IMARC Group, a leading market research company, has recently released a report titled "Pumps Market Size, Share, Trends and Forecast by Product Type, Application, and Region, 2025-2033." The study provides a detailed analysis of the industry, including the global pumps market share, size, trends and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Pumps Market Highlights:

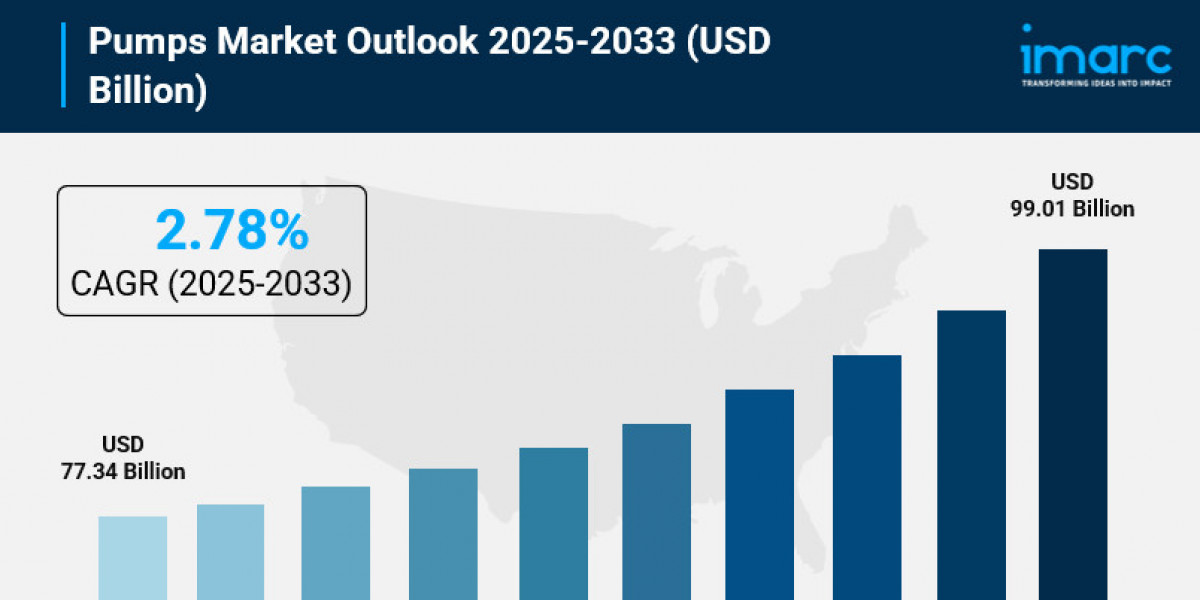

- Pumps Market Size: Valued at USD 77.34 Billion in 2024.

- Pumps Market Forecast: The market is expected to reach USD 99.01 billion by 2033, growing at an impressive rate of 2.78% annually.

- Market Growth: The pumps market is experiencing steady growth driven by rapid urbanization, infrastructure development, and technological innovation.

- Technology Integration: Advanced technologies like IoT-enabled systems, smart monitoring solutions, and AI-powered analytics are transforming pump operations and maintenance.

- Regional Leadership: Asia-Pacific commands the largest market share at 46.5%, fueled by massive industrialization and infrastructure expansion projects.

- Energy Efficiency Focus: Rising energy costs are pushing industries toward energy-efficient pumping solutions, with pumping systems consuming between 25% to 50% of total industrial energy usage.

- Key Players: Industry leaders include Baker Hughes Company, Ebara Corporation, Flowserve Corporation, Grundfos Holding A/S, Xylem Inc., and Schlumberger Limited, which dominate the market with innovative solutions.

- Market Challenges: Integration of new technologies with existing systems and the need for sustainable, eco-friendly solutions present ongoing industry challenges.

Claim Your Free “Pumps Market” Insights Sample PDF: https://www.imarcgroup.com/pumps-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Industry Trends and Drivers:

- Explosive Growth in Urbanization and Industrialization:

The world is witnessing an unprecedented transformation as cities expand and industries proliferate across the globe. According to the World Health Organization, almost 68% of individuals are expected to reside in urban areas by 2050. This massive shift is fundamentally reshaping how we manage water, energy, and industrial processes. Urban expansion creates enormous demand for essential infrastructure—water supply systems, sewage networks, and HVAC installations that keep buildings comfortable and functional. Every new residential complex, shopping mall, and office tower needs pumps working behind the scenes to deliver water, manage waste, and regulate temperature. The scale is staggering, and pumps are at the heart of making modern urban life possible. Industrial growth parallels this urban expansion, with manufacturing facilities and processing plants requiring sophisticated pump systems to handle everything from cooling machinery to transferring chemicals and materials through production lines. In 2023, total construction spending reached $1.98 trillion in the United States, marking a 7.4% increase from 2022. This growth was primarily driven by nonresidential construction, which saw a 17.6% year-over-year surge. Behind these massive construction projects, thousands of pumps work continuously, ensuring operations run smoothly and efficiently.

