IMARC Group has recently released a new research study titled “Mexico Rubber Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033,” which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Mexico Rubber Market Overview

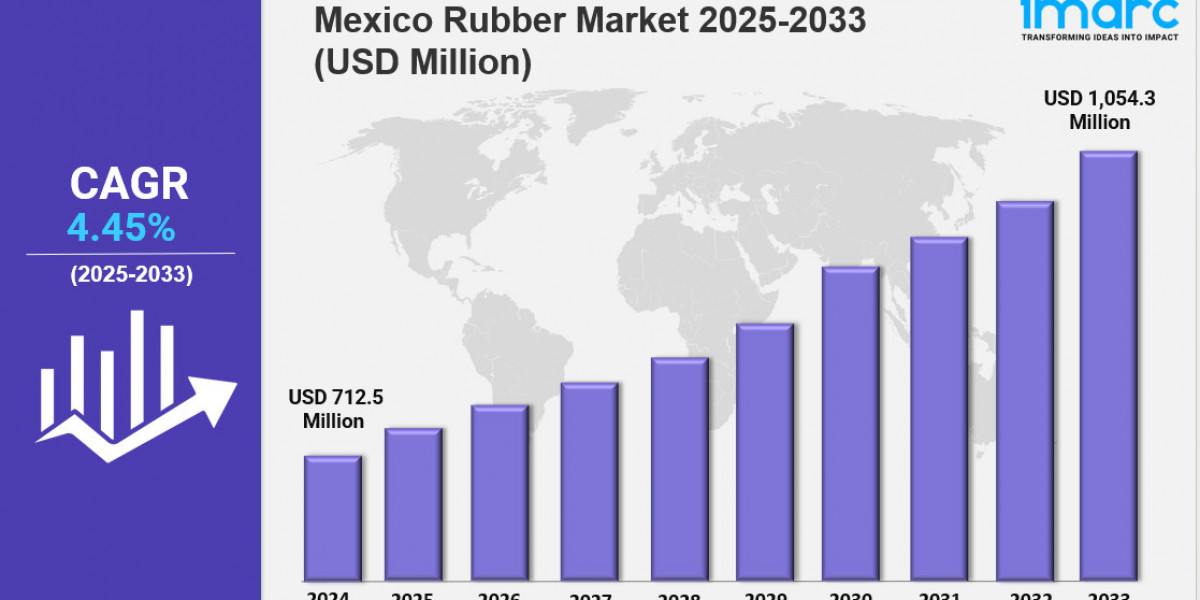

The Mexico rubber market size reached USD 712.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,054.3 Million by 2033, exhibiting a growth rate (CAGR) of 4.45% during 2025-2033.

Market Size and Growth

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 712.5 Million

Market Forecast in 2033: USD 1,054.3 Million

Market Growth Rate 2025-2033: 4.45%

Request for a sample copy of the report: https://www.imarcgroup.com/mexico-rubber-market/requestsample

Key Market Highlights:

✔️ Strong market growth driven by expanding automotive, construction, and manufacturing sectors

✔️ Increasing demand for synthetic and natural rubber in tires, industrial goods, and consumer products

✔️ Growing investments in domestic production and recycling initiatives to support sustainability and supply chain resilience

Mexico Rubber Market Trends

The Mexico rubber market is experiencing remarkable growth, driven by the nation’s strong position as the seventh-largest vehicle producer in the world. With over 3.5 million vehicles manufactured annually, demand for high-performance rubber materials such as EPDM and nitrile rubber has surged by nearly 18% since 2023.

Leading global suppliers, including Continental and Sumitomo Riko, have expanded their operations in Guanajuato and San Luis Potosí to meet the increasing need for advanced rubber compounds that improve fuel efficiency and enhance durability. Today, the automotive industry accounts for approximately 62% of total industrial rubber consumption, making it the largest contributor to the overall Mexico rubber market share.

Supply Chain Transformation and Nearshoring Advantages

The ongoing nearshoring movement is reshaping Mexico’s industrial landscape. As manufacturers adopt just-in-time supply models, demand for localized production and faster logistics has grown sharply. This shift has strengthened Mexico’s role as a strategic hub in the North American rubber supply chain.

Environmental policies are also steering market behavior. Since the Circular Economy Law took effect in 2023, sustainable rubber sourcing has grown by over 40% annually. Major tire producers such as Michelin and Bridgestone now prioritize FSC-certified natural rubber, aligning with global sustainability goals and supporting long-term Mexico rubber market growth.

Innovation and Sustainability in Rubber Production

Sustainability and innovation are at the core of the industry’s transformation. Rising global rubber prices—up 22% in early 2024— have accelerated research into alternative materials and recycling technologies. Farmers in Chihuahua are expanding the cultivation of guayule, a drought-resistant plant that provides a renewable source of natural rubber.

Recycling initiatives are gaining traction as well. Recycled rubber now accounts for 28% of industrial usage, with growing investment in pyrolysis technology, which allows producers to recover high-quality rubber from discarded tires. These advancements are not only improving cost efficiency but are also key drivers of Mexico rubber market growth, supporting both environmental and economic goals.

Mexico’s massive infrastructure and energy projects are fueling further expansion. The US$14 billion Tren Maya railway and major urban highway upgrades in Mexico City have driven a 31% increase in construction-related rubber consumption. Materials such as polyurethane and silicone rubber are becoming increasingly popular for vibration control and seismic protection applications.

In the energy sector, PEMEX and other industry leaders are creating specialized demand for chloroprene rubber in offshore operations, valued for its high chemical resistance. Meanwhile, strategic partnerships between Mexican and European manufacturers are resulting in new specialty rubber production facilities in Veracruz, boosting local capacity and supply chain resilience.

Manufacturing centers in Monterrey and Querétaro are embracing Industry 4.0 technologies to modernize production. More than 60% of rubber producers have now adopted advanced vulcanization systems, improving energy efficiency, reducing waste, and ensuring consistent product quality. These innovations are enhancing Mexico’s competitiveness and export potential in the global rubber market.

Mexico Rubber Market Outlook

Looking ahead, the Mexico rubber market forecast points to steady, sustainable growth over the next decade. The main growth drivers include rising automotive production, expanding infrastructure investments, and increased use of sustainable raw materials.

With both domestic demand and export opportunities on the rise, Mexico is well-positioned to strengthen its role in the international rubber industry. Industrial modernization, environmental responsibility, and technological innovation will continue to shape the next phase of Mexico rubber market growth, ensuring the country remains a vital player in the global supply chain for years to come.

Mexico Rubber Market Segmentation:

The market report segments the market based on product type, distribution channel, and region:

Breakup by Type:

Synthetic Rubber

Natural Rubber

Breakup by Application:

Tire

Non-Tire Automotive

Footwear

Industrial Goods

Others

Breakup by Region:

Northern Mexico

Central Mexico

Southern Mexico

Others

Ask Analyst & Browse Full Report with TOC & List of Figures: https://www.imarcgroup.com/request?type=report&id=33903&flag=C

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Key Highlights of the Report

Market Performance (2019-2024)

Market Outlook (2025-2033)

COVID-19 Impact on the Market

Porter’s Five Forces Analysis

Strategic Recommendations

Historical, Current and Future Market Trends

Market Drivers and Success Factors

SWOT Analysis

Structure of the Market

Value Chain Analysis

Comprehensive Mapping of the Competitive Landscape

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91-120-433-0800

United States: +1 201971-6302