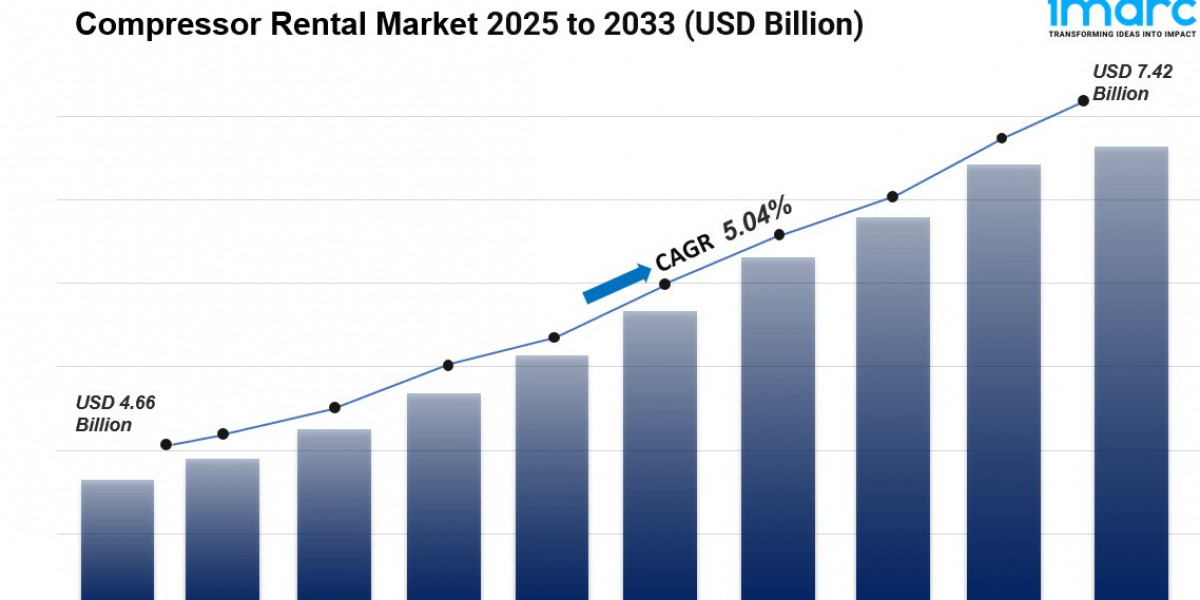

The global compressor rental market size was valued at USD 4.66 Billion in 2024. The market is projected to reach USD 7.42 Billion by 2033, exhibiting a CAGR of 5.04% during 2025-2033. Asia Pacific currently dominates the market, holding a significant market share of over 37.6% in 2024. The market is experiencing steady growth driven by growing needs for short-term and flexible equipment solutions across industries like construction, mining, and oil and gas, mounting focus on cost-effectiveness coupled with the desire to minimize capital spending, and technological advancements in compressors along with an uptick in infrastructure development projects worldwide.

Key Stats for Compressor Rental Market:

- Compressor Rental Market Value (2024): USD 4.66 Billion

- Compressor Rental Market Value (2033): USD 7.42 Billion

- Compressor Rental Market Forecast CAGR: 5.04%

- Leading Segment in Compressor Rental Market in 2024: Rotary Screw (67.7%)

- Key Regions in Compressor Rental Market: Asia Pacific, Europe, North America, Latin America, Middle East and Africa

- Top companies in Compressor Rental Market: Acme Fabcon India Private Limited, Aggreko Plc, Ar Brasil Compressores Ltda, Ashtead Group Plc, Atlas Copco AB, Caterpillar Inc., Herc Rentals Inc., Ingersoll-Rand US Trane Holdings Corporation (Trane Technologies Plc), Ramirent Finland Oy (Loxam), United Rentals Inc., etc.

Why is the Compressor Rental Market Growing?

