IMARC Group, a leading market research company, has recently releases a report titled “RTA Furniture Market Size, Share, Trends and Forecast by Product, Material, Distribution Channel, End User, and Region, 2025-2033.” The study provides a detailed analysis of the industry, including the global RTA furniture market size, share, growth, trends, and forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

RTA Furniture Market Highlights:

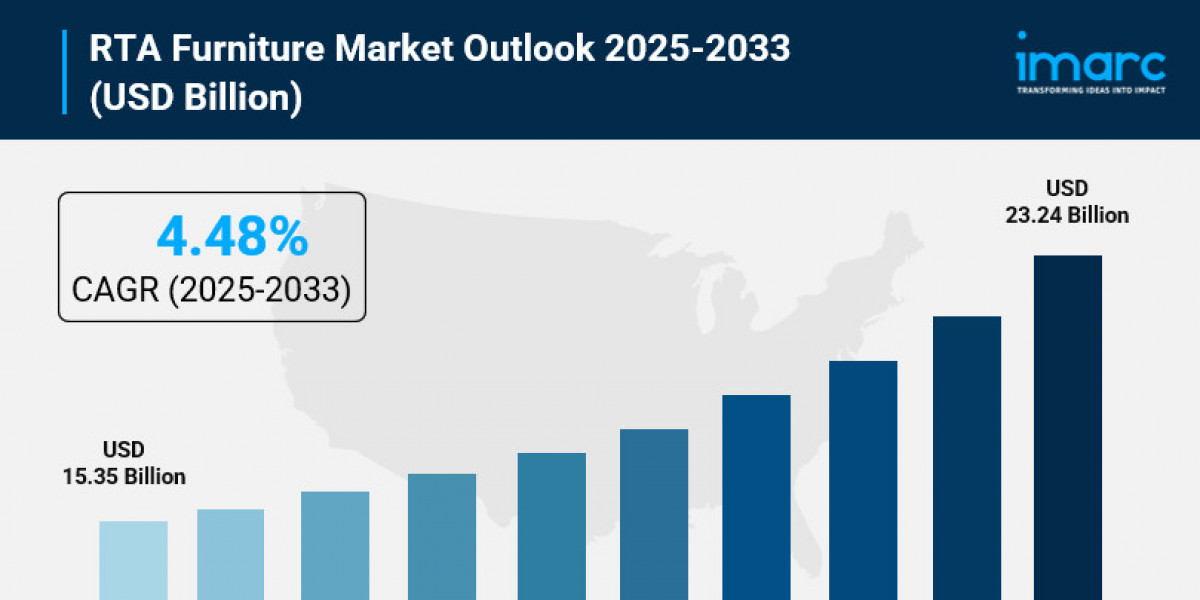

- RTA Furniture Market Size: Valued at USD 15.35 Billion in 2024.

- RTA Furniture Market Forecast: The market is expected to reach USD 23.24 Billion by 2033, growing at an impressive rate of 4.48% annually.

- Market Growth: The RTA furniture market is experiencing robust growth driven by the rising DIY culture, increasing demand for affordable and space-saving solutions, and growing environmental consciousness among buyers.

- Technology Integration: Digital visualization tools, augmented reality applications, and online shopping platforms are transforming how people discover, visualize, and purchase RTA furniture.

- Regional Leadership: Asia-Pacific commands the largest market share at 39.8%, fueled by rapid urbanization, compact living trends, and a tech-savvy consumer base embracing e-commerce platforms.

- Sustainability Focus: Manufacturers are increasingly using eco-friendly materials like reclaimed wood, bamboo, and FSC-certified timber, responding to growing demand for sustainable furniture options.

- Key Players: Industry leaders include Ashley HomeStore, Inter IKEA Systems B.V., Sauder Woodworking Co., Bush Furniture, and Flexsteel Industries Inc., which dominate the market with innovative and customizable solutions.

- Market Challenges: Balancing ease of assembly with durability, managing logistics for bulky items, and meeting diverse design preferences across different regions present ongoing challenges.

Request for a sample copy of the report: https://www.imarcgroup.com/rta-furniture-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Industry Trends and Drivers:

- The DIY Revolution Reshaping Furniture Consumption:

Modern buyers are embracing hands-on experiences when furnishing their homes. The DIY culture isn't just a passing trend anymore—it's becoming the preferred way people approach home design. According to a study by home design platform Houzz, renovation spending has skyrocketed, with median expenditures jumping 60% from USD 15,000 in 2020 to USD 24,000 in 2023. This surge reflects a fundamental shift in how people view furniture shopping. They're looking for more than just ready-made products—they want the satisfaction of building something themselves, the flexibility to customize pieces to their exact specifications, and the cost savings that come with assembly-included pricing. Manufacturers are responding by simplifying assembly processes, creating clearer step-by-step instructions, and even launching innovative platforms. In 2024, EXEDY introduced "DIY Designer," a groundbreaking service that lets customers design custom-sized furniture pieces and receive pre-cut wood materials from home improvement centers, making personalization easier than ever.

