The global ultrafast lasers market is rapidly advancing, driven by the increasing demand for extremely precise and high-speed laser applications in industries such as electronics manufacturing, automotive, medical, aerospace, and research. Ultrafast lasers produce highly brief light pulses in femtoseconds or picoseconds, enabling energy delivery at unimaginable speeds without damaging surrounding materials. This property makes them ideal for delicate micromachining, precise cutting, and advanced scientific applications, propelling their adoption worldwide.

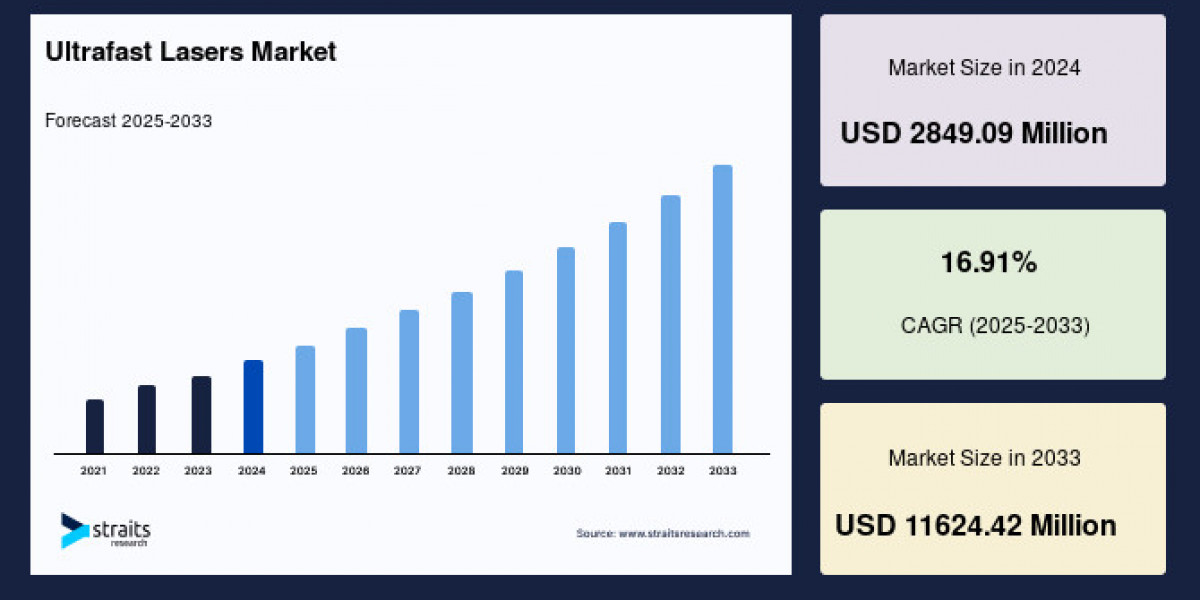

Market Size 2024 – USD 2849.09 million.

Market Size 2025 – USD 3330.87 million.

Market Size 2033 – USD 11624.42 million.

CAGR (2025–2033) – 16.91%.

Get request sample now: https://straitsresearch.com/report/ultrafast-lasers-market/request-sample

Market Drivers

Growing miniaturization and demand for precise microfabrication in consumer electronics and automotive industries fuel ultrafast laser adoption. These lasers support tightly controlled dimensional accuracy and help OEMs bring innovative, compact devices to market faster.

Advanced functionalities in healthcare and medical devices require ultrafast laser machining for high-precision applications like surgical instruments and diagnostics.

Ultrafast lasers enable machining of diverse materials biological tissue, metals, dielectrics without causing thermal damage, improving production quality and reducing post-processing.

Technological improvements such as tapered double-clad fiber amplifiers have enhanced power output, beam quality, and cost efficiency.

High demand in Asia-Pacific, spurred by numerous electronics OEMs in China and Japan, plus growing automotive sectors, drives significant market share growth.

North America’s expanding electronics manufacturing and research activities, including advanced microscopy techniques, add to robust market expansion.