- Revolutionary Smart Technology Integration:

The pump industry is undergoing a digital revolution that's fundamentally changing how these critical systems operate and are maintained. IoT Analytics' State of IoT Summer 2024 report reveals that connected IoT devices are expected to reach 16.6 billion by the end of 2023, growing by 15% compared to 2022. Smart pumps equipped with IoT sensors and advanced monitoring capabilities represent a quantum leap forward from traditional mechanical systems. These intelligent devices continuously communicate their operating status, energy consumption, and maintenance needs in real-time. What makes this particularly transformative is the predictive maintenance capability these smart systems provide. Instead of waiting for pumps to fail—which can shut down entire facilities and cause enormous losses—operators now receive advance warnings when components show signs of wear. This predictive approach prevents expensive breakdowns, extends equipment lifespan, and dramatically reduces operational costs. Real-time monitoring also enables operators to optimize pump performance continuously, adjusting speeds and flows to match actual demand rather than running at fixed capacity regardless of need.

- Massive Infrastructure Investment Wave:

Governments worldwide are committing unprecedented resources to infrastructure modernization, creating enormous opportunities for the pumps industry. In February 2024, the Biden-Harris Administration announced nearly USD 6 Billion in funding for clean drinking water and wastewater infrastructure. This initiative includes over USD 2.6 Billion designated specifically for upgrading wastewater and sanitation systems, contributing to a total of USD 7 Billion in infrastructure funding for water-related projects. These investments reflect a global recognition that aging infrastructure in developed nations needs comprehensive upgrades, while developing economies require massive new installations to support growing populations. Water and wastewater treatment facilities depend entirely on pump systems to move and process millions of gallons daily. Transportation networks need pumps for drainage and flood control. Energy generation plants—whether fossil fuel, nuclear, or renewable—rely on pumps for cooling systems and fluid management. The scope of these infrastructure projects creates sustained, long-term demand that extends across decades, not just years.

- Critical Focus on Energy Efficiency and Sustainability:

Energy consumption has become a critical concern driving fundamental changes in pump technology and selection. According to the U.S. Department of Energy (DOE), pumping systems often consume between 25% to 50% of total energy usage in industrial facilities. This enormous energy appetite makes pumps a prime target for efficiency improvements that can deliver substantial cost savings and environmental benefits. Rising energy costs and environmental concerns are pushing industries and municipalities toward high-efficiency pumping solutions. Traditional pumps that continuously run at fixed speeds regardless of actual demand waste tremendous amounts of electricity. Modern energy-efficient pumps equipped with VFDs and high-efficiency motors cut energy consumption dramatically while reducing carbon emissions. States with the largest share of firms adopting AI technologies—including Colorado at 7.4%, Florida at 6.6%, Utah at 6.5%, Nevada at 6.5%, and Delaware at 6.5%—are seeing rapid growth in demand for technologically advanced, energy-optimized pumping solutions.

- Water Scarcity Driving Advanced Management Systems:

Water scarcity has emerged as one of the defining challenges of our era, fundamentally reshaping how societies manage this precious resource. Smart water management systems designed to optimize usage and minimize losses rely heavily on advanced pump technologies. Variable-speed pumps that can adjust their operation based on real-time demand help reduce water waste while ensuring adequate supply. Pressure management systems prevent pipe bursts and leakage that waste enormous quantities of treated water. Agricultural irrigation represents a particularly critical application, especially in water-stressed regions. Modern irrigation systems use sophisticated pumps that deliver precise amounts of water exactly when and where crops need it, eliminating the waste associated with traditional flooding methods. Submersible and centrifugal pumps designed specifically for agricultural applications help farmers maximize crop yields while minimizing water consumption—an increasingly vital balance as climate change affects rainfall patterns and water availability.

Pumps Market Report Segmentation:

Breakup by Product Type:

- Centrifugal Pump

- Axial Flow Pump

- Radial Flow Pump

- Mixed Flow Pump

- Positive Displacement Pump

- Reciprocating Pump

- Rotary Pump

- Others

Centrifugal pumps dominate with 66.8% market share, remaining the preferred choice across industries due to their efficiency, reliability, and versatility in handling diverse fluid types.

Breakup by Application:

- Agriculture

- Construction and Building Services

- Water and Wastewater

- Power Generation

- Oil and Gas

- Chemical

- Others

Water and wastewater leads with 18.5% market share in 2024, reflecting the universal need for clean water supply and effective waste management systems worldwide.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia-Pacific holds the commanding position with over 46.5% of the global market share in 2024, driven by explosive urbanization and industrial expansion across the region. Countries like China and India are experiencing unprecedented urban growth, with Singapore witnessing the biggest urban population surge at 4.9% in 2023 according to the World Bank.

Who are the key players operating in the industry?

The report covers the major market players including:

- Baker Hughes Company

- Ebara Corporation

- Flowserve Corporation

- Grundfos Holding A/S

- ITT Inc.

- KSB SE & Co. KGaA

- Pentair plc

- Schlumberger Limited

- Sulzer Ltd.

- The Weir Group PLC

- Vaughan Co. Inc.

- Xylem Inc.

Ask Analyst For Request Customization: https://www.imarcgroup.com/request?type=report&id=7272&flag=E

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1–201971–6302