IMARC Group, a leading market research company, has recently releases a report titled “Legal Services Market Report by Service (Taxation, Real Estate, Litigation, Bankruptcy, Labor/Employment, Corporate, and Others), Mode (Online Legal Services, Offline Legal Services), End User (Legal Aid Consumers, Private Consumers, SMEs, Charities, Large Businesses, Government), and Region 2025-2033.” The study provides a detailed analysis of the industry, including the global legal services market size, trends, share and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Legal Services Market Highlights:

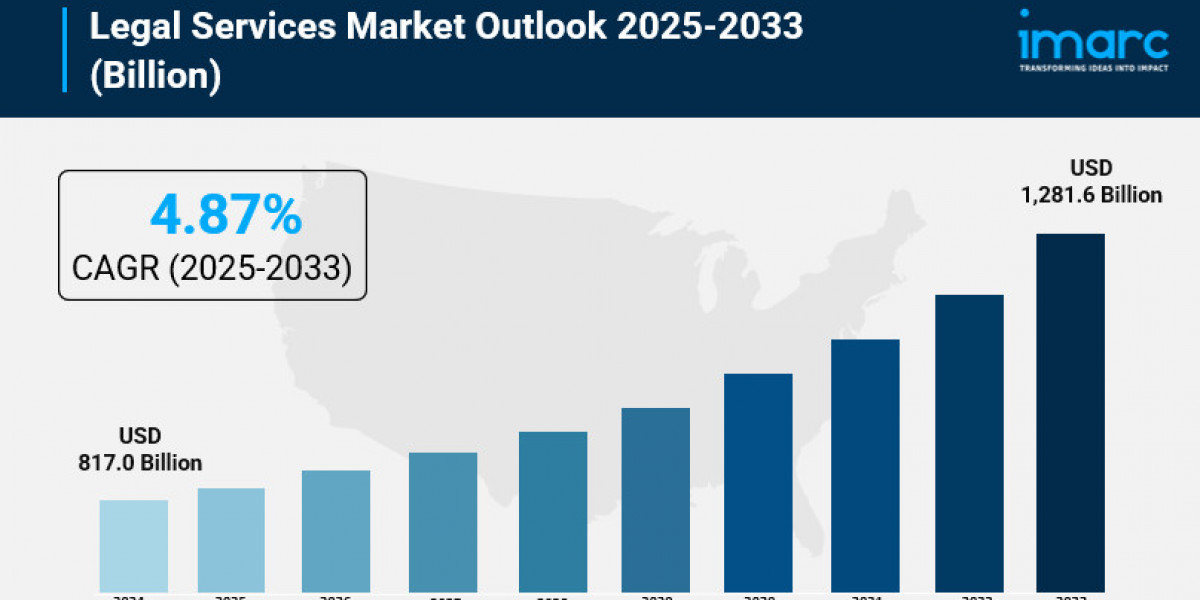

- Legal Services Market Size: Valued at USD 817.0 Billion in 2024.

- Legal Services Market Forecast: The market is expected to reach USD 1,281.6 billion by 2033, growing at an impressive rate of 4.87% annually.

- Market Growth: The legal services market is experiencing steady growth driven by increasing regulatory complexity, business expansion, and rising litigation demands.

- Technology Integration: Advanced technologies like AI-powered legal research, cloud-based case management, and automated document review are transforming legal service delivery.

- Regional Leadership: North America commands the largest market share, driven by sophisticated legal infrastructure and high corporate spending on legal services.

- Digital Transformation: Growing adoption of legal technology platforms and virtual consultation services is reshaping client engagement models.

- Key Players: Industry leaders include Allen & Overy LLP, Baker McKenzie, Clifford Chance LLP and Deloitte which dominate the market with comprehensive global legal solutions.

- Market Challenges: Rising operational costs, talent acquisition challenges, and the need for digital transformation present ongoing hurdles for traditional law firms.

