Introduction

The Raman Spectroscopy Market refers to the global market for instruments, consumables and solutions based on Raman spectroscopy—an analytical technique that exploits inelastic scattering of monochromatic light (typically from a laser) to probe vibrational, rotational and other molecular modes in a sample. Raman systems are used for material identification, chemical composition analysis, quality control, process monitoring and research across multiple industries including pharmaceuticals, life sciences, semiconductors, materials science, food & beverages and environmental monitoring.

Learn how the Raman Spectroscopy Market is evolving—insights, trends, and opportunities await. Download report: https://www.databridgemarketresearch.com/reports/global-raman-spectroscopy-market

The Evolution

Historical Development

Raman spectroscopy was first observed in the 1920s by C. V. Raman. Analytical utilisation began in the mid-20th century, but commercial instrumentation only became viable in the 1970s-1980s when laser sources, optical components and detectors matured. Initially restricted to research labs, the technique gradually entered industrial and quality-control use in the 1990s. As lasers, optics, computer controls and software advanced in the 2000s, Raman spectrometers became more compact, reliable and cost-effective. Portable Raman units appeared in the 2010s, enabling field and on-site analysis.

Key Innovations or Milestones

Development of multi-wavelength lasers, high-sensitivity CCD detectors and improved optics enabled full-scale commercial instruments.

Introduction of handheld and portable Raman devices for trace-analysis, counterfeit detection and security applications.

Emergence of sampling enhancements such as Surface-Enhanced Raman Scattering (SERS) and Tip-Enhanced Raman Scattering (TERS) enabling single-molecule sensitivity.

Integration of Raman systems with other analytical platforms (e.g., microscopy, process-analytical-technology systems) and cloud/AI data analytics for real-time monitoring.

Growth in hyperspectral Raman imaging for materials science, pharmaceuticals and semiconductor failure-analysis.

Shifts in Demand and Technology

Early demand was driven by academia and specialised research. In recent years the demand base has broadened into industrial quality-control, process monitoring, pharmaceuticals (active-pharmaceutical-ingredient identification, polymorph detection), food safety (adulteration detection), environmental testing (pollutants), and semiconductor/materials‐analysis (thin films, nanomaterials). Technological progress—miniaturisation, automation, connectivity and AI analytics—has reduced barriers to adoption and enabled new applications. The shift from benchtop only to portable/handheld instruments is significant.

Market Trends

Emerging Industry Trends

Non-destructive, rapid analysis has become a key requirement across industries, increasing Raman adoption over traditional IR or destructive chemical tests.

Growth in portable and handheld devices that allow on-site or in-process measurement rather than centralized labs.

Increased use in pharmaceutical/regulatory environments (e.g., PAT, real-time release testing) and expanding use in food & beverage and agriculture for quality and safety assurance.

Advances in SERS, TERS and other Raman enhancements opening new frontiers (trace detection, biosensing, wearables for biomedical monitoring).

Broader adoption in semiconductor, materials science and nanotechnology sectors for characterising advanced materials, graphene, carbonnanotubes and 2D-materials.

Technology Adoption and Advancements

Raman instrumentation is evolving with higher sensitivity detectors (EM-CCD, CMOS), better lasers (e.g., ultra-short pulsed, tunable wavelengths), advanced sampling accessories (optical fibres, probes, microscopy attachments), and software incorporating AI/machine-learning for spectral interpretation. Sampling techniques such as SERS and TERS provide higher sensitivity and new application segments. Portable Raman spectrometers, smartphone-linked devices and cloud-connectivity are increasing usability and reducing cost. Data-management systems and real-time monitoring software enable broader industrial use.

