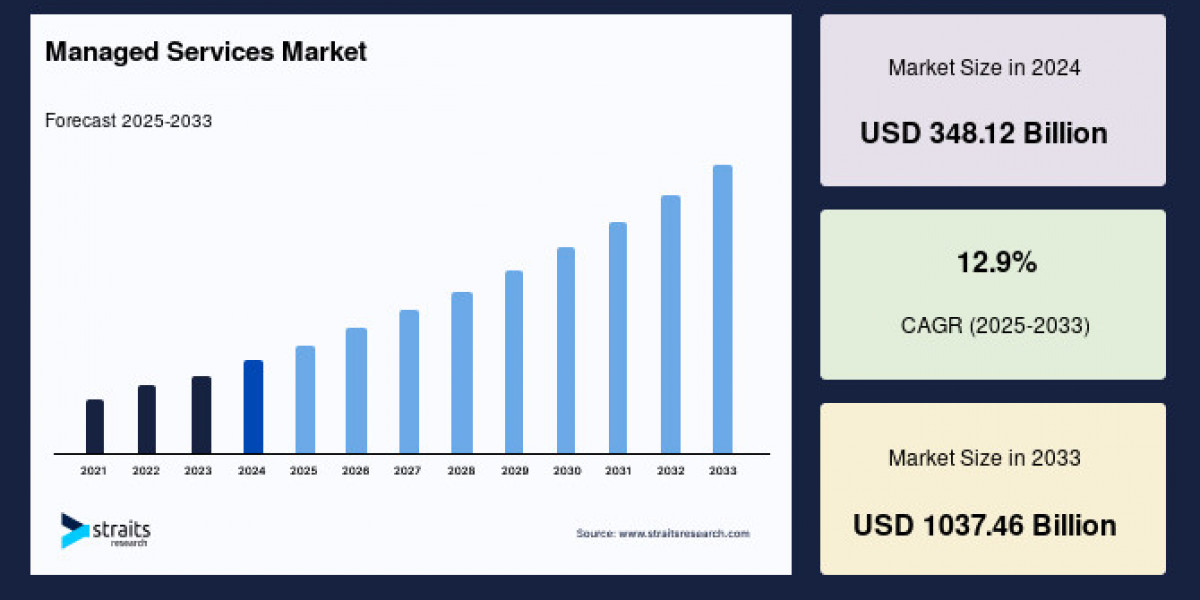

Market Size 2024 – USD 348.12 billion.

Market Size 2025 – USD 393.02 billion.

Market Size 2033 – USD 1037.46 billion.

CAGR (2025–2033) – 12.9%.

Get request sample now:

→ https://straitsresearch.com/report/managed-services-market/request-sample

Market Drivers

Increasing complexity in IT infrastructure and the accelerating pace of digital transformation initiatives require specialized MSPs to manage diverse environments encompassing cloud computing, cybersecurity, IoT, and data analytics.

Managed services provide scalable and adaptable IT infrastructure solutions, allowing enterprises to adopt new technologies efficiently while lowering operating costs and improving resource allocation.

Growing adoption of Bring Your Own Device (BYOD) policies and remote work strategies boosts demand for managed security and device management services.

Regulatory and compliance requirements drive enterprises to engage MSPs to ensure secure data handling and risk management following standards like ISO, HIPAA, PCI DSS, and FedRAMP.

Enterprises’ focus on improving agility, reducing downtime, and leveraging automation enhances the appeal of managed services, which also support enhanced customer experiences.

Market Challenges

Implementation of managed services can encounter resistance due to concerns over data security, especially in highly regulated industries such as healthcare and finance.

Integration of managed services with existing legacy systems can be complicated and costly, requiring skilled personnel and updated infrastructure.

Variations in global regulatory environments create challenges for MSPs to provide compliant solutions universally.

Managing the risks associated with BYOD strategies, including data leakage and unauthorized access, remains a significant concern for organizations adopting managed services.

Detailed Market Segmentation

By Service Type

Managed Data Center Services: Holds the largest share, driven by demand for scalable infrastructure and rapid deployment of new IT services while optimizing onsite assets.

Business Process Outsourcing (BPO): Dominates with a high CAGR, fueled by enterprises outsourcing core business processes to focus on strategic tasks. Investments in automation and cloud computing further boost this segment.

Managed Security Services: Increasingly critical due to growing cyber threats and compliance requirements, offering protection, monitoring, and incident response.

Managed Network Services: Enable optimized network operations, bandwidth management, and seamless connectivity.

Other Managed IT Services: Include application management, cloud hosting, and help desk services.

By Deployment Mode

On-Premise: Largest deployment mode, preferred for enhanced control, customization without dependency on internet connectivity.

Cloud-Based: Rapidly growing due to flexibility, reduced capital expenditure, and scalability, particularly appealing for SMEs.

By Enterprise Size

Large Enterprises: Major adopters leveraging managed services to handle vast and complex IT infrastructure across multiple geographies.

SMEs: Emerging market segment benefiting from access to advanced IT services without heavy upfront investments.

By Industry

Financial Services: Largest adopter due to stringent regulatory and security needs.

Healthcare: Demand driven by data privacy, remote patient management, and regulatory compliance.

Manufacturing, Retail, Telecom, and Government: Increasing managed service adoption to optimize operations and digital presence.

By Region

North America: The largest regional market, supported by high concentration of IT service providers and digital enterprise adoption.

Europe: Fastest-growing market with expanding cloud adoption and regulatory compliance investments.

Asia-Pacific: Growing digital transformation and the rise of SMBs foster rapid managed services market growth.

Latin America & MEA: Emerging markets focusing on infrastructure upgrades and security.

Top Players Analysis (Numbered)

IBM Corporation: A global leader offering comprehensive managed IT, cloud, and security services.

Accenture Plc: Provides consulting-driven managed services with focus on digital transformation and cloud adoption.

Cognizant Technology Solutions: Strong in IT outsourcing and business process services.

Tata Consultancy Services (TCS): Provides wide-ranging managed services with a focus on innovation and automation.

HCL Technologies: Offers extensive managed infrastructure and application services globally.

Capgemini: Known for hybrid cloud and cybersecurity-focused managed services.

DXC Technology: Provides end-to-end managed IT and cloud solutions supporting large enterprise clients.

→ Purchase the Full Report Today! https://straitsresearch.com/buy-now/managed-services-market

Conclusion

The managed services market is positioned for rapid growth catalyzed by complex IT requirements, regulatory pressures, and the imperative for digital transformation. As enterprises increasingly rely on MSPs to manage infrastructure, security, and operations, the industry will continue to evolve with a focus on flexibility, scalability, and cybersecurity.

Straits Research Pvt. Ltd. provides actionable market research data, especially designed and presented for decision making and ROI.

About Us

Straits Research is a market intelligence company providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision-makers. Straits Research Pvt. Ltd. provides actionable market research data, especially designed and presented for decision making and ROI.

Frequently Asked Questions (FAQ)

What is the managed services market size for 2024, 2025, and 2033?

Market Size 2024 – USD 348.12 billion.

Market Size 2025 – USD 393.02 billion.

Market Size 2033 – USD 1037.46 billion.

What is the CAGR for managed services during 2025–2033?

CAGR – 12.9%.

Which service segment holds the largest market share?

Managed data center services have the largest share, supported by BPO and managed security.

What are the key challenges to market growth?

Data security concerns, integration complexities, and regulatory variations are major challenges.

Who are the leading managed service providers?

IBM, Accenture, Cognizant, TCS, HCL, Capgemini, and DXC Technology lead the global market.