Regional Trends

The tridecanol market shows meaningful geographic variation, reflecting maturity, feedstock access, industrialization levels, and regulatory environments.

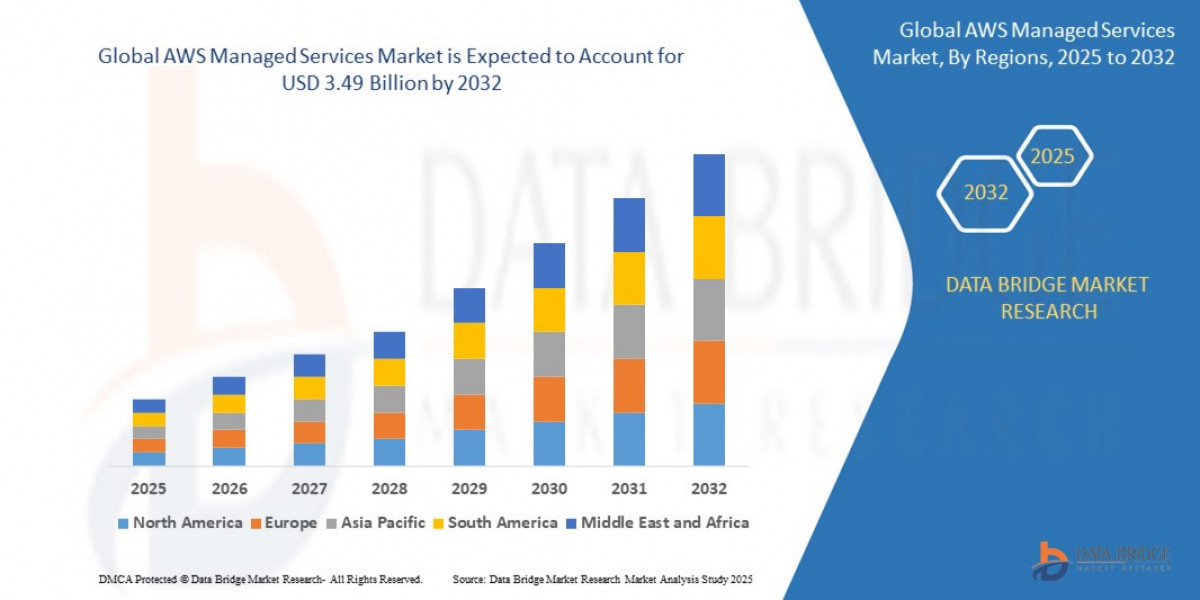

North America: This region is one of the mature markets for tridecanol, with well-developed personal care, chemical, and pharmaceutical sectors. cites North America as the largest market in 2024. Its strong R&D capabilities, regulatory scrutiny, and demand for specialty ingredients support stable growth.

Europe: Europe is expected to be among the faster-growing regions (per Straits), supported by regulatory push for sustainable chemicals, eco-friendly formulations, and strict chemical safety standards. The region’s emphasis on “green chemistry” drives uptake of natural or bio-derived variants.

Asia-Pacific: This region is often projected to see the fastest growth, thanks to rapid industrialization, urbanization, burgeoning cosmetics & personal care demand (especially in China, India, South Korea), and rising manufacturing base. For instance, some reports forecast that Asia will constitute a significant share of global demand.

Latin America, Middle East & Africa (MEA): These regions currently represent smaller shares but are increasingly seen as growth opportunities. In Latin America, growth in end-use industries like personal care and detergents may drive incremental demand. In MEA, the challenge is lower industrial base and regulatory constraints, but niche opportunities exist in specialty formulations.

Thus, regional strategies must account for local regulatory regimes, raw material supply (e.g. oleochemicals or petrochemical feedstocks), and downstream industry growth.

Segments

X: Product Type (Natural vs Synthetic / Grades)

Synthetic tridecanol: produced via petrochemical routes (e.g. hydrogenation of intermediates). This segment has historically dominated due to consistency and cost advantages.

Natural / bio-derived tridecanol: derived from renewable feedstocks (e.g. plant oils) and gaining traction due to sustainability, consumer preference, and regulatory pressure. Reports note rising demand for “green” surfactants and ingredients.

Grades (e.g. pharmaceutical grade, cosmetic grade, industrial grade): Different purity and specification grades serve distinct segments; e.g. pharmaceutical grade demands high purity and regulatory compliance.

Y: Application / Function

Tridecanol’s versatility allows segmentation by its functional use:

Surfactants / emulsifiers / wetting agents (largest share): used in detergents, cleaning agents, emulsions. includes “wetting agents, surfactants, emulsifiers” as key segments.

