IMARC Group has recently released a new research study titled “South Korea Fintech Market Report by Service (Digital Payments, Personal Finance, Alternative Financing, Insurtech, B2C Financial Services Market Places, E-Commerce Purchase Financing, and Others), and Region 2025-2033”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

South Korea Fintech Market Overview

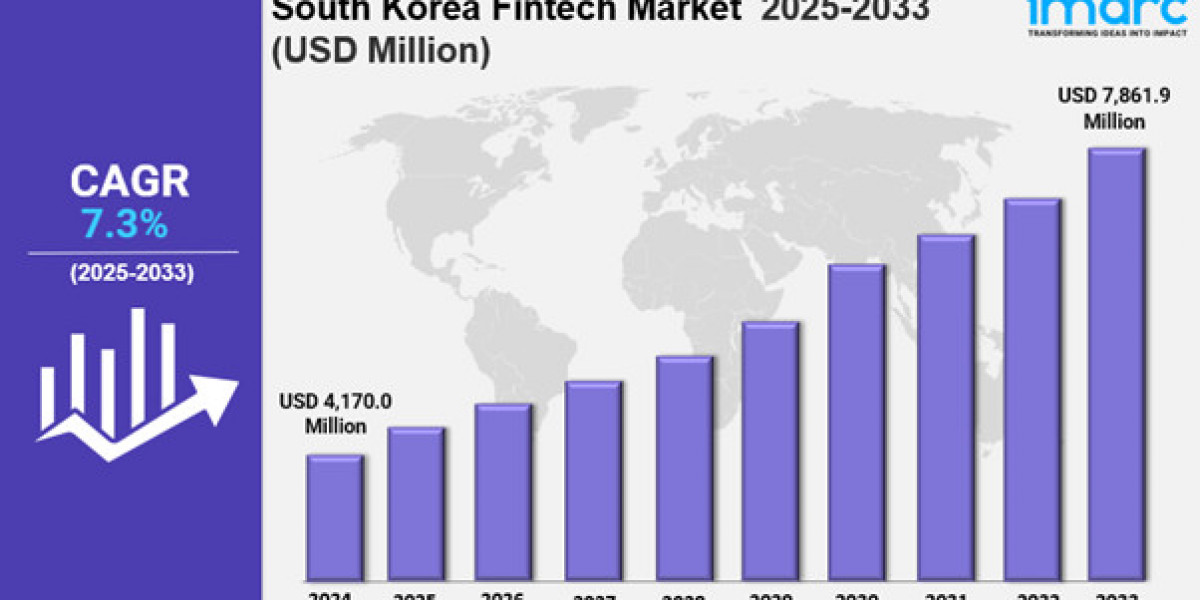

The South Korea fintech market size reached USD 4,170.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 7,861.9 Million by 2033, exhibiting a growth rate (CAGR) of 7.3% during 2025-2033.

Market Size and Growth

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 4,170.0 Million

Market Forecast in 2033: USD 7,861.9 Million

Market Growth Rate (2025-2033): 7.3%

Request for a sample copy of the report: https://www.imarcgroup.com/south-korea-fintech-market/requestsample

Key Market Highlights:

✔️ Rapid growth driven by digital payment adoption and tech-savvy consumers

✔️ Surging demand for innovative financial services, including mobile banking and investment apps

✔️ Increasing focus on regulatory frameworks to enhance security and consumer trust

Trends in the South Korea Fintech Market

The South Korea fintech market is set to experience several transformative trends that will shape its future landscape. One of the most significant trends is the increasing integration of artificial intelligence (AI) and machine learning into financial services. By 2025, AI-driven solutions will play a crucial role in enhancing customer experiences, from personalized recommendations to risk assessment in lending.

Additionally, the rise of decentralized finance (DeFi) platforms will challenge traditional financial systems, offering innovative alternatives for borrowing, lending, and trading. This shift towards DeFi will likely attract tech-savvy consumers looking for more flexible and accessible financial solutions.

