Other sources estimate somewhat more conservative numbers: for example Fact.MR reports the 2023 market size as USD 1.14 billion, with a 5.6 % CAGR through 2033. Regardless of the baseline, consensus suggests solid growth driven by rising consumer awareness of health, beauty, and performance benefits of collagen products.

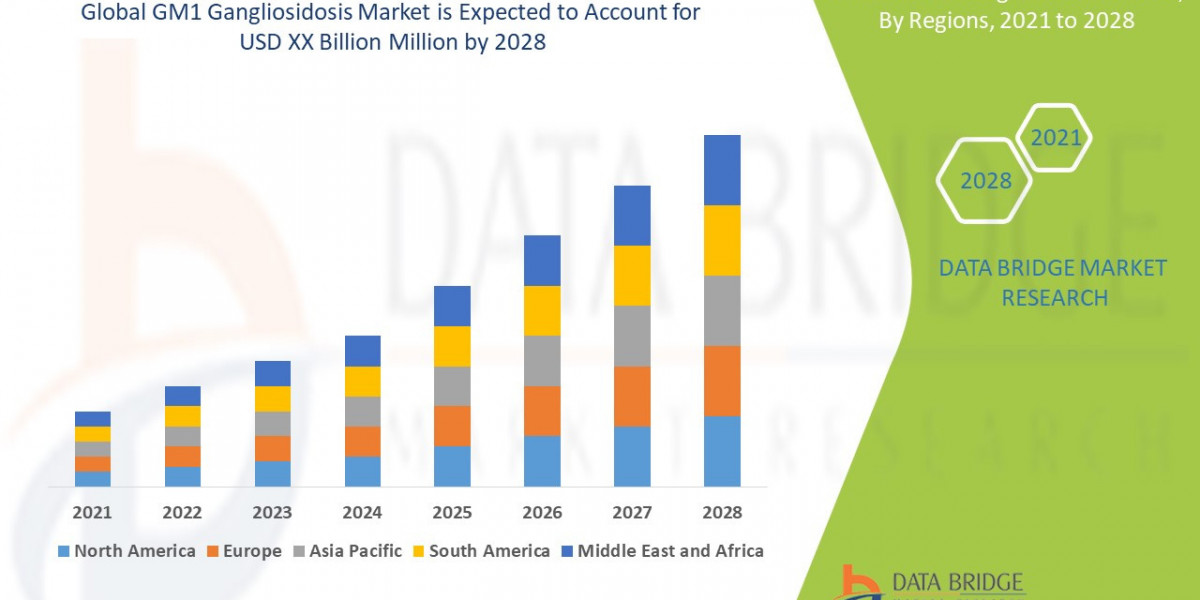

Regional Trends

Understanding how bovine collagen uptake varies by geography is critical for stakeholders planning market entry or expansion.

North America

North America is among the leading markets for collagen (and by extension bovine collagen), driven by high consumer awareness, strong health & wellness trends, and established e-commerce and supplement distribution systems. In the U.S. collagen market, the bovine-source segment was valued at about USD 881.3 million in 2024, and is projected to nearly double by 2030.

Europe

Europe often holds the largest regional share in many collagen reports due to health-conscious populations, robust cosmetics industry, and demand for clean-label and sustainable sourcing. According to , Europe is expected to remain a dominant region for bovine collagen.

Asia-Pacific

The Asia-Pacific region is seen as one of the fastest-growing for bovine collagen, fueled by rising disposable incomes, urbanization, growing beauty markets (especially in China, India, Japan), and increasing demand in functional foods and nutraceuticals.

Latin America, Middle East & Africa

These regions are less mature but offer growth potential. Challenges include weaker infrastructure, regulatory hurdles, and lower awareness, but niche players are investing in supply chains and local sourcing.

In summary: Europe often leads in share, North America is mature with strong per capita uptake, and Asia-Pacific is the high-growth region to watch.

Market Segmentation

In the bovine collagen market, segmentation is typically along Source / Form / Application / Type lines (I’ll denote them as X, Y, Z for clarity, though actual names vary). Below is a representative segmentation structure and current insights.

X: Source / Grade

Grass-fed bovine collagen vs Conventionally raised bovine collagen

For hydrolyzed bovine collagen specifically, the grass-fed segment is often preferred for “premium / clean-label” positioning. For instance, in 2024, grass-fed sources held 57.5 % share in hydrolyzed bovine collagen.

Y: Form / Physical Format

Powder

Liquid / Solution

Powder form often dominates due to ease of storage, transport, and blending in supplements or food formulations. Liquid forms though more expensive to package are increasingly used in functional drinks or ready-to-consume formats.

Z: Application / End Use

Common application (or end-use) segments include:

Food & Beverages (e.g. protein drinks, functional foods)

Dietary Supplements / Nutraceuticals

Cosmetics & Personal Care (skin creams, serums, beauty drinks)

Pharmaceutical / Biomedical / Medical Devices

Others (e.g. animal feed, industrial uses)

According to , the pharmaceutical / nutraceutical / supplement (health) segment often commands a large share sometimes 50 % or more in older publications. In hydrolyzed bovine collagen, the health supplements / skincare / sports nutrition verticals drive demand strongly.