Regional and Global Adoption Patterns

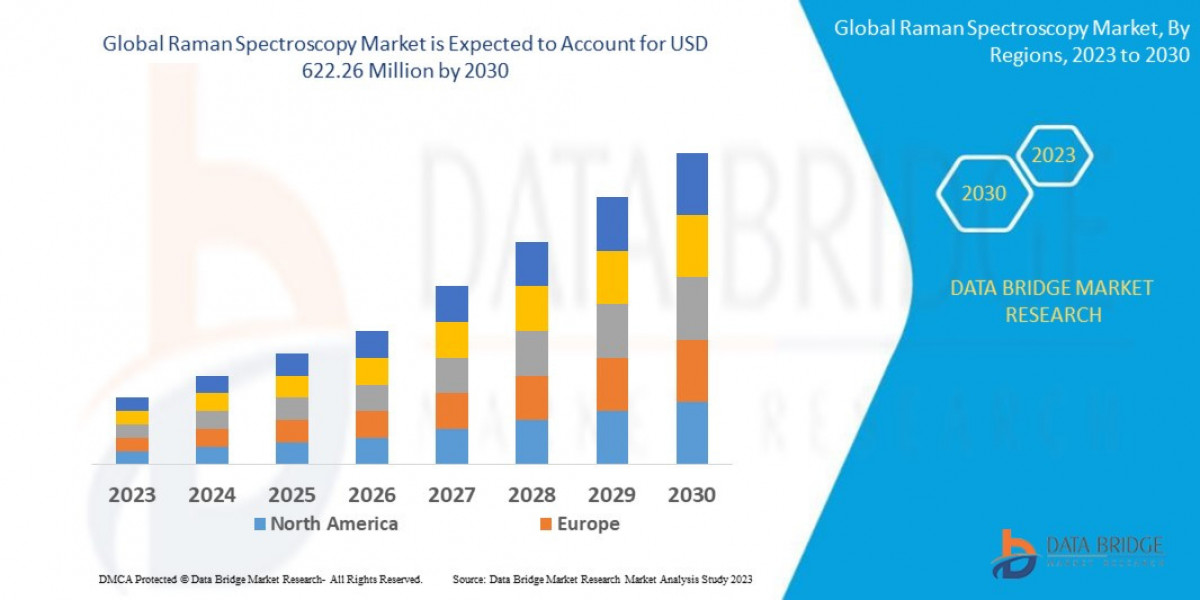

North America: Historically the largest market owing to strong research infrastructure, high R&D investment and early adoption across pharmaceuticals and materials science.

Asia-Pacific: Rapid growth due to expanding pharmaceutical manufacturing, semiconductor industry, materials research and increasing instrumentation adoption in China, India, Japan and South Korea. Many sources identify Asia-Pacific as the fastest-growing region.

Europe: Strong and mature market with robust analytical-instrumentation tradition and increasing emphasis on process control, quality assurance and regulatory compliance.

Latin America & Middle East/Africa: Emerging markets where growth is driven by educational/research infrastructure expansion, materials science investment and need for food safety/quality solutions.

Challenges

Industry Challenges

High Equipment Cost: Raman spectrometers (especially benchtop or high‐end units) remain high-cost instruments which restricts uptake among smaller firms or less-developed markets.

Complexity and Expertise: Proper use of Raman requires trained operators, good sampling protocols and spectral interpretation expertise—barrier in some markets.

Competition from Alternative Technologies: Infrared spectroscopy (FT-IR), NIR, mass spectrometry and other analytic methods remain cheaper or more established in some applications, limiting Raman penetration.

Limited Penetration in Some Applications: Despite clear benefits, adoption in food & beverage, agriculture or small laboratories is still uneven.

Consumables and Maintenance Costs: Probes, lasers and calibration maintenance add ongoing cost.

Supply-Chain & Component Constraints: Availability of high‐precision optics, lasers and detectors can be subject to supply constraints, especially in global disruption events.

Key Barriers to Growth

High capital expenditure and long ROI times in smaller markets limit new-adoption.

Lack of infrastructure or service support in emerging markets restricts usage, especially for advanced Raman techniques (e.g., SERS, TERS).

Fragmentation of applications and varying sample requirements make standardisation challenging, slowing broader industrial rollout.

Budget constraints in academic, government and small-firm end-users.

Regulatory and validation burdens (especially in pharmaceutical or food segments) can slow instrument deployment.