- Compact Living Driving Smart Furniture Solutions:

Urban spaces are shrinking, and furniture needs to adapt. As more people move into smaller apartments, particularly in fast-growing cities across Asia and metropolitan areas in the United States, the demand for space-efficient, multifunctional furniture has exploded. U.S. homeowners are now spending an average of USD 8,526 on interior design services, with expenditures ranging from USD 2,056 to USD 15,215, demonstrating a serious investment in making the most of limited space. RTA furniture fits perfectly into this equation—it ships flat, stores easily, and can be assembled to fit specific room dimensions. The appeal goes beyond just space savings. Young professionals and frequent movers appreciate furniture that's lightweight and easy to disassemble when it's time to relocate. In response, manufacturers are creating modular designs that serve multiple purposes: sofa beds that convert from seating to sleeping, storage units with adjustable configurations, and dining tables that expand or contract based on need.

- Sustainability Becoming Non-Negotiable:

Environmental consciousness isn't just a marketing buzzword anymore—it's reshaping purchasing decisions. Buyers are actively seeking furniture made from sustainable materials and produced through eco-friendly processes. Manufacturers are responding by sourcing wood from certified sustainable forests, using reclaimed materials, and highlighting Forest Stewardship Council (FSC) certifications. The appeal of RTA furniture in this context is multifaceted. The flat-pack design significantly reduces shipping costs and carbon emissions compared to pre-assembled furniture. According to IMARC Group projections, the global e-commerce market will reach USD 214.5 Trillion by 2033, and within this digital marketplace, buyers are increasingly filtering for products that align with their environmental values. In 2025, Rove Lab launched a new line of modular furniture that emphasizes not just easy assembly and compact shipping, but specifically highlights eco-friendly production procedures. Companies that integrate recycled materials, non-toxic finishes, and waste-reduction manufacturing processes are winning over environmentally conscious buyers who refuse to compromise their values for convenience.

- Digital Commerce Revolutionizing Furniture Shopping:

The way people shop for furniture has fundamentally changed. E-commerce platforms have broken down geographical barriers, allowing buyers to browse thousands of options from their homes. This digital transformation is particularly evident in Asia-Pacific, where India's online furniture and home market is projected to reach USD 40 Billion by 2026. The convenience factor is obvious—shoppers can compare prices, read reviews, and visualize furniture in their spaces using augmented reality tools before making a purchase. But the impact goes deeper. Digital platforms enable manufacturers to reach customers in secondary cities and rural areas who previously had limited access to diverse furniture options. The integration of visualization technology means buyers can see exactly how a piece will look in their space, reducing uncertainty and returns. Social media is also playing a surprising role, with design influencers showcasing RTA furniture transformations and styling ideas, making these products aspirational rather than just practical. In 2024, Bush Industries rebranded as eSolutions Furniture to specifically address the evolving requirements of customers in both residential and commercial spaces, recognizing that the digital-first approach is here to stay.

RTA Furniture Market Report Segmentation:

Breakup by Product:

- Tables

- Chairs and Sofas

- Storage

- Beds

- Others

Chairs and sofas dominate with 34.2% market share, reflecting the priority people place on comfortable, versatile seating that can serve multiple functions in compact living spaces.

Breakup by Material:

- Wood

- Glass

- Steel

- Others

Wood leads with 56.9% of market share, driven by its natural aesthetic appeal, durability, and the growing demand for sustainable materials from certified forests.

Breakup by Distribution Channel:

- Specialty Stores

- Flagship Stores

- Home Centers

- Online Stores

- Others

Flagship stores command 38.5% market share, as brands create immersive shopping experiences where customers can interact with products and receive personalized advice.

Breakup by End User:

- Residential

- Commercial

Residential accounts for 64.6% of the market, as homeowners and apartment dwellers seek affordable, easy-to-assemble furniture solutions for their personal living spaces.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Who are the key players operating in the industry?

The report covers the major market players including:

- Ashley HomeStore

- Bush Furniture

- Flexsteel Industries Inc.

- Homestar Corporation

- Inter IKEA Systems B.V.

- Prepac Manufacturing Ltd

- Sauder Woodworking Co.

- Simplicity Sofas

- South Shore Furniture

- Tvilum A/S

- Walker Edison Furniture Company LLC

- Whalen Furniture (Li & Fung Limited)

Ask Analyst For Request Customization: https://www.imarcgroup.com/request?type=report&id=4696&flag=E

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302