Lubricants / plasticizers / additives: used in industrial specialty formulations.

Personal care / cosmetics: as an emollient, thickener, or co-emulsifier in creams, lotions, hair care.

Pharmaceuticals / excipients: used in formulations, solvents, or delivery systems in pharma.

Others: niche uses such as specialty intermediates, chemical intermediates, etc.

Some sources emphasize growth in personal care & cosmetics segment as a key driver.

Z: End-Use Industry

Cosmetics & personal care

Pharmaceutical / healthcare

Industrial / chemical / manufacturing

Home care & cleaners

Others (textiles, plastics, specialty chemicals)

Each end-use industry imposes different purity, regulatory, and cost constraints. For example, the cosmetics sector may prefer “natural” variants; industrial sector may lean synthetic for cost efficiency.

Segmental growth trends suggest that surfactants / emulsifiers and personal care & cosmetics may see faster expansion, especially where “clean label” and biodegradable ingredients are preferred.

Top Players (A, B)

Some of the major players in the global tridecanol / tridecyl alcohol space (and related fatty alcohols) include:

BASF SE

KH Neochem Company

Clariant

Sasol Limited

Kao Corporation

Ecogreen Oleochemicals

Emery Oleochemicals

Musim Mas Holdings

KLK Oleo

OleoN NV

Croda International Plc

Arkema, Dow, Evonik, Stepan, Wilmar

and others.

These players compete on factors such as production efficiency, feedstock sourcing, product purity, regulatory compliance, sustainability credentials, regional presence, and strategic partnerships. Some focus more on oleochemicals; others integrate across fatty alcohol value chains.

Get Your Sample Report Now:- https://straitsresearch.com/report/tridecanol-market/request-sample

Market Drivers

Rising demand in personal care & cosmetics

Consumers are increasingly looking for high-performance, mild, and “green” ingredients. Tridecanol is used as emollient, thickener, and co-surfactant, driving demand in skin care, hair care, etc.Growth of surfactants & cleaning agents

As urbanization and hygiene awareness rise, detergents, cleaners, and emulsified systems expand, fueling use of surfactant ingredients like tridecanol.Industrial & specialty chemical demand

In lubricants, plasticizers, coatings, and specialty formulations, tridecanol is an important intermediate or additive.Sustainability & bio-based trends

The shift toward environmentally friendly, biodegradable, and renewable raw materials pushes interest in bio-derived tridecanol.Technological advances & process optimization

Better catalytic processes, yield improvements, and separation technologies reduce costs and make production more scalable.Regulatory & safety pressure

Stricter regulations on certain chemicals push formulators to seek safer alternatives, possibly favoring compounds like tridecanol with acceptable toxicity and handling profiles (provided regulation allows).

Challenges

Feedstock volatility & raw material costs

Whether derived from petrochemical or oleochemical sources, feedstock price fluctuations can squeeze margins.Regulatory & safety constraints

Handling, classification, toxicity, and environmental regulations may limit use or impose compliance costs.Competition from alternatives / substitutes

For some applications, other fatty alcohols, esters, or synthetic “green” molecules may compete.Technical complexity & scale

High purity, stringent specifications (especially for cosmetics or pharma) demand advanced purification, increasing costs.Market fragmentation & small niche demand

Being a niche specialty chemical, demand is more limited compared to mass chemicals, making scale an issue.Supply chain constraints

Distribution, logistics, storage (flammability), and transportation safety add complexity.

Frequently Asked Questions (FAQs)

Q1. What is the current size and growth rate of the global tridecanol market?

A: According to , the market was valued at USD 238.3 million in 2024 and is forecast to reach USD 441.06 million by 2033 (CAGR 7.1 %) . Other sources estimate different bases (e.g. USD 350 million in 2023 with growth to USD 510 million by 2032)

Q2. Which region leads the market?

A: North America is currently the largest region according to . Europe is among the fastest growing, while Asia-Pacific is expected to show the highest growth momentum.

Q3. What are the major product & application segments?

A: Key segments include product type (synthetic vs natural; grades), application/function (surfactants, emulsifiers, lubricants, personal care), and end-use industries (cosmetics, pharma, industrial). The surfactants / emulsifiers slice tends to dominate.

Q4. Who are the leading players?

A: Some top players are BASF SE, KH Neochem, Clariant, Sasol, Kao Corporation, Emery Oleochemicals, Musim Mas, KLK Oleo, Croda, etc.

Q5. What are the key growth drivers and constraints?

A: Drivers include growing personal care demand, surfactant demand, sustainability trends, technological improvements. Constraints include feedstock volatility, regulation, alternatives, purification costs, supply chain complexity.