Saudi Arabia Contactless Payments Market Overview

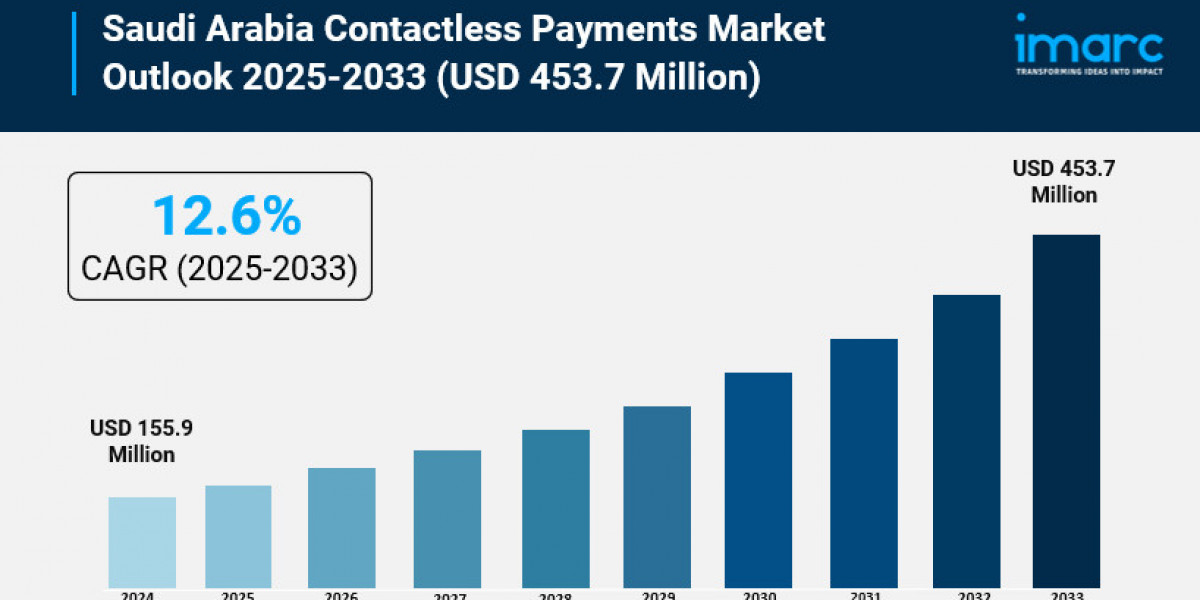

Market Size in 2024: USD 155.9 Million

Market Size in 2033: USD 453.7 Million

Market Growth Rate 2025-2033: 12.6%

According to IMARC Group's latest research publication, "Saudi Arabia Contactless Payments Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033", The Saudi Arabia contactless payments market size reached USD 155.9 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 453.7 Million by 2033, exhibiting a growth rate (CAGR) of 12.6% during 2025-2033.

Download a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-contactless-payments-market/requestsample

How AI is Reshaping the Future of Saudi Arabia Contactless Payments Market

- AI-powered fraud detection systems in Saudi Arabia enhance security by analyzing transaction patterns in real time, reducing payment fraud significantly.

- The government’s push for AI adoption in financial services supports smarter, faster verification processes, making contactless payments safer and more user-friendly.

- AI-driven personalized offers and rewards are boosting consumer engagement and adoption of contactless payment methods across retail and hospitality sectors.

- Integration of AI with digital wallets improves payment speed and accuracy, enhancing the overall customer experience in Saudi Arabia’s fast-growing market.

- Saudi fintech startups leverage AI to optimize contactless payment infrastructure, expanding accessibility and enabling seamless transactions nationwide with reduced operational costs.

Saudi Arabia Contactless Payments Market Trends & Drivers:

The Saudi Arabia contactless payments market is booming, driven by the widespread adoption of NFC-enabled devices. Most smartphones and payment cards now support tap-and-go transactions, which are embraced across retail, dining, and public transport. Banks and retailers actively promote contactless terminals, making payments faster, safer, and more convenient. This adoption aligns closely with Saudi Arabia’s Vision 2030, which encourages a cashless economy and digital transformation across society, demonstrating a shift in consumer behavior towards digital wallets and contactless methods.

Government initiatives play a significant role in accelerating contactless payment use. The Saudi Central Bank’s introduction of Mada, the national electronic payment network, has created robust infrastructure for secure digital transactions. Alongside subsidies for deploying contactless terminals and public awareness campaigns, these initiatives foster a supportive environment. Furthermore, collaborations with fintech companies and regulatory frameworks under Vision 2030 ensure constant innovation and wider market access, with digital transactions surging to over 10.8 billion and increasing consumer confidence in cashless solutions.

Consumer demand for speedy, secure, and hygienic payment options is rapidly rising in Saudi Arabia. Contactless payments appeal due to the convenience of fast checkouts without physical contact, a trend amplified by public health concerns. Consumers also appreciate advanced security features that protect against fraud. This growing preference is reflected in the near-complete penetration of contactless payments in face-to-face transactions, reportedly reaching 98%. Banks and merchants capitalize on this shift by aggressively marketing contactless options and enhancing user experience with mobile wallets such as Apple Pay and Google Pay.

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=31407&flag=E

Saudi Arabia Contactless Payments Industry Segmentation:

The report has segmented the market into the following categories:

Type Insights:

- Smartphone Based Payments

- Card Based Payments

- Credit Cards

- Debit Cards

- Others

Application Insights:

- Retail

- Consumer Electronics

- Fashion & Garments

- Others

- Transportation

- Healthcare

- Hospitality

- Others

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in Saudi Arabia Contactless Payments Market

- September 2025: Saudi Central Bank launches enhanced SARIE 2.0 instant payment system with advanced AI security features, processing over 500 million transactions monthly with 99.9% uptime reliability.

- August 2025: Major Saudi retailers report 85% of transactions now processed through contactless methods, exceeding government targets with significant growth in digital wallet usage among younger demographics.

- July 2025: New fintech regulations enable international payment providers to operate in Saudi Arabia, increasing competition and innovation in contactless payment solutions across all industry sectors.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302