IMARC Group, a leading market research company, has recently released a report titled "Glider Aircraft Market Size, Share, Trends and Forecast by Type, Propulsion, Application, and Region, 2025-2033." The study provides a detailed analysis of the industry, including the global glider aircraft market share, size, growth, trends, and forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Glider Aircraft Market Highlights:

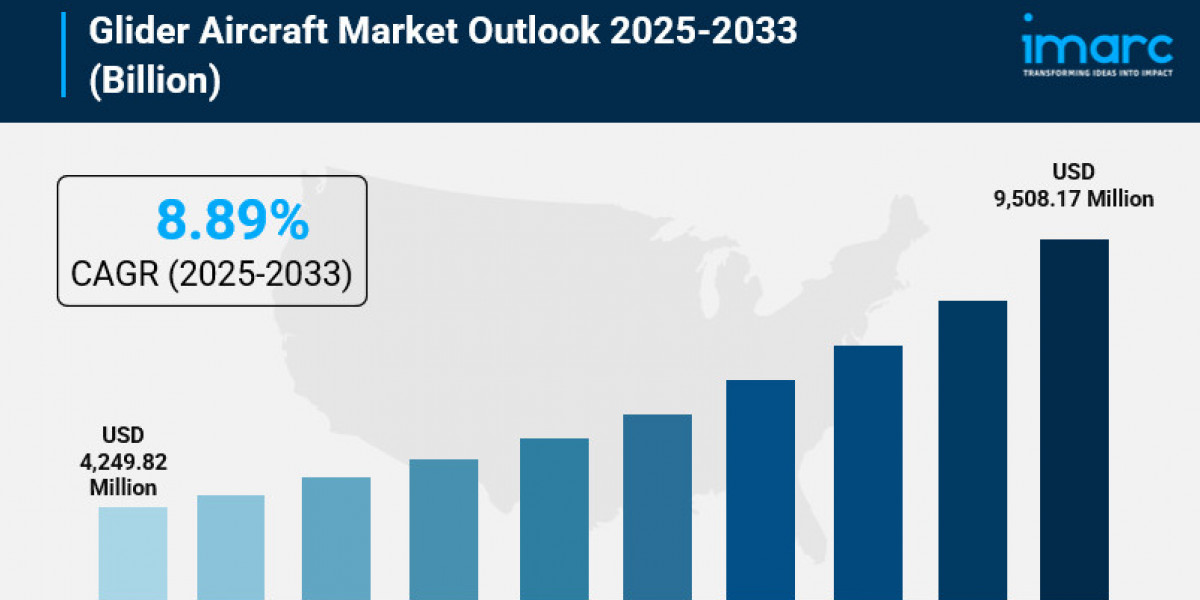

- Glider Aircraft Market Size: Valued at USD 4,249.82 Million in 2024.

- Glider Aircraft Market Forecast: The market is expected to reach USD 9,508.17 Million by 2033, growing at an impressive rate of 8.89% annually.

- Market Growth: The glider aircraft market is experiencing robust growth driven by the surging popularity of recreational aviation, adventure tourism, and the integration of sustainable propulsion technologies.

- Technology Integration: Electric propulsion systems, advanced composite materials, and innovative aerodynamic designs are transforming glider performance and efficiency.

- Regional Leadership: Europe commands the largest market share at 38.7%, fueled by a strong aviation culture, extensive gliding infrastructure, and widespread participation in competitive events.

- Sustainability Focus: The shift toward green aviation and the development of electric-powered gliders are creating new opportunities for manufacturers focused on environmental solutions.

- Key Players: Industry leaders include Alexander Schleicher GmbH, DG Aviation GmbH, Lange Aviation GmbH, Schempp-Hirth Flugzeug-Vertriebs GmbH, and Pipistrel d.o.o. (Textron Inc.), which dominate the market with innovative designs.

- Market Challenges: High initial costs, regulatory complexities, and the need for specialized infrastructure present ongoing challenges for market expansion.

Claim Your Free “Glider Aircraft Market” Insights Sample PDF: https://www.imarcgroup.com/glider-aircraft-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Industry Trends and Drivers:

- Explosive Growth in Adventure Tourism:

The global adventure tourism market, which is estimated to be to be USD 804.51 billion, has been growing at a rapid rate as tourists seek unique travel experiences beyond customary vacations. In particular, the air sector of the market is growing rapidly, with gliding, hang-gliding and paragliding being preferred for the aerial experience and the various beautiful views of the landscapes that can only be seen when flying. In the Adventure Travel Trade Association's (ATTA) State of the Industry report, an average tour operator served 6,553 visitors, an increase of 54% over the previous year. The demand for gliders increases with the size of the adventure seeking community, and they are used for recreation, training, and in commercial operations. Gliding offers have become especially popular in the Swiss Alps, as well as in the French Riviera and the Southern Alps in New Zealand, where trip reservations have regularly reached 65% capacity.