Request for a sample copy of the report: https://www.imarcgroup.com/legal-services-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Industry Trends and Drivers:

- Explosive Growth in Corporate Legal Demand:

The business world is becoming increasingly complex, because it is true that companies now face more of the regulatory requirements than ever before. Am Law 100 firms showed an 8.4% rise in worked rates according to the Thomson Reuters Report exceeding mid-tier firms. Latham & Watkins and Kirkland & Ellis lead this trend because their corporate and litigation groups created record revenues. This surge in corporate legal spending reflects the growing need for expertise in compliance, mergers, acquisitions, and business transactions. For modern firms, advanced legal help is important when charting today's rules. It is because of this that companies invest rather heavily in external counsel and in internal legal departments.

- Revolutionary Technology Integration Transforming Legal Practice:

New technologies are reshaping how legal services are provided globally now. Data coming from the 2024 Legal Technology Survey by the American Bar Association shows that 73% of litigators use technology in order to file within court and that 67% of attorneys pay so they can use services for online research. AI-powered legal research tools do dramatically reduce the time that lawyers spend preparing cases, while cloud-based practice management systems allow lawyers to collaborate smoothly across global offices. Document automation and also contract analysis software streamline all routine tasks. Lawyers then can focus on valuable considered labor. This technological revolution does not just change how lawyers work but reshapes what clients expect and it creates new competitive advantages for firms using technology.

- Massive Growth in Litigation and Dispute Resolution:

The business environment has become increasingly litigious, with companies facing more disputes across multiple jurisdictions. The litigation segment held the largest market share of over 29% in 2024, driven by the rise in high-stakes lawsuits in areas such as intellectual property disputes. Complex commercial disputes, regulatory enforcement actions, and cross-border litigation are creating substantial demand for specialized legal expertise. The rise of ESG-related litigation, cybersecurity breach lawsuits, and antitrust enforcement is opening entirely new practice areas. In June 2024, Kirkland & Ellis LLP was recognized in the Chambers Crisis & Risk Management guide as a leading law firm, with their Crisis Management team achieving a Band 1 ranking. This recognition highlights how firms are building specialized capabilities to meet emerging client needs.

- Strategic Market Consolidation and Expansion:

The business environment is increasingly litigious, and companies dispute more in multiple jurisdictions. For 2024, the litigation segment held over 29% of the market, as high-stakes lawsuits rose in areas such as intellectual property disputes. Complex commercial disputes, regulatory enforcements as well as cross-border litigations do demand specialized legal expertise in a substantial way. Entirely new practice areas are opening due to antitrust enforcement, cybersecurity breach lawsuits, also the rise of ESG-related litigation. In June 2024, Kirkland & Ellis LLP was recognized as a leading law firm in the Chambers Crisis & Risk Management guide. Their Crisis Management team achieved a Band 1 ranking as well. As for this recognition, emerging client needs are met by way of specialized capabilities firms are building.

- Enhanced Security and Regulatory Compliance Demands:

Firms are pursuing growth by way of mergers, acquisitions, and calculated partnerships. Therefore, the legal services industry is undergoing meaningful structural changes now. In 2024, large firms generated 75.6% of the size of the US legal services market. Global reach, multidisciplinary benches, and technology budgets enabled these firms to do so. This focus shows the benefit obtained through handling difficult, multi-jurisdictional issues and serving global corporate clients. Recruiting costs are in excess of USD 230,000 per associate which squeezes margins as well as forces firms to automate routine tasks or raise rates. Because talent is short, firms invest heavily in technology as they deliver alternative services to maintain profitability also to meet client demands.

Legal Services Market Report Segmentation:

Breakup by Service:

- Taxation

- Real Estate

- Litigation

- Bankruptcy

- Labor/Employment

- Corporate

- Others

Breakup by Mode:

- Online Legal Services

- Offline Legal Services

Breakup by End User:

- Legal Aid Consumers

- Private Consumers

- SMEs

- Charities

- Large Businesses

- Government

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Who are the key players operating in the industry?

The report covers the major market players including:

- Allen & Overy LLP

- Baker McKenzie

- Clifford Chance LLP

- Deloitte

- DLA Piper

- Kirkland & Ellis LLP

- KPMG International Limited

- Latham & Watkins LLP

- Norton Rose Fulbright

- Sidley Austin LLP

- Skadden, Arps, Slate, Meagher & Flom LLP

- White & Case LLP

Ask Analyst & Browse full report with TOC List of Figures: https://www.imarcgroup.com/request?type=report&id=8782&flag=C

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302