The compressor rental market is expanding robustly as industries worldwide recognize the financial and operational advantages of renting over buying. Compressed air is often called the "fourth utility" in industrial operations—as essential as electricity, water, and natural gas. It powers pneumatic tools, drives manufacturing processes, supports construction equipment, and enables countless industrial applications. But the compressors that generate this vital resource represent substantial investments that not every business can justify.

What's driving the shift to rentals? Start with the most obvious advantage: flexibility. Industrial projects rarely have consistent, predictable compressed air requirements. A construction company might need massive air capacity during the foundation phase when jackhammers and pneumatic drills work around the clock, but far less during interior finishing. An oil and gas operation might require specialized compression for drilling, but once the well is established, those needs disappear. Buying compressors for peak demand means owning expensive equipment that sits idle much of the time. Renting allows businesses to match capacity precisely to current needs.

The capital cost consideration is significant. Industrial compressors aren't cheap—quality units can cost tens or hundreds of thousands of dollars. For many businesses, especially smaller operators and project-based companies, that capital is better deployed elsewhere. Renting converts a major capital expenditure into a manageable operational expense, preserving cash flow and financial flexibility.

Infrastructure development worldwide is creating massive demand for rental compressors. In India, total expenditure on infrastructure development reached INR 10 Lakh Crore (approximately USD 120 Billion) in the 2023-24 budget, according to industry reports. These enormous projects—highways, railways, airports, power plants, urban development—all require compressed air for countless applications. Rental services provide the scalable capacity these megaprojects need without the logistical nightmare of transporting, maintaining, and eventually disposing of owned equipment.

The United States is seeing similar investment patterns. On June 26, 2024, U.S. Transportation Secretary Pete Buttigieg announced USD 1.8 billion in grants through the RAISE program, supporting 148 projects across the country. Construction expenditure in the United States during March 2025 reached a seasonally adjusted annual rate of USD 2,196.1 Billion—a 2.8% increase compared to March 2024 at USD 2,135.8 Billion. Each of these projects requires compressed air solutions, and rental services provide the most cost-effective way to meet those needs.

Request Sample URL: https://www.imarcgroup.com/compressor-rental-market/requestsample

AI Impact on the Compressor Rental Market:

Artificial intelligence and IoT connectivity are revolutionizing how rental compressors are monitored, maintained, and optimized. This isn't future speculation—it's happening right now throughout rental fleets worldwide, transforming both provider operations and customer experiences.

Predictive maintenance represents AI's most immediate impact. Modern rental compressors come equipped with sensors monitoring dozens of parameters—temperatures, pressures, vibrations, flow rates, power consumption, and more. AI algorithms analyze this continuous data stream, learning normal operational patterns for each machine. When the system detects deviations from baseline—a temperature running slightly high, a vibration pattern changing, pressure fluctuations increasing—it flags potential problems before they cause failures.

This predictive capability matters enormously for rental operations. Rather than waiting for equipment to break down (reactive maintenance) or servicing everything on fixed schedules (preventive maintenance), rental companies can intervene precisely when needed (predictive maintenance). This reduces maintenance costs, extends equipment life, and most importantly for customers—prevents unexpected downtime.

Fleet optimization benefits dramatically from AI analytics. Rental companies operate complex logistics—thousands of compressor units scattered across hundreds of customer sites, all with different rental terms, maintenance needs, and utilization patterns. AI systems analyze this complexity, identifying opportunities to improve efficiency. Which units should be repositioned to meet emerging demand? Which customers might soon need capacity upgrades? Which equipment is underutilized and could be redeployed? These operational intelligence insights improve profitability while ensuring equipment availability.

Remote monitoring and diagnostics have transformed customer service. When a customer experiences issues with rented equipment, the rental provider's technical team can remotely access the compressor's data, often diagnosing problems without site visits. They can see exactly how the equipment is being used, whether issues stem from the compressor itself or from how it's integrated into the customer's system. This accelerates problem resolution while reducing service costs.

