Filing IRS Form 941 correctly and on time is a critical responsibility for every employer. The form ensures that your federal payroll taxes — including income tax withholding, Social Security, and Medicare contributions — are accurately reported to the IRS. For QuickBooks users, this process becomes remarkably simpler thanks to built-in e-filing features. In this comprehensive guide, we’ll walk you through how to enable IRS Form 941 e-filing in QuickBooks Online Payroll, how QuickBooks populates Form 941, and what differences you should know between QuickBooks Form 941 Desktop Version and the online version.

Understanding IRS Form 941 and Its Role in Payroll Reporting

Before diving into QuickBooks Online setup, it’s important to understand what Form 941 actually represents. The IRS Form 941, Employer’s Quarterly Federal Tax Return, is used to report wages, tips, and other compensation paid to employees. It also includes withheld federal income tax and both employer and employee portions of Social Security and Medicare taxes.

Businesses must file Form 941 every quarter — typically by the last day of the month following the end of each quarter. With QuickBooks Form 941, employers can automate much of this reporting process, reducing the risk of manual entry errors.

When QuickBooks populates Form 941, it automatically pulls in data from your payroll records, including total wages, federal withholdings, and other tax details. This automation helps ensure that your quarterly tax filings are accurate and timely.

Benefits of E-Filing Form 941 in QuickBooks Online Payroll

Switching to e-filing within QuickBooks Online Payroll offers several advantages for small and medium-sized businesses:

Faster Filing: Submit directly to the IRS within minutes — no printing or mailing required.

Reduced Errors: Automatic data population minimizes calculation and entry mistakes.

Real-Time Status: You can track your filing status directly in QuickBooks.

Environmentally Friendly: E-filing eliminates paper waste and postage costs.

Secure Submission: Your sensitive data is transmitted securely to the IRS through authorized channels.

If you are still using QuickBooks Form 941 Desktop Version, e-filing can also be enabled there, but the process differs slightly. The online version provides a more streamlined, cloud-based filing experience.

Step-by-Step Guide: Enable IRS Form 941 E-Filing in QuickBooks Online Payroll

Here’s a detailed walkthrough for enabling and submitting Form 941 QuickBooks Online e-filing feature:

Step 1: Sign In to Your QuickBooks Online Payroll Account

Log in to your QuickBooks Online account using your administrator credentials. From the dashboard, navigate to the Payroll tab. If this is your first time setting up payroll, you’ll need to complete basic information, including your EIN (Employer Identification Number) and business details.

Step 2: Access Payroll Tax Settings

Go to Settings in the top-right corner.

Select Payroll Settings.

Under Tax Setup, locate and click Federal Taxes.

Here, ensure that your EIN and filing information are correct. QuickBooks uses this data when populating Form 941 automatically.

Step 3: Enable E-Filing and E-Payment Options

In the Federal Tax setup, scroll to E-File and E-Pay Enrollment.

Choose Enroll Now.

Fill out your business name, contact information, and filing credentials exactly as they appear with the IRS.

Agree to the authorization terms and submit your enrollment form.

Once the IRS approves your e-filing enrollment (which typically takes 24–48 hours), you’ll be ready to file QuickBooks Form 941 electronically.