Market Challenges

Complexity of ultrafast laser systems requires skilled technical expertise for operation and integration, acting as a barrier for wider industrial adoption.

High initial costs and maintenance expenses limit accessibility, especially for SMEs and emerging markets.

Alternatives such as excimer, Q-switched, and continuous wave lasers are often favored for specific applications due to cost or simpler operation.

Integration of ultrafast lasers into existing manufacturing workflows can encounter operational challenges.

Market Segmentation

By Laser Type

Solid-State Lasers: Largest segment by market share, growing steadily. Used broadly across scientific, industrial, and medical applications for their high performance and versatility.

Fiber Lasers: Second largest segment, notable for industrial manufacturing tasks including cutting, welding, and additive manufacturing. Increasing applications in healthcare for diagnostics and therapy drive growth.

By End User

Consumer Electronics: Leads the market with the highest growth rate. Driven by microfabrication needs for compact, high-performance devices with exacting tolerances.

Automotive: Holds the second largest market share. Growth fueled by ultrafast laser applications in driverless vehicle technologies, electronic innovations, and manufacturing precision.

Medical: Expanding segment due to ultrafast lasers’ utility in surgical tools, therapy, and diagnosis.

Aerospace & Defense: Uses ultrafast lasers for advanced material processing, testing, and manufacturing.

Research: Fundamental and applied research push continuous technology development and new use cases.

By Pulse Duration

Picosecond Lasers: Largest market share segment, important for manufacturing miniature and functional electronic components such as PCBs and thin flex circuits.

Femtosecond Lasers: Second largest segment, gaining traction in handheld electronics manufacturing and medical sector applications due to extreme precision.

By Region

Asia-Pacific: Largest market share and fastest growth region, attributed to substantial electronics OEM activity, automotive manufacturing, and aggressive government R&D funding.

North America: Second largest, driven by high technology adoption, advanced research, and electronics manufacturing.

Europe and LAMEA: Growing markets influenced by industrial modernization and specialized medical applications.

Top Players Analysis (Numbered)

Thorlabs Inc.: Leading manufacturer specializing in ultrafast laser components and systems for scientific and industrial uses.

Wuhan Huaray Precision Laser Co., Ltd.: Key player focused on precision laser manufacturing in Asia-Pacific.

Amplitude Laser: Known for innovative ultrafast laser design and solutions catering to various global industries.

Coherent, Inc.: Significant contributor to ultrafast laser development with a wide product portfolio.

Trumpf GmbH + Co. KG: Provides industrial laser technology including ultrafast lasers for manufacturing and medical applications.

NKT Photonics: Offers specialized fiber laser technologies integrated into ultrafast laser systems.

IPG Photonics Corporation: Major supplier of fiber lasers crucial for ultrafast laser applications.

Buy Full Report Now: https://straitsresearch.com/buy-now/ultrafast-lasers-market

Conclusion

The ultrafast lasers market is set for remarkable growth, driven by continuous miniaturization demands, advances in healthcare technologies, and rising adoption in automotive and electronics manufacturing. Despite challenges related to cost and complexity, technological innovation continues to improve laser performance and broaden applications, making ultrafast lasers indispensable in modern industry and research.

About Us

Straits Research is a market intelligence company providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision-makers. Straits Research Pvt. Ltd. provides actionable market research data, especially designed and presented for decision making and ROI.

Frequently Asked Questions (FAQ)

What is the ultrafast lasers market size in 2024, 2025, and 2033?

Market Size 2024 – USD 2849.09 million.

Market Size 2025 – USD 3330.87 million.

Market Size 2033 – USD 11624.42 million.

What is the CAGR of the market during 2025–2033?

CAGR – 16.91%.

Which laser type holds the largest market share?

Solid-state lasers are the largest segment due to wide-ranging applications.

Who are the leading end users of ultrafast lasers?

Consumer electronics and automotive sectors dominate usage.

What pulse duration segment leads the market?

Picosecond lasers hold the largest share due to manufacturing needs in electronics.

Which region leads the market in ultrafast lasers?

Asia-Pacific dominates with highest market share and fastest growth.