Energy optimization algorithms deliver real value to customers. Many modern rental compressors can automatically adjust operation based on actual air demand rather than running constantly. AI systems analyze demand patterns over time, learning when high capacity is needed and when output can be reduced. ELGi's STABILISOR technology exemplifies this—delivering up to 15% energy savings by dynamically matching output to requirements. For customers paying electricity bills, these savings directly offset rental costs.

Utilization tracking provides transparency and billing accuracy. IoT-connected compressors record precise operating hours, idle time, and performance metrics. This data ensures accurate billing based on actual usage rather than estimates. It also helps customers understand their true compressed air consumption, potentially revealing opportunities to optimize their operations.

Segmental Analysis:

Analysis by Technology Type:

- Rotary Screw

- Reciprocating

- Centrifugal

Rotary screw technology dominates with approximately 67.7% market share in 2024, and there are solid reasons for this leadership. The fundamental design of rotary screw compressors delivers superior efficiency and reliability compared to alternatives. They provide continuous, consistent compressed air flow—critical for industrial processes where interruptions can disrupt production or compromise quality. Unlike reciprocating compressors that deliver pulsating air flow, rotary screw units produce steady output that many applications require.

The operational characteristics make rotary screw compressors particularly attractive for rental applications. They run quietly with minimal vibration, making them suitable for noise-sensitive environments like hospitals, research facilities, and urban construction sites where disturbance must be minimized. Their compact design relative to capacity makes them easier to transport and position than reciprocating units of equivalent output.

Technological advancements have expanded rotary screw capabilities. Oil-free rotary screw compressors are essential in pharmaceuticals and food production where even trace contamination would be unacceptable. The availability of these specialized units in rental fleets allows industries with stringent air quality requirements to access appropriate equipment without the substantial capital investment oil-free technology requires. Variable speed drive technology allows modern rotary screw compressors to adjust output precisely to demand, delivering significant energy savings—a capability that makes them cost-effective even at premium rental rates.

Analysis by Compressor Type:

- Air Compressor

- Gas Compressor

Air compressors represent the bulk of rental demand, serving the diverse compressed air needs across construction, manufacturing, and general industrial applications. Gas compressors fill specialized niches in oil and gas exploration, petrochemical processing, and offshore drilling where specific gases must be compressed under varying pressure conditions.

The specialized nature of gas compression creates rental opportunities. Equipment for handling natural gas, hydrogen, nitrogen, carbon dioxide, or other process gases requires specialized design and materials. Safety and compliance standards for hazardous gas handling are stringent, and rental providers ensure equipment meets regulatory requirements—alleviating compliance concerns for customers. This specialized equipment is costly to purchase and maintain, making rental cost-effective for short-term projects or applications requiring equipment customization for specific gas types and compression requirements.

Analysis by End Use Industry:

- Construction

- Mining

- Oil and Gas

- Power

- Manufacturing

- Chemical

- Others

Construction leads with approximately 38.9% market share, reflecting the sector's project-based nature and varying compressed air needs. Construction projects exhibit dramatic demand fluctuations throughout their lifecycle. Initial phases might require extensive pneumatic tools for demolition and excavation. Foundation work involves jackhammers and rock drills. Concrete work requires pneumatic pumps and sprayers. Finishing phases might need sandblasting equipment. Each phase requires different capacity and equipment types—making rental far more practical than ownership.

The construction sector operates in competitive, deadline-driven environments where schedule delays cost money. Compressor rental services offer quick access to necessary equipment, minimizing downtime and keeping projects on track. Modern, energy-efficient rental units align with sustainability goals that increasingly influence construction projects, particularly for large infrastructure developments or projects seeking environmental certifications.

Mining operations require compressed air for drilling, rock breaking, ventilation, and countless other applications—often in remote locations lacking permanent infrastructure. The project-based, location-specific nature of mining makes equipment rental practical.

