Introduction

The Asia-Pacific Digital Lending Platform Market refers to software and services that support online origination, underwriting, servicing and management of loans through digital channels across banks, non-bank lenders and fintech entities in the Asia-Pacific region. These platforms enable automated credit decisioning, faster loan disbursement, digital onboarding, risk analytics and compliance tracking.

This market is of global relevance because the Asia-Pacific region hosts a large share of the world’s digital-finance growth, has high mobile and internet penetration, and features underserved lending segments—posing a substantial opportunity for digital lending platforms.

Learn how the Asia-Pacific Digital Lending Platform Market is evolving—insights, trends, and opportunities await. Download report: https://www.databridgemarketresearch.com/reports/asia-pacific-digital-lending-platform-market

The Evolution

The adoption of digital lending platforms in Asia-Pacific began in the mid-2010s when fintech firms started offering peer-to-peer (P2P) and marketplace lending services. Traditional banks responded by integrating components of digital origination to reduce cost and improve turnaround time.

Key milestones include:

Introduction of mobile-first loan applications and alternative data underwriting (e.g., in India and Southeast Asia).

Development of end-to-end lending platforms covering origination, servicing, collections and analytics.

Deployment of AI and machine-learning-based risk engines and decision automation modules around 2018-2020.

Emergence of embedded lending via e-commerce, BNPL (buy-now-pay-later) and digital banking models in major markets like China, India, Australia and Southeast Asia.

Over time, the shift in demand moved from basic digital applications to full-stack lending platforms, cloud deployment, modular architecture, and sophisticated analytics. The impact of COVID-19 accelerated digital adoption, forcing lenders to shift from branch-based distribution to online origination and servicing, thus raising demand for lending platforms that support remote processes.

Market Trends

Several trends are defining the Asia-Pacific digital lending platform market:

1. Rise of embedded and BNPL-driven lending: As e-commerce and digital wallets proliferate, lending is being embedded into checkout, wallet and marketplace flows. Platforms are adapting to support instant credit and BNPL models integrated within retail ecosystems.

2. Growth of cloud-native lending platforms: Lenders are migrating from on-premise architecture to cloud-based platforms offering scalability, faster deployment and lower capital cost. This is particularly important in fast-growing markets such as India and Southeast Asia.

3. AI/ML and alternative data underwriting: Platforms increasingly integrate AI models, biometric verification, device and behavioural data and alternative data sources (social, mobile-usage) to assess creditworthiness—particularly in markets with large un- or under-banked populations.

4. Regulatory-tech co-evolution: Governments and regulators across Asia-Pacific are launching fintech sandboxes, licensing frameworks and open-banking standards. These regulatory moves are spurring platform adoption and innovation in lending.

5. Bank-fintech collaboration: Traditional banks and non-bank lenders partner with fintechs and lending-platform providers to accelerate digital transformation, leveraging the platforms to modernize legacy systems and improve customer experience.

6. Focus on SME and retail lending segments: Beyond consumer lending, digital lending platforms are increasingly applied to SME lending, equipment financing and unsecured credit in underserved segments. Lenders need platforms that support modular workflows, credit scoring for SMEs and integrated servicing.

Challenges

The Asia-Pacific digital lending platform market faces the following key challenges:

1. Data privacy and cybersecurity risks: Handling financial data, alternative data and AI-based decisioning raises regulatory risk and reputational exposure. Lenders and platform providers must address compliance, data governance and cyber-resilience.

2. Regulatory fragmentation across countries: Each market in Asia-Pacific has differing regulations for digital lending, fintech licensing, data use and underwriting. This complicates cross-border platform roll-out and standardisation.

3. Integration with legacy banking systems: Many banks still run legacy core systems. Implementing modern lending platforms requires complex integration, change management and significant investment.

4. Credit risk and collections in digital context: While origination is easier online, servicing, collections and risk management for digital loans remain challenging in markets with limited credit bureau coverage or weak infrastructure.

5. Limited digital infrastructure in some markets: In less developed markets, limitations in internet penetration, digital identity frameworks and device availability hinder full-scale platform adoption.

These barriers must be addressed for the Asia-Pacific market to realise its full potential.