- Revolutionary Electric Propulsion Technology:

The market for glider aircraft is changing with electric power systems moving the design into totally new territory. In April 2024, Schempp-Hirth Flugzeug-Vertriebs GmbH released the Ventus-3E self-launch motor-glider. The new aircraft can take off unassisted from the ground, thanks to a retractable propulsion system with a peak output of 39 kW (52 hp). Like many green aircraft, this benefits from easy access to the battery and ease of control. The electric glider market in particular is growing rapidly. As of 2022, the electric glider market was valued at USD 3,089.29 million, and is projected to reach USD 14,404.07 million by the end of 2030. The Antares, a revolutionary aircraft, equipped with Lange Aviation's RED.3 battery system, containing 60% more energy, can safely, powerfully, silently and emission-free climb to an altitude of 5600 m the Antares 21E. These developments represent not merely the evolutionary development of gliders, but a generational step in performance within the context of global environmental obligations.

- Flourishing Flight Training Infrastructure:

Increasingly, gliders are taking on a greater role in pilot training around the world. Flight schools have discovered that gliders are able to teach basic aerodynamics, stick and rudder flying skills, and flight management, at a lower operating cost. Flight training organizations have built gliding fleets to provide student pilots with flight training at the lowest possible cost and avoid the fuel costs of powered training aircraft. Gliders are used for ab initio flight training, in energy management, weather reading and precision landing, all of which transfer to powered flight. Training and sport together are responsible for the 70.2% of new aircraft sales to the general aviation market that are sailplanes. This results in a lower stall speed and greater lift/drag ratio, allowing greater flight duration times and turning these aircraft into training gliders. In response to this demand, manufacturers produce modern, more durable, economical and forgiving sailplanes that novice pilots learning to fly a glider can operate successfully.

- Military and Defense Applications Driving Demand:

A major and growing market for gliders in such roles is the military and defense sector. The military has been involved with gliders in reconnaissance and surveillance and troop insertion, where the extremely specialized properties of gliders, such as stealth, are considered superior to what powered aircraft can offer. Their quiet operation lends itself to special operations in future and patrols along borders with a need for noise discipline. Military gliders were used in both world wars of the last century to transport large numbers of troops and heavy equipment directly into combat theatres, a feature still recognized by armies today. The increasing risk from transnational threats to national security is driving a need to replace and upgrade military equipment with new technology. Defense organizations practice with glider aircraft in war games or joint training exercises. Glider type aircraft are also useful in military scenarios that are not strictly warfare, and as military fleets age and attempt to overcome funding constraints, the use of glider-type military aircraft is likely to continue, as they provide advantages in fuel efficiency and low maintenance.

Glider Aircraft Market Report Segmentation:

Breakup by Type:

- Sailplane

- Hang Gliders

Sailplanes dominate with 70.2% market share, remaining the preferred choice due to their efficient aerodynamics, long-distance gliding capabilities, and versatility for both recreational and competitive applications.

Breakup by Propulsion:

- Powered

- Non-Powered

Non-powered gliders represent the traditional segment, while powered variants (including electric self-launch systems) are experiencing the fastest growth due to technological advancements and convenience benefits.

Breakup by Application:

- Commercial

- Military

The commercial segment leads the market, driven by recreational flying, flight training schools, and adventure tourism operators, though the military segment shows promising growth potential.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Europe dominates with 38.7% market share, benefiting from established gliding clubs, competitive events, favorable geography including the Alps, and strong aviation heritage.

Who are the key players operating in the industry?

The report covers the major market players including:

- AirBorne Australia

- Albatross Flying Systems (opc) Private Limited

- Alexander Schleicher GmbH

- AMS - FLIGHT, d.o.o.

- Bautek Fluggeräte GmbH

- DG Aviation GmbH

- HPH Spol S R.O.

- Lange Aviation GmbH

- Moyes Delta Gliders

- North Wing

- Pipistrel d.o.o. (Textron Inc.)

- Schempp-Hirth Flugzeug-Vertriebs GmbH

- Wills Wing Inc.

Ask Analyst For Request Customization: https://www.imarcgroup.com/request?type=report&id=8321&flag=E

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1–201971–6302