Oil and gas operations use compressed air and gas compression throughout exploration, drilling, and production. Requirements vary dramatically by project phase and location. Rental services provide specialized equipment exactly when and where needed without the logistics of maintaining owned equipment across dispersed operations.

Manufacturing facilities need reliable compressed air for pneumatic controls, material handling, spray finishing, and process applications. While large facilities typically own base-load compression capacity, they rent supplemental equipment during production surges, equipment maintenance periods, or when testing new processes before committing to capital purchases.

Analysis of Compressor Rental Market by Regions

![Regional Market Map]

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Asia Pacific dominates the global market with 37.6% share, driven by the region's explosive industrial growth and infrastructure development. Rapid urbanization and infrastructure expansion across India, China, and Southeast Asian nations create massive demand for compressed air in construction, manufacturing, and mining. The region's commitment to cost-effectiveness makes rental services particularly attractive—businesses can access quality equipment without substantial capital investment.

India exemplifies the regional growth dynamics. The Index of Industrial Production grew 5.2% in November 2024, with manufacturing expanding 5.8% and mining growing 1.9%. Infrastructure spending reached INR 10 Lakh Crore (USD 120 Billion) in the 2023-24 budget. This industrial and infrastructure boom creates sustained compressed air demand across diverse applications.

The adoption of advanced compressor technologies throughout Asia Pacific is driving rental demand for specialized equipment. Oil-free and energy-efficient models that rental providers offer help businesses meet stringent quality and efficiency standards without capital investment. Environmental regulations and sustainability commitments are prompting businesses to explore eco-friendly compressor rental options, balancing operational efficiency with environmental responsibility.

North America, with the United States accounting for the majority of regional activity, represents a mature but growing market. American businesses increasingly recognize rental advantages—flexibility, capital preservation, and access to latest technology. The robust infrastructure investment—USD 1.8 billion through the RAISE program supporting 148 projects—drives demand for temporary equipment solutions.

Construction expenditure reaching USD 2,196.1 Billion annually (March 2025) creates massive compressed air requirements. Industries prefer renting to avoid equipment maintenance burdens and capital depreciation. Technological advancements in energy-efficient, IoT-enabled compressors make rental increasingly attractive as companies can access cutting-edge technology without long-term commitments.

Request Customization: https://www.imarcgroup.com/request?type=report&id=2456&flag=E

What are the Drivers, Restraints, and Key Trends of the Compressor Rental Market?

Market Drivers:

Capital preservation is the fundamental driver. Businesses across industries recognize that tying up capital in compressor purchases makes little financial sense when rental alternatives exist. This is especially true for project-based companies where compressed air needs fluctuate dramatically. Converting major capital expenditures into manageable operational expenses improves financial flexibility and preserves cash for core business activities.

Infrastructure investment worldwide creates sustained rental demand. From India's USD 120 billion infrastructure budget to America's RAISE program grants to megaprojects throughout Asia Pacific, these developments require temporary compressed air solutions at scales that make ownership impractical.

Industrial growth drives baseline demand. Manufacturing expansion, mining operations, energy production, and construction activity all require compressed air. As industrial output grows—particularly in emerging markets—compressed air demand grows correspondingly, and rental services capture significant portions of that growth.

Project-based business models favor rentals. Construction companies, mining operations, oil and gas explorers, and event organizers all work on projects with defined timeframes and locations. Owning equipment means maintaining, storing, and transporting it between projects. Renting provides exactly what each project needs without ongoing ownership burdens.

Technology access motivates rental adoption. The latest energy-efficient, IoT-enabled compressors deliver performance and cost advantages that older equipment can't match. Rental services provide access to cutting-edge technology without the capital investment of purchasing new equipment.

Maintenance cost avoidance is substantial. Compressor ownership involves ongoing maintenance, parts replacement, periodic overhauls, and operator training. These costs are included in rental rates, but more importantly—the time and hassle of managing maintenance disappears entirely.