Market Scope

The Asia-Pacific digital lending platform market can be segmented and analysed along the following dimensions:

By Component:

Solutions (Loan origination, Decision automation, Portfolio & loan servicing, Risk & compliance)

Services (Implementation, Training & education, Support & maintenance)

By Deployment Mode:

On-premise

Cloud / SaaS

By End-User / Application:

Retail lending (personal loans, credit cards, BNPL)

SME lending

Corporate lending

Microfinance & P2P lending

Regional Analysis:

East Asia (China, Japan, South Korea)

South Asia (India, Bangladesh, Pakistan)

Southeast Asia (Indonesia, Malaysia, Philippines, Thailand, Vietnam)

Oceania (Australia & New Zealand)

Note: While this article focuses on Asia-Pacific, the market structure also mirrors global lending-platform segments.

End-User Industries:

Banking & financial services

Fintech & P2P lenders

E-commerce and marketplace platforms offering embedded finance

Microfinance institutions

Market Size and Factors Driving Growth

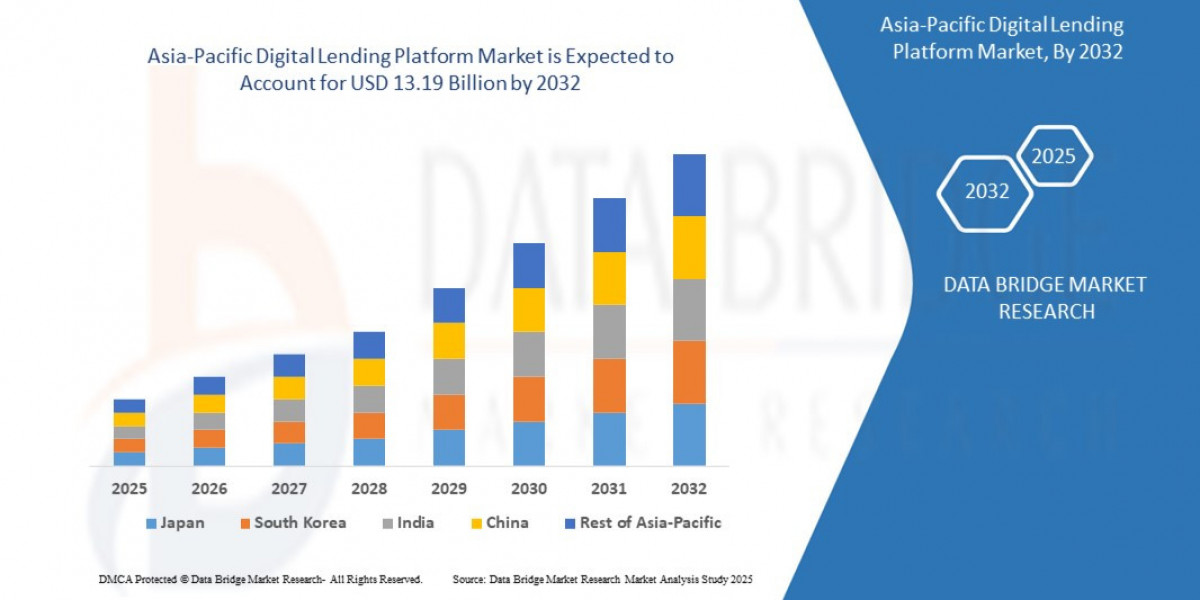

The Asia-Pacific digital lending platform market size was valued at USD 3.01 billion in 2024 and is expected to reach USD 13.19 billion by 2032, at a CAGR of 20.3% during the forecast period

Large underserved borrower base and inclusion push: Many Asia-Pacific markets have significant un- and under-banked populations. Digital lending platforms provide access to credit for these segments via mobile and digital channels.

Smartphone and internet penetration: Widespread smartphone adoption and improved connectivity support online loan origination and servicing.

Fintech friendly regulation and open banking: Governments in Asia-Pacific are encouraging digital banking, fintech licensing and open-banking systems, enabling customer data to be used for faster credit decisions.

Bank and fintech collaboration: Traditional lenders adopt digital platforms to enhance competitiveness and customer experience, while fintechs bring agility, creating demand for modern lending solutions.