Market Risks

Economic downturns may reduce R&D spending, instrumentation budgets and delay purchasing cycles.

Technological leap might shift attention away from Raman to next-gen techniques (e.g., Internet-of-Things sensors, miniaturised spectrometers) reducing long-term demand for traditional Raman systems.

If adoption plateaus in key sectors (pharma, semiconductors) the market growth could slow.

Supply-chain disruptions (laser shortages, semiconductor/optics bottlenecks) could delay instrument production and deployment.

Market Scope

Segmentation by Instrument Type

Benchtop Raman Spectrometers

Handheld & Portable Raman Devices

Microscopy Raman Systems

Specialty Raman (FT-Raman, fibre-optics Raman)

Among these, the handheld & portable segment is expected to witness robust growth, driven by field-analysis demand and lower cost.

Segmentation by Sampling Technique

Conventional Raman

Surface-Enhanced Raman Scattering (SERS)

Tip-Enhanced Raman Scattering (TERS)

Others (Resonance Raman, Hyper-Raman)

SERS in particular is poised for faster growth due to its sensitivity and emerging biosensing applications.

Segmentation by Application

Pharmaceutical & Life Sciences (drug development, polymorph detection, biopharma)

Materials Science & Nanotechnology (graphene, carbon nanotubes, semiconductors, coatings)

Semiconductor & Electronics Manufacturing (wafer/failure analysis, thin-film characterisation)

Food & Beverage / Agriculture (adulteration detection, crop/soil analysis)

Environmental & Forensics (pollutant detection, hazardous-material screening)

Among these, the pharmaceutical & life-sciences segment remains a major revenue contributor, while materials/nanotech and food/-beverage segments represent high-growth opportunities.

Regional Analysis

North America (United States, Canada)

Europe (Germany, UK, France, Nordic, etc.)

Asia-Pacific (China, Japan, India, South Korea, Southeast Asia)

Latin America (Brazil, Mexico, Argentina)

Middle East & Africa (GCC, South Africa, North Africa)

End-User Industries

Pharmaceutical / Biopharmaceutical Companies

Research Institutions & Universities

Semiconductor & Electronics Manufacturers

Food & Beverage Producers & Testing Labs

Materials & Nanotechnology R&D

Government & Regulatory Agencies

Environmental Monitoring & Forensics Labs

Market Size and Factors Driving Growth

The global raman spectroscopy market size was valued at USD 394.32 million in 2024 and is projected to reach USD 724.47 million by 2032, with a CAGR of 7.9% during the forecast period of 2025 to 2032.

Major Growth Drivers

Growing R&D and Pharmaceutical Activity

The pharmaceutical, biotech and life-science sectors increasingly rely on Raman spectroscopy for drug development, quality control, polymorph and impurity detection, and process monitoring (PAT).

Rising investment in biotech, genomics and precision medicine expands instrument demand.

Demand for Non-Destructive Testing and Quality Assurance

Industries such as food & beverage, agriculture, materials science and electronics emphasise non-destructive, rapid and in-line analytical solutions. Raman instrumentation meets these needs.

Advances in Portable & Handheld Raman Systems

Field-deployable Raman spectrometers enable on-site, real-time analysis in security, environmental monitoring, agriculture and manufacturing-floor applications. Adoption of handheld devices widens the addressable market.

Materials & Nanotechnology Growth

Emerging materials such as graphene, 2D‐materials, carbon nanotubes, coatings, thin films and semiconductors require advanced characterisation tools like Raman spectroscopy. Demand from materials science accelerates adoption.

Emerging Market Expansion

Asia-Pacific (China, India, Southeast Asia) is growing rapidly due to increasing research infrastructure, manufacturing, material science investment, food-safety needs and regulatory compliance. Europe and Latin America also show rising uptake.

Opportunities in Emerging Regions

Asia-Pacific: With the fastest growth trajectory, this region’s pharmaceutical manufacturing, electronics/semiconductor industry, materials research and food safety imperatives present strong upside.