Environmental regulations favor modern equipment. Rental fleets stock the latest models meeting current emissions, noise, and efficiency standards. For businesses in regions with stringent regulations, renting ensures compliance without the burden of upgrading owned equipment.

Market Restraints:

Long-term cost considerations can favor ownership for some applications. When compressed air requirements are consistent and permanent, the cumulative cost of renting can eventually exceed purchase price. Businesses with stable, predictable needs might find ownership more economical over extended periods.

Transportation and logistics add costs. Compressors are heavy, bulky equipment requiring specialized transport. For remote locations or frequent relocations, transportation expenses can significantly increase total rental costs.

Availability during peak demand periods can be challenging. When major projects or seasonal activities create simultaneous demand spikes, rental availability may tighten. Businesses may face higher rates or limited equipment selection during these periods.

Dependency on rental providers creates potential vulnerability. If a rental company experiences financial difficulties, logistical problems, or service quality issues, customers' operations could be affected. This dependence makes provider selection and relationship management important.

Standardization limitations can be frustrating. Rental equipment may not integrate seamlessly with existing infrastructure or may lack specific features that owned equipment could be specified to include. This standardization sometimes forces operational compromises.

Market Key Trends:

IoT connectivity and smart monitoring are becoming standard rather than optional. Modern rental compressors feature sensors and connectivity enabling remote monitoring, predictive maintenance, and performance optimization. This technology improves reliability while reducing operating costs—creating value for both rental providers and customers.

Energy efficiency is no longer a premium feature—it's expected. With 80% of industrial companies having sustainability strategies, energy-efficient compressors have become baseline requirements. Rental fleets are upgrading to meet these expectations, offering units that deliver significant energy savings compared to older technology.

Flexible rental terms are expanding. Traditional rental agreements offered daily, weekly, or monthly rates. Modern providers increasingly offer customized terms matching project lifecycles—from short-term emergency rentals to multi-year agreements with flexible capacity adjustments.

Turnkey solutions are gaining popularity. Rather than just providing equipment, many rental companies now offer complete compressed air solutions—including installation, integration with existing systems, operator training, and ongoing optimization support. This full-service approach reduces customer complexity.

Sustainability certifications and carbon footprint tracking are emerging as differentiators. Rental providers are quantifying and reporting the environmental benefits of their modern equipment, helping customers meet their own sustainability reporting requirements.

Cross-industry equipment standardization is improving efficiency. Rental providers are standardizing on versatile equipment platforms that can serve multiple industries, improving fleet utilization while ensuring broad equipment availability.

Digital platforms for rental management are streamlining operations. Customers can browse available equipment, request quotes, arrange delivery, monitor performance, and manage contracts through online portals—bringing consumer-grade convenience to industrial equipment rental.

Leading Players of Compressor Rental Market:

According to IMARC Group's latest analysis, prominent companies shaping the global compressor rental landscape include:

- Acme Fabcon India Private Limited

- Aggreko Plc

- Ar Brasil Compressores Ltda

- Ashtead Group Plc

- Atlas Copco AB

- Caterpillar Inc.

- Herc Rentals Inc.

- Ingersoll-Rand US Trane Holdings Corporation (Trane Technologies Plc)

- Ramirent Finland Oy (Loxam)

- United Rentals Inc.

These industry leaders dominate through extensive rental fleets, global service networks, and comprehensive support capabilities. They invest heavily in modern, energy-efficient equipment and IoT-enabled monitoring systems that deliver superior performance and reliability. Strategic relationships with construction companies, industrial manufacturers, and resource extraction operations provide steady demand while geographic diversification reduces regional economic risks.

