T86 clearance, also known as Entry Type 86, is a customs process designed to expedite the import of low-value e-commerce shipments into the United States. It applies to packages valued at $800 or less, allowing for faster clearance while ensuring compliance with regulatory requirements. This clearance method helps importers avoid duties and taxes on qualifying shipments, streamlining entry through electronic filing.Introduced by U.S. Customs and Border Protection in 2019, Type 86 clearance supports remote filing via the Automated Broker Interface (ABI), which speeds up processing and improves shipment tracking. It also accommodates shipments subject to Partner Government Agency regulations, making it a practical option for many low-value parcels.By simplifying the customs process and enhancing visibility, Entry Type 86 has become an essential tool for businesses and individuals shipping small-value goods. Its ability to reduce delays and administrative burdens makes it increasingly relevant in today’s e-commerce landscape.

Understanding T86 Clearance and Type 86 Clearance

T86 Clearance simplifies customs procedures for low-value shipments entering the U.S., while setting clear rules for eligibility and documentation. It accelerates clearance by using electronic filings, with specific value limits and regulatory oversight, ensuring faster processing without duties for qualifying imports.

Definition of T86 Clearance

T86 Clearance, also called Type 86 Clearance, is an electronic customs clearance process under Section 321 of U.S. law. It applies to shipments valued at $800 or less, exempting them from duty.This clearance mode is designed for de minimis shipments—those considered low-value enough to bypass regular customs duties. T86 clearance requires importers to electronically file necessary documents to U.S. Customs and Border Protection (CBP). This ensures regulatory compliance and visibility while speeding up the import process.The system reduces paperwork and accelerates processing times for e-commerce and other small parcel shipments entering U.S. commerce.

Key Criteria and Requirements

To qualify for T86 Clearance, shipments must meet strict conditions:

- Value Limit: The total value of goods per person per day must not exceed $800.

- Electronic Filing: Importers must submit shipment data electronically via the Automated Commercial Environment (ACE).

- Shipment Type: Applicable mainly to low-value e-commerce shipments and small parcels.

- Compliance: All regulatory requirements, such as product restrictions and proper documentation, must be met despite duty exemption.

Failure to comply results in denial of T86 status, requiring conventional clearance and duties. This system helps customs maintain control, even with duty-free shipments.

Purpose and Authorization Levels

T86 Clearance aims to streamline customs for small shipments while maintaining border security. It facilitates quicker release by reducing the need for physical inspections on low-value goods.Authorization for T86 clearance rests with CBP, which sets the value threshold and controls entry procedures. Businesses benefit from cost savings because no duty is charged on qualifying shipments, and faster processing boosts customer satisfaction.The clearance process balances efficient trade flow with regulatory oversight to prevent misuse, fraud, or security risks. This makes T86 vital for cross-border e-commerce growth and U.S. import regulation.

Application and Maintenance Process

The process for obtaining and maintaining Type 86 Clearance requires specific eligibility criteria, correct documentation, and adherence to procedural steps. Proper application ensures smooth customs processing, while ongoing compliance is necessary to retain clearance status.

Eligibility and Documentation

Type 86 Clearance applies to shipments valued at $800 or less, primarily for e-commerce imports under Section 321. Eligible applicants include importers, owners, or their authorized customs brokers.Required documentation includes a declaration filed through the Automated Commercial Environment (ACE) system. This declaration must accurately state the shipment’s value, origin, and description. All shipments must comply with Partner Government Agency (PGA) data requirements when applicable.Applicants must maintain clear and up-to-date records to demonstrate eligibility and respond promptly to any customs inquiries. Failure to provide accurate documentation can delay clearance or result in disqualification.

Application Procedure

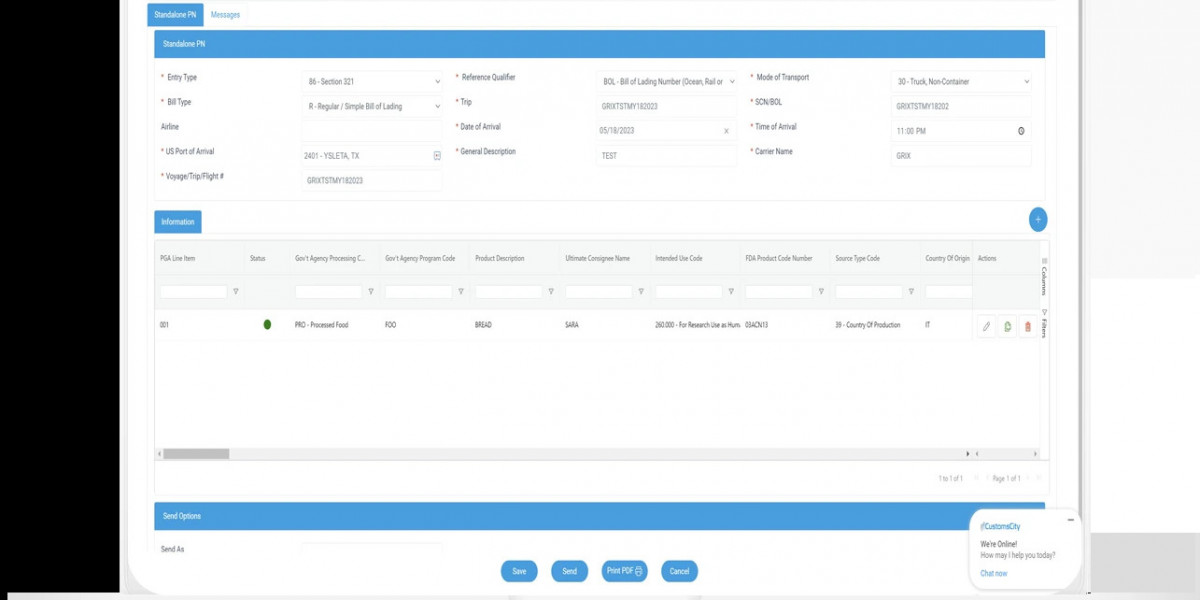

The application process begins by filing an entry via the ACE system using the Type 86 designation. Importers may act as self-filers or appoint a customs broker to submit the declaration.The declaration requires detailed information, including shipment value, description, and compliance with relevant regulations. Pre-clearance support allows approval before the shipment arrives at the port, speeding the clearance timeline.Once submitted, customs reviews the package under de minimis rules, exempting eligible shipments from duties and taxes. Timely and accurate filings help prevent shipments from leaving the port prior to customs inspection.

Renewal and Revocation Guidelines

Type 86 Clearance does not follow a typical renewal cycle but requires continuous compliance with customs rules and documentation accuracy. Customs monitors shipments for adherence to entry criteria and may revoke clearance privileges if violations occur.Revocation may result from repeated misfiling, failure to meet PGA requirements, or attempts to import shipments exceeding the $800 threshold. In such cases, importers could be subject to more complex entry procedures and additional inspections.To maintain clearance status, importers should regularly update records and ensure all filings comply with current regulations. Consistent compliance reduces the risk of revocation and promotes efficient clearance.