Some further observations:

Within application, cosmetics / beauty / skincare is frequently the fastest-growing sub-segment, driven by anti-aging, skin elasticity, and “beauty-from-within” trends.

For type, one can also segment by collagen type (Type I, Type II, etc.), native vs hydrolyzed, or by peptide molecular weight; in hydrolyzed markets, low-molecular-weight peptides have higher absorption and command premium pricing.

By combining such axes, one can define a matrix of many sub-segments (e.g. grass-fed / powder / cosmetics / Type I hydrolyzed, etc.).

Top Players (AB)

Here are some of the leading companies (“A, B, …”) in the bovine collagen / hydrolyzed collagen space, and key moves or differentiators:

Rousselot B.V. a major global collagen & gelatin supplier, active in specialty collagen derivatives

GELITA AG German company, strong in collagen peptides, gelatin, and R&D

Nitta Gelatin Inc. Japanese firm with extensive presence in Asia

Collagen Solutions Plc UK/Europe-based, often serving biomedical / medical device segments

PB Leiner / PB Gelatins active in Europe, gelatin and collagen derivatives

Weishardt Group

Darling Ingredients Inc.

Nippi Collagen NA Inc.

Connoils, Advanced BioMatrix Inc., etc.

In the hydrolyzed bovine collagen space, key players include Rousselot, Gelita AG, Nitta Gelatin, Gelnex, Collagen Solutions among others.

Many of these players compete on purity, peptide profile, sourcing transparency (e.g. grass-fed, non-GMO, BSE-free), regulatory certification (food / pharma grade), and geographic footprint.

Get Your Sample Report Now:- https://straitsresearch.com/report/bovine-collagen-market/request-sample

Market Drivers

Several forces propel the bovine collagen market:

Health & Wellness / Anti-Aging Trends

Growing consumer interest in skin health, joint support, muscle repair, and aging prevention boosts demand for collagen supplements and cosmeceutical products.Increasing Use in Food & Beverage / Functional Foods

Collagen is used to enrich protein drinks, bars, functional foods, and nutraceutical formulations, leveraging its binding, gelling, and texturizing properties.Advances in Extraction / Purification Techniques

New enzymatic or process innovations enable higher yields, purer peptides, lower cost, and tailored molecular weight profiles, making collagen more attractive to formulators.Rising Middle-Class & Disposable Income (especially in Asia)

Growth in consumer purchasing power in emerging markets leads to more demand for beauty, wellness, and premium nutrition products.Cross-Industry Use (Cosmetics, Pharma, Biomedical)

Collagen’s utility in wound healing, tissue engineering, drug delivery, and dermal fillers opens specialty higher-margin markets.Clean-Label & Natural Positioning

Brands favor “natural protein,” “no synthetic additives,” “grass-fed,” “non-GMO” claims, which align well with bovine collagen when properly sourced.

Market Challenges & Restraints

However, the market also faces headwinds:

Raw Material Price Volatility & Supply Disruptions

Bovine collagen relies on cattle slaughter by-products (bones, hides). Fluctuations in cattle industry, feed prices, BSE or disease outbreaks (e.g. mad cow disease concerns) can affect supply or cost.Allergenicity & Consumer Concerns

Some fraction of population has sensitivities or cultural/religious objections to bovine products. notes that 3 % of global population might have allergy to bovine milk / derivatives.Regulatory & Quality / Safety Barriers

Ensuring BSE-free status, complying with food / drug / supplement regulations in multiple jurisdictions, and maintaining consistent GMP / quality standards across global markets is challenging.Competition from Alternative Collagen Sources

Marine, porcine, plant-based, and fermentation-derived collagens are gaining traction (especially for “clean-label” or vegan-friendly claims). Some reports show marine collagen growing faster in certain geographies.Consumer Skepticism / Efficacy Debates

Although many studies support benefits, some consumers remain skeptical of claims around collagen supplements. Brands must support their products with credible clinical evidence.Cultural / Religious Constraints

In markets with a high share of vegetarian, religious dietary restrictions (Hindu, Buddhist, etc.), bovine origin may be less acceptable unless certified halal / kosher.

FAQs (Frequently Asked Questions)

Q1: What is the projected growth rate (CAGR) for the bovine collagen market?

According to , 10.3 % CAGR (2025–2033)

Other sources (e.g. Fact.MR) estimate 5.6 % CAGR (2023–2033)

Verified Market Reports suggests 9.1 % CAGR from 2026 to 2033.

Q2: Which region dominates the bovine collagen market?

Europe is often cited as the largest region by share, with North America and Asia-Pacific close behind. Asia-Pacific is anticipated to grow fastest.

Q3: Who are key players in the bovine collagen market?

Major firms include Rousselot, GELITA AG, Nitta Gelatin, Collagen Solutions Plc, PB Leiner, Weishardt, Darling Ingredients, and Nippi Collagen NA Inc.

Q4: Which application segments drive demand?

Health / nutraceutical / supplement sector and cosmetics / personal care are often the fastest-growing and highest-demand segments. Food & beverage also contributes via functional foods.

Q5: What is the difference between bovine collagen and marine collagen?

Bovine collagen generally offers higher extraction yield and lower cost vs marine sources, but marine collagen often appeals to specific consumer segments (e.g. pescatarian, halal/kosher) and can command premium pricing.