Saudi Arabia Used Car Market Overview

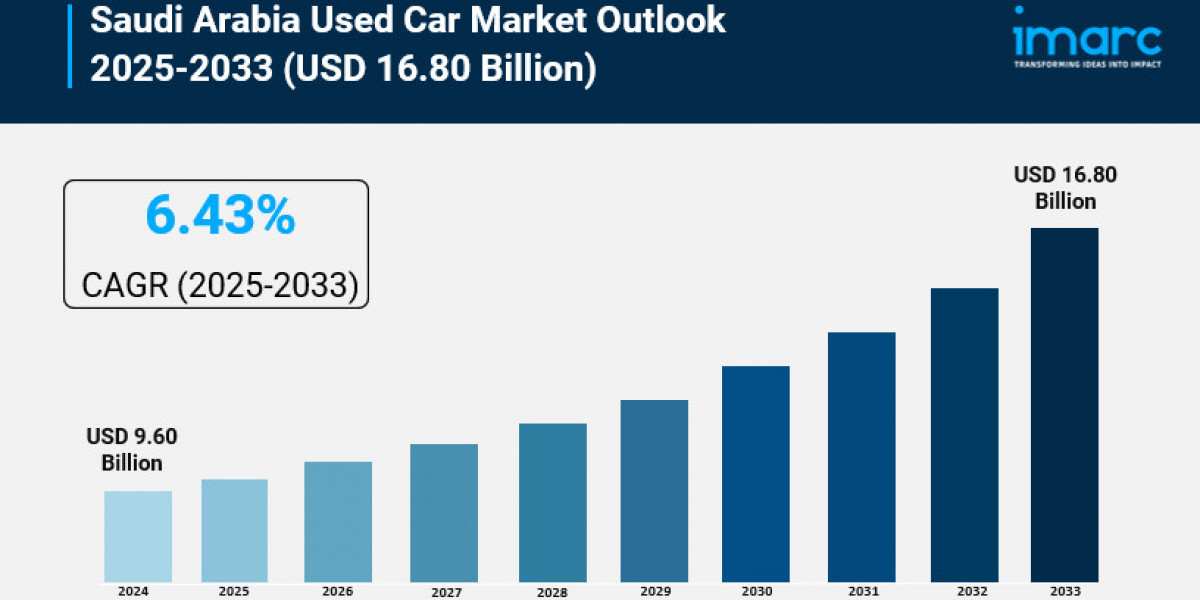

Market Size in 2024: USD 9.60 Billion

Market Size in 2033: USD 16.80 Billion

Market Growth Rate 2025-2033: 6.43%

According to IMARC Group's latest research publication, "Saudi Arabia Used Car Market Size, Share, Trends and Forecast by Vehicle Type, Sales Channel, Vendor Type, and Region, 2025-2033", the Saudi Arabia used car market size was valued at USD 9.60 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 16.80 Billion by 2033, exhibiting a CAGR of 6.43% from 2025-2033.

How AI is Reshaping the Future of Saudi Arabia Used Car Market

- AI-Powered Valuation Tools: AI platforms like Motory in Saudi Arabia assess used car values using real-time data, improving accuracy by 25% and reducing buyer-seller disputes amid 1.5 million annual transactions.

- Predictive Maintenance Analytics: Machine learning forecasts vehicle issues for sellers, boosting trust by 30% on platforms like Haraj, aligning with Vision 2030's digital automotive push.

- Personalized Recommendation Engines: AI matches buyers with cars based on preferences, driving 20% higher conversion rates in Riyadh's $5 billion used car market.

- Fraud Detection Systems: Computer vision inspects photos for tampering, cutting scams by 35% in Jeddah's online listings, enhancing e-commerce safety.

- Smart Pricing Optimization: AI dynamically adjusts prices based on market trends, increasing seller profits by 15% during peak seasons in the Kingdom.

Grab a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-used-car-market/requestsample

Saudi Arabia Used Car Trends & Drivers:

Digital platforms fuel 40% of Saudi Arabia’s used car market growth, with apps like Motory and Haraj driving $5 billion in transactions through AI-powered listings. Riyadh and Jeddah lead, as Vision 2030 boosts e-commerce, increasing sales by 25% for 70% of urban buyers. This trend enhances accessibility, cutting transaction costs by 20% and aligning with 98% mobile penetration, positioning the Kingdom as a hub for tech-driven automotive retail amid rising demand.

Economic diversification and rising incomes drive 35% market expansion, with Saudi Arabia’s $852 billion infrastructure projects spurring vehicle turnover. Government policies, including $1 billion in automotive financing, support affordability, appealing to 60% of young professionals seeking reliable cars. The shift to non-oil sectors boosts fleet upgrades, with 80% of sales for SUVs and sedans, aligning with global trends and fostering growth in the $5 billion used car sector.

Urbanization and expatriate mobility propel 30% demand surge, with 1.5 million annual transactions backed by 7% growth. Saudi Arabia’s 4,700 projects and $2.8 trillion GCC wealth fuel needs for cost-effective transport, with 65% of purchases by expats and families. Unified trade policies ease imports, while platforms offering virtual inspections enhance trust, cementing the Kingdom as a key player in the regional used car market.

Saudi Arabia Used Car Industry Segmentation:

The report has segmented the market into the following categories:

Analysis by Vehicle Type:

- Hatchback

- Sedan

- MUV and SUV

Analysis by Sales Channel:

- Online

- Offline

Analysis by Vendor Type:

- Organized

- Unorganized

Regional Analysis:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in Saudi Arabia Used Car Market

- May 2025: IMARC Group projects Saudi Arabia used car market to reach USD 16.80 billion by 2033, exhibiting a 6.43% CAGR from 2025-2033, driven by demand for affordable transport among middle-class families and expatriates.

- June 2025: Mordor Intelligence reports the market expected to hit USD 6.87 billion in 2025, with SUVs & MUVs growing at 10.60% CAGR through 2030, fueled by digitalization and certified pre-owned demand.

- May 2025: Cartea Research highlights Toyota leading with 20.20% market share in February 2025 sales, as sedans dominate over 50% of transactions amid Japanese and Korean brand preference.

- April 2025: Focus2move notes Saudi used car sector benefiting from EV growth, with 33.5% H1 2025 increase in electric vehicle availability via local manufacturing like Ceer Motors partnerships.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St., Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302