Latin America & Middle East/Africa: Though smaller base markets, increasing deployment of advanced instrumentation in research, agriculture and food testing offers new prospects.

Portable/Handheld Raman Growth: In sectors like security (counterfeit detection), agriculture (soil/crop analysis), food quality (on-line scanning) portable Raman devices create new demand beyond traditional lab use.

Integration with AI/Cloud Analytics: Deployment of software-driven Raman solutions, with spectral libraries, AI-based interpretation and remote monitoring, will broaden applicability and lower operator-skill barriers.

Conclusion

The Raman Spectroscopy market is on course for meaningful growth through to 2032 as instrumentation becomes more advanced, accessible and widely applied across industries. From an estimated base of ~USD 0.8 billion in 2023, analysts forecast the market will reach around USD 1.1 billion by 2028 at a ~7% CAGR, and potentially upwards of USD 2.3 billion by 2032 with sustained ~7–8% growth. Adoption drivers span pharmaceuticals, materials science, semiconductors, food safety, environmental monitoring and on-site/portable analysis.

Industry participants—including instrument manufacturers, software/analytics providers, consumables suppliers and end-users—should prioritise innovation in portable and high-sensitivity instruments (e.g., SERS/TERS), AI/cloud-enabled analytics, service/support infrastructure in emerging regions and strategic partnerships to expand applications. Competitive positioning will be determined by cost-efficiency, usability (handheld devices), integration with manufacturing/production workflows, and expansion into high-growth geographies.

Risks remain—including cost barriers, expertise requirements, alternative technologies, and economic/R&D spend fluctuations—but the core value proposition of Raman spectroscopy (non-destructive, rapid, versatile analysis) ensures it remains a strategic tool across multiple industries. For stakeholders, aligning product development, geographic expansion and cross-industry applications will unlock the most value in this evolving market.

FAQs

1. What is the Raman spectroscopy market?

It covers the global market for Raman instrumentation, consumables, software/analytics and services used for Raman-based molecular and material analysis across industries.

2. What was the market size recently and what growth is expected?

In 2023 the market was estimated at around USD 0.8 billion. Projections suggest growth to about USD 1.1 billion by 2028 at ~7% CAGR, and some forecasts extend to USD 2.3 billion by 2032 at ~7-8% CAGR.

3. What are major growth drivers?

Key drivers include increased R&D and pharmaceutical activity, demand for non-destructive testing and quality control, portable/handheld Raman adoption, materials science growth and emerging market penetration.

4. Which region leads the market?

North America is a leading market based on instrumentation adoption and research infrastructure. Asia-Pacific is the fastest-growing region owing to manufacturing growth, materials research and emerging regulatory/quality-control demand.

5. What are major challenges?

Challenges include high capital costs for instrumentation, requirement for skilled operators, competition from alternative analytic techniques, limited adoption in some sectors and supply-chain/maintenance costs.

6. What segments offer the best opportunities?

Handheld/portable Raman devices, SERS/TERS sampling techniques, applications in pharmaceuticals/biotech, materials science (2D-materials, nanotechnology), food/-beverage and agriculture, and emerging markets (Asia, Latin America) offer strong opportunity.

7. How is the market segmented?

The market is segmented by instrument type (benchtop, handheld, microscopy), sampling technique (conventional Raman, SERS, TERS), application (pharma, life science, materials science, semiconductor, food/beverage, environmental) and region (North America, Europe, Asia-Pacific, Latin America, Middle East & Africa).

Browse More Reports:

Global Ready Meals Market

Global Recreational Vehicle Market

Global Revenue Cycle Management (RCM) Market

Global Rodenticides Market

Global Salt Substitute Market

Global Samarium Cobalt Magnets Market

Global Semiconductor IP Market

Global Semiconductor Memory Market

Global Single Use Medical Devices Reprocessing Market

Global Software-Defined Anything Market

Global Somatostatin Analogs Market

Global Spinach Market

Global Sports Analytics Market

Global Steel Wire Market

Global Subdural Hematoma Treatment Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com