Step 4: Prepare Your Quarterly Form 941

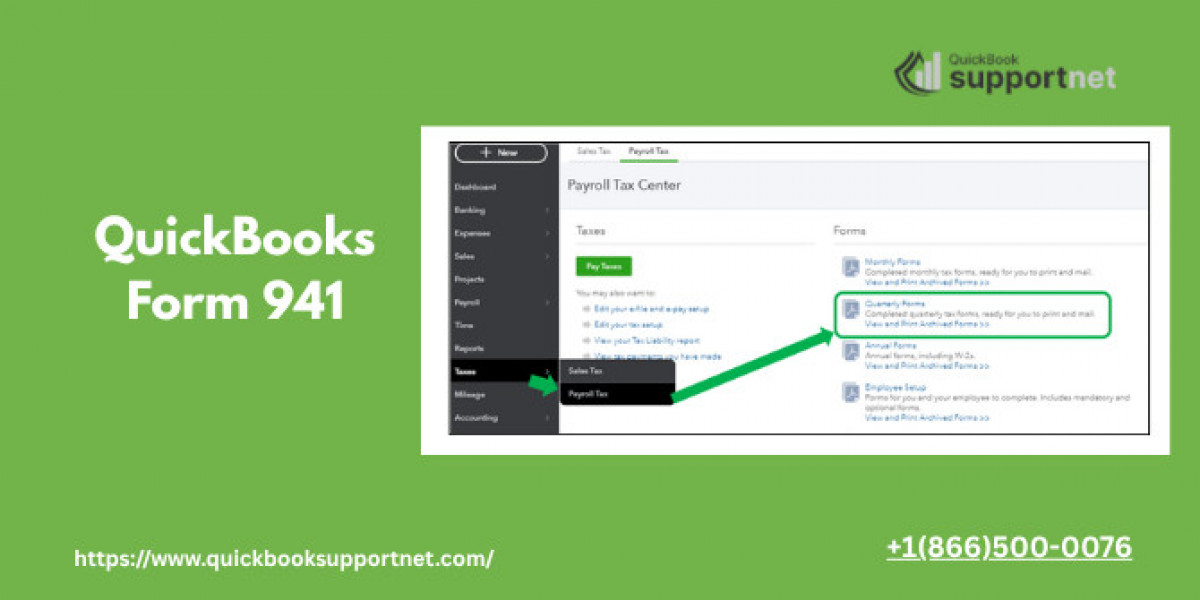

Navigate to Taxes > Payroll Tax.

Under Forms, select Quarterly Form 941.

Review the pre-filled information — QuickBooks populates Form 941 automatically using your payroll data.

Verify that all wage, tax, and withholding figures are correct before submission. You can preview the form to confirm every section matches your payroll records.

Step 5: E-File Your Form 941

Once your data is verified:

Click E-File Form.

Follow the on-screen instructions to sign and submit electronically.

QuickBooks will confirm submission and display a tracking status — Accepted, Pending, or Rejected — directly on your dashboard.

If the form is rejected, QuickBooks provides error messages detailing the issue so you can make corrections and resubmit easily.

Step 6: Download and Save a Copy

Always download and store a digital copy of your filed Form 941 QuickBooks Online for compliance and recordkeeping. The IRS recommends retaining these records for at least four years.

Troubleshooting Common E-Filing Errors

While QuickBooks simplifies payroll tax filings, you might occasionally encounter technical or submission issues. Here are common problems and solutions:

Incorrect EIN or Business Info: Verify that your business data matches your IRS records.

Pending Enrollment: Wait until your e-file enrollment is fully processed before filing.

Network Connection Error: Check your internet stability or try again later.

IRS System Downtime: Occasionally, IRS servers undergo maintenance, which may delay submissions.

If you’re still having trouble, reach out to QuickBooks Payroll Support at +1(866)500-0076 for expert assistance.

Comparing QuickBooks Form 941 Online and Desktop Version

Both QuickBooks Form 941 Desktop Version and Form 941 QuickBooks Online support electronic filing, but they cater to different user needs.

QuickBooks Desktop: Best for businesses that prefer local installations and advanced reporting tools. It requires installing the payroll tax table updates before filing each quarter.

QuickBooks Online: Cloud-based, accessible anywhere, and automatically updates tax rates and forms. It’s ideal for remote teams and real-time collaboration.

In both versions, QuickBooks populates Form 941 automatically using your payroll data, minimizing human error and saving valuable time.

Best Practices for Smooth Form 941 Filing in QuickBooks

To ensure accurate and efficient filing every quarter:

Keep Payroll Data Updated: Regularly verify employee details, wages, and withholdings.

File Before the Deadline: Avoid IRS penalties by submitting on time each quarter.

Review Tax Settings Frequently: Ensure your EIN, deposit schedule, and filing frequency are correct.

Backup Data: Always save copies of previous filings for future audits or references.

Stay Informed: IRS may update the Form 941 layout or requirements periodically. QuickBooks automatically reflects these changes, but reviewing them helps maintain compliance.

Why Choose QuickBooks for Payroll Tax Filing?

QuickBooks simplifies the payroll process from start to finish. By integrating your payroll data with federal tax filing systems, it eliminates redundant work, saves time, and reduces the chances of IRS rejections.

Whether you use QuickBooks Online or the QuickBooks Form 941 Desktop Version, you can rely on its accuracy and convenience. Plus, real-time filing confirmations and support ensure peace of mind.

If you face any challenges while setting up or filing, don’t hesitate to connect with QuickBooks Payroll experts at +1(866)500-0076.

Final Thoughts

Enabling IRS Form 941 e-filing in QuickBooks Online Payroll is one of the smartest steps any employer can take for smooth quarterly reporting. From automatic data population to real-time filing status, QuickBooks takes the guesswork out of tax compliance.

With e-filing enabled, you’ll save hours of manual work, reduce errors, and maintain total confidence in your payroll tax submissions.

For step-by-step help, technical troubleshooting, or advanced payroll setup, you can always reach professional support at QuickBooksupportnet — your trusted partner for QuickBooks-related solutions.