Embedded finance and BNPL growth: Lending platforms are embedded into e-commerce, wallets and marketplaces, driving usage and demand for faster, digital credit.

Need for operational efficiency and cost reduction: Digital lending platforms automate underwriting, servicing and collections to reduce cost-to-serve and improve risk management.

Cloud adoption and modular platforms: The shift to cloud-native, modular platforms accelerates deployment and scalability, which appeals to banks and non-bank lenders.

Growth of SME and micro-lending segments: SMEs often face credit access issues; platforms that support automation, data-driven scoring and integrated servicing are gaining traction.

Opportunities in emerging sub-regions such as Southeast Asia, South Asia and Oceania remain strong given the digital infrastructure momentum, regulatory focus and fintech growth. Providers that offer scalable, locally compliant platforms and partner with local digital lenders will benefit.

Conclusion

The Asia-Pacific digital lending platform market stands at a critical inflection point. With a current size of around USD 1.98 billion and projected growth to approximately USD 11.13 billion by 2030 at ~28% CAGR, the opportunity is substantial. Success for vendors and financial institutions will depend on delivering robust, scalable, secure platforms; adapting to regulatory and data-privacy frameworks; integrating AI and analytics; and targeting underserved borrower segments.

To capture future growth, stakeholders must address the challenges of data governance, digital infrastructure gaps, legacy integration and regional regulatory diversity. As embedded finance, BNPL and mobile-first lending expand, the demand for digital lending platforms will intensify. Innovation focussed on cloud deployment, alternative-data underwriting, seamless borrower experience and open ecosystem integration will differentiate leaders. The path ahead requires agile execution, regional insight and partnerships across fintech, banking and regulatory domains. In doing so, the Asia-Pacific digital lending platform market will play a defining role in the future of lending and financial inclusion across the region.

FAQs

1. What is a digital lending platform?

A digital lending platform is a software and service ecosystem that enables online loan origination, underwriting, servicing and management through digital channels (web/mobile) for banks, fintechs and lenders.

2. What is the size of the Asia-Pacific digital lending platform market currently?

In 2023 the market was estimated at approximately USD 1.98 billion. Grand View Research

3. What is the forecasted growth rate for the market?

The market is expected to grow at a CAGR of around 28% between 2024-2030. Grand View Research

4. What major segments drive the market?

Key segments include solutions (loan origination, decision automation, servicing) and services (implementation, support). Deployment via cloud is gaining share. Applicational segments include retail lending, SME lending and embedded finance.

5. Which countries are leading in the region?

India, China, Australia, South Korea and Southeast Asia are key markets. India is projected to record high growth due to fintech adoption and large under-banked populations. Cognitive Market Research

6. What are the main challenges?

Challenges include data privacy/cybersecurity, regulatory fragmentation, integration with legacy systems, and limited digital infrastructure in some markets.

7. What drives adoption of digital lending platforms?

Drivers include smartphone penetration, fintech regulation, need for financial inclusion, demand for faster lending and cost-efficiency for lenders.

8. What is embedded finance and why is it important?

Embedded finance refers to integrating lending products directly into non-financial digital platforms (e-commerce, wallets). It drives growth by placing credit at point-of-need and increasing platform usage.

9. What future opportunities exist?

Opportunities lie in underserved markets, SME lending segments, marketplaces and BNPL integrations, cloud-native platforms, alternative-data underwriting and partnerships across banks and fintechs.

10. What should platform providers prioritise?

They should prioritise cloud scalability, strong data analytics and AI, regional regulatory compliance, modular architecture for rapid deployment, strong cybersecurity, and partnerships with local lenders and fintechs.

Browse More Reports:

Global Artificial Food Flavours Market

Global Asparagus Extract Market

Global Aspheric Lenses Market

Global Astrocytoma Market

Global Ataxia Market

Global Audio Communication Monitoring Market

Global Augmented Reality and Virtual Reality Market

Global Autoimmune Lymphoproliferative Syndrome (ALPS) Market

Global Automatic Coffee Machines Market

Global Automatic Content Recognition Market

Global Automotive Air Purifier/Ionizer Market

Global Automotive Aluminum Market

Global Automotive Display Market

Global Automotive Display Unit Market

Global Automotive Fuel Cell Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com