Key Developments in Compressor Rental Market:

- February 2025: ELGi Equipments launched its groundbreaking proprietary STABILISOR technology, aimed at transforming air compressor operations in industrial settings experiencing fluctuating air demand. This innovative system introduces a unique "Recirculate and Recover" principle that dynamically aligns compressor output with actual plant requirements in real-time. The technology reduces the frequency of load/unload cycles that waste energy and stress equipment, while enhancing overall system reliability. Most significantly, STABILISOR delivers up to 15% energy savings—a substantial reduction that directly impacts operating costs. For rental customers, this technology provides cutting-edge efficiency without capital investment, demonstrating how rental services provide access to the latest innovations.

- June 2024: U.S. Transportation Secretary Pete Buttigieg announced USD 1.8 billion in grants through the RAISE (Rebuilding American Infrastructure with Sustainability and Equity) program, supporting 148 infrastructure projects across the country. This massive federal investment in infrastructure development directly drives demand for construction equipment rentals, including compressors. Each of these projects requires reliable compressed air for pneumatic tools, concrete equipment, and numerous other applications. The grant structure—supporting projects nationwide—creates distributed demand that rental services are uniquely positioned to serve efficiently. This government investment exemplifies how public infrastructure spending creates sustained market growth for equipment rental providers.

- March 2025: Construction expenditure in the United States reached a seasonally adjusted annual rate of USD 2,196.1 Billion, representing a 2.8% increase compared to March 2024's USD 2,135.8 Billion, according to industry reports. This robust construction activity creates massive and sustained demand for compressor rentals. Construction projects at this scale require temporary compressed air solutions that can be scaled up during peak phases and scaled down during lighter activity periods. The year-over-year growth demonstrates the construction sector's continued strength and corresponding equipment rental demand. For compressor rental providers, this represents stable, growing baseline demand across residential, commercial, and infrastructure construction segments.

- November 2024: India's Index of Industrial Production recorded impressive growth of 5.2%, a significant acceleration from October 2024's 3.5%, according to the Press Information Bureau. The manufacturing sector specifically grew by 5.8%, while mining recorded 1.9% growth. This industrial expansion creates sustained compressed air demand across diverse applications—from powering manufacturing automation to supporting material handling to enabling pneumatic controls. The acceleration in growth rates suggests strengthening industrial momentum that will continue driving compressor rental demand throughout India's rapidly expanding industrial sector.

- Recent Development: The European Union's commitment to reducing net greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels is fundamentally reshaping equipment markets. By Q2 2024, emissions had decreased 2.6% compared to Q2 2023, demonstrating concrete progress toward ambitious targets. This regulatory environment strongly favors rental services offering modern, energy-efficient compressors. Rather than investing in upgrading owned equipment to meet evolving standards, European businesses increasingly turn to rental providers who maintain fleets of compliant, efficient equipment. This trend positions rental services as sustainability enablers, helping customers meet environmental commitments without major capital investments.

- Recent Development: Industrial companies worldwide are prioritizing sustainability, with approximately 80% having already developed dedicated sustainability strategies, according to industry surveys. This widespread commitment to environmental responsibility is driving demand for energy-efficient equipment across all sectors. Rental providers respond by upgrading fleets to the latest high-efficiency models, creating competitive advantages through environmental performance. For customers, renting provides access to equipment that supports their sustainability goals without the capital investment required to purchase new efficient compressors. This alignment between customer sustainability priorities and rental provider fleet strategies is accelerating the transition toward rental models.

- Recent Development: The UAE's oil and gas market reached 3.4 barrels per day in 2024, according to industry projections, with continued growth expected. This robust activity level requires extensive compressed air and gas compression services throughout exploration, production, and processing operations. The oil and gas sector's project-based nature—with exploration in different locations, drilling campaigns at specific sites, and maintenance programs on defined schedules—makes equipment rental ideal. Rather than owning and maintaining diverse compression equipment for operations spread across the region, companies increasingly rely on rental providers who deliver appropriate equipment exactly when and where needed, handle maintenance, and remove it when projects conclude.

Speak To An Analyst: https://www.imarcgroup.com/request?type=report&id=2456&flag=C

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302