Furthermore, the focus on cybersecurity will intensify, as both consumers and providers prioritize the protection of sensitive financial data. As these trends unfold, the South Korea fintech market share is expected to grow, reflecting the increasing reliance on technology in financial services and the evolving expectations of consumers in a digital-first economy.

Market Dynamics of the South Korea Fintech Market

Rapid Adoption of Digital Payment Solutions

The South Korea fintech market is witnessing rapid adoption of digital payment solutions, driven by the country's advanced technological infrastructure and high smartphone penetration. As consumers increasingly favor convenience and speed in their financial transactions, digital wallets and mobile payment platforms have gained immense popularity. By 2025, it is expected that this trend will continue to grow, with more individuals opting for contactless payments and online transactions over traditional cash methods. The rise of e-commerce and the need for seamless payment experiences further fuel this demand, leading to a significant expansion of the South Korea fintech market size.

As a result, both established financial institutions and emerging fintech startups are investing heavily in developing innovative payment solutions to capture a larger share of this burgeoning market.

Regulatory Support and Innovation

Regulatory support for fintech innovation is another key dynamic shaping the South Korea fintech market. The South Korean government has implemented various initiatives aimed at fostering a conducive environment for fintech growth, including the establishment of regulatory sandboxes that allow startups to test their products with fewer restrictions. This supportive regulatory framework encourages innovation and attracts investment in the fintech sector. By 2025, it is anticipated that these efforts will result in a more diverse range of financial services, from lending and insurance to wealth management and blockchain solutions.

The increased collaboration between traditional banks and fintech companies will also enhance service offerings, further expanding the South Korea fintech market share. As the regulatory landscape evolves, it will likely empower more players to enter the market, driving competition and improving consumer choice.

Growing Demand for Personalized Financial Services

The demand for personalized financial services is a significant driver of the South Korea fintech market. As consumers become more aware of their financial needs and preferences, they are seeking tailored solutions that cater to their individual circumstances. By 2025, it is expected that fintech companies will increasingly leverage data analytics and artificial intelligence to provide customized financial advice, investment strategies, and budgeting tools. This shift towards personalization not only enhances user satisfaction but also fosters loyalty among consumers.

Moreover, the integration of social features within fintech applications will allow users to share insights and experiences, creating a community-driven approach to financial management. Consequently, this trend will contribute to the overall growth of the South Korea fintech market size, as more individuals turn to fintech solutions for their unique financial needs.

Buy Now: https://www.imarcgroup.com/checkout?id=19164&method=1370

South Korea Fintech Market Segmentation:

The market report segments the market based on product type, distribution channel, and region:

Service Insights:

- Digital Payments

- Online Purchases

- POS (Point of Sales) Purchases

- Personal Finance

- Digital Asset Management Services

- Remittance/ International Money Transfers

- Alternative Financing

- P2P Lending

- SME Lending

- Crowdfunding

- Insurtech

- Online Life Insurance

- Online Health Insurance

- Online Motor Insurance

- Online Other General Insurance

- B2C Financial Services Market Places

- Banking and Credit

- Insurance

- E-Commerce Purchase Financing

- Others

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=19164&flag=C

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Key Highlights of the Report

1. Market Performance (2019-2024)

2. Market Outlook (2025-2033)

3. COVID-19 Impact on the Market

4. Porter’s Five Forces Analysis

5. Strategic Recommendations

6. Historical, Current and Future Market Trends

7. Market Drivers and Success Factors

8. SWOT Analysis

9. Structure of the Market

10. Value Chain Analysis

11. Comprehensive Mapping of the Competitive Landscape

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers create lasting impact. The firm offers comprehensive services for market entry and market expansion.

IMARC’s services include thorough market assessments, feasibility studies, company formation assistance, factory setup support, regulatory approvals and license navigation, branding, marketing and sales strategies, competitive landscape and benchmark analysis, pricing and cost studies, and sourcing studies.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302