The Debt Collection Software Market is undergoing rapid expansion as financial institutions, collection agencies, and enterprises recognize the value of technology-driven debt recovery. Automated platforms are increasingly essential for streamlining debt management, ensuring compliance, and enhancing recovery rates in an era marked by rising loan volumes and evolving regulatory expectations.

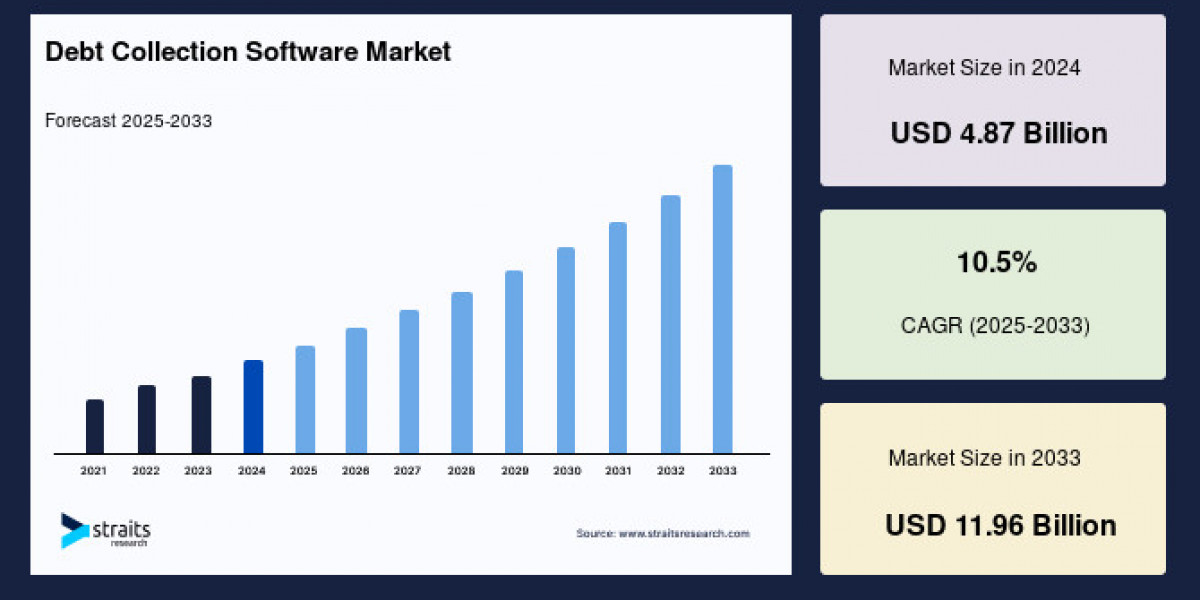

Market Size 2024 – USD 4.87 billion

Market Size 2025 – USD 5.38 billion

Market Size 2033 – USD 11.96 billion

CAGR (2025–2033) – 10.1%

For the latest research and strategic insights, you can request a sample report @https://straitsresearch.com/report/debt-collection-software-market/request-sample

Market Drivers

Accelerating digital transformation across the BFSI sector, healthcare, and telecom is a core driver, with organizations seeking more efficient, accurate, and compliant collection strategies. The surge in digital lending, growing non-performing loans (NPLs), and increasing regulatory scrutiny have pushed organizations to adopt intelligent tools powered by AI and machine learning. Automation in communication, segmentation, payment prediction, and compliance tracking optimizes the end-to-end collection process. Cloud-based solutions are favored for their scalability and low upfront costs, making them accessible to both SMEs and large enterprises.

The dramatic rise in delinquency rates fueled by the aftermath of global disruptions has also made it critical for enterprises to minimize bad debt and collection costs, further supporting the shift to robust software solutions. Notably, demands for data security and personalized customer experience have directed market innovation toward secure, respectful, and data-driven communication.

Market Challenges

Varied Regulations: Debt collection laws differ regionally, requiring software providers to offer flexible platforms to meet multi-jurisdictional compliance.

Integration Complexities: Migrating from manual systems or older software to cloud-based platforms introduces transitional challenges, particularly for organizations with legacy infrastructure.

Innovative business solutionsData Privacy Risks: As sensitive debtor data is being managed, ensuring security against breaches and cyberattacks is paramount.

Impact of War: Although less direct, armed conflict or geopolitical instability can disrupt international supply chains, alter credit markets, and trigger a surge in NPLs, indirectly affecting adoption rates and vendor operations.

Segments

Component: Software and services, with services (consulting, integration, training) expected to register strong growth as organizations seek tailored deployments.

Deployment: Cloud-based and on-premise; cloud dominates due to flexibility, rapid updates, and easier regulatory integration.

Organization Size: Large enterprises hold the lion’s share, but rapid growth is seen among SMEs leveraging SaaS models.

Innovative business solutionsEnd-user: Banks, collection agencies, finance companies, healthcare, telecom & utilities, and government. Banks and finance companies are projected to dominate as regulatory requirements and NPLs intensify

For detailed research, request sample or buy the complete report @https://straitsresearch.com/buy-now/debt-collection-software-market.

Top Players Analysis

The competitive landscape features leading technology and specialist firms:

Fair Isaac Corporation (FICO)

Experian

CGI Group Inc

Pegasystems Inc

Temenos Group AG

TransUnion

Chetu Inc

Fiserv Inc

Nucleus Software

TietoEVRY

Interactive Intelligence Group Inc

Debtcol Software Pty Ltd

Oracle Corporation

Totality Software

Advantage Software

InterProse

Scorto Inc.

About Us

Straits Research is a market intelligence company providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision-makers. Straits Research Pvt. Ltd. provides actionable market research data, especially designed and presented for decision making and ROI.

FAQs

Q1: What is the global Debt Collection Software Market Size for 2024, 2025, and 2033?

A1: The market is valued at USD 4.87 billion in 2024, USD 5.38 billion in 2025, and is projected to reach USD 11.96 billion by 2033, growing at a CAGR of 10.1%.

Q2: What drives the Debt Collection Software Market?

A2: Automation, regulatory compliance, rising NPLs, digital transformation, and increasing adoption of AI-powered and cloud solutions are key drivers.

Q3: Which segments are leading in the Debt Collection Software Market?

A3: Software and cloud-based solutions; large enterprises dominate spending, alongside banks and finance companies. However, SMEs and services are growing rapidly.

Q4: Who are the major players in this market?

A4: Fair Isaac Corporation (FICO), Experian, CGI, Temenos, TransUnion, Pegasystems, Chetu, Fiserv, Nucleus Software, and more lead the market with innovative automated solutions.

Q5: What challenges does the market confront?

A5: Multi-jurisdictional compliance, data security, complex integrations, and supply chain or credit disruptions due to global instability or war.