The American insurance industry is facing a once-in-a-generation transformation. For decades, inefficiencies in claims management—manual data entry, lengthy investigations, and disjointed systems—have plagued insurers and frustrated policyholders. But that’s no longer the case. With the rise of Generative AI (GenAI), insurers are discovering smarter, faster, and more personalized ways to handle claims. The most successful companies aren’t just experimenting—they’re implementing GenAI use cases that are redefining what efficient, customer-focused insurance looks like.

The Next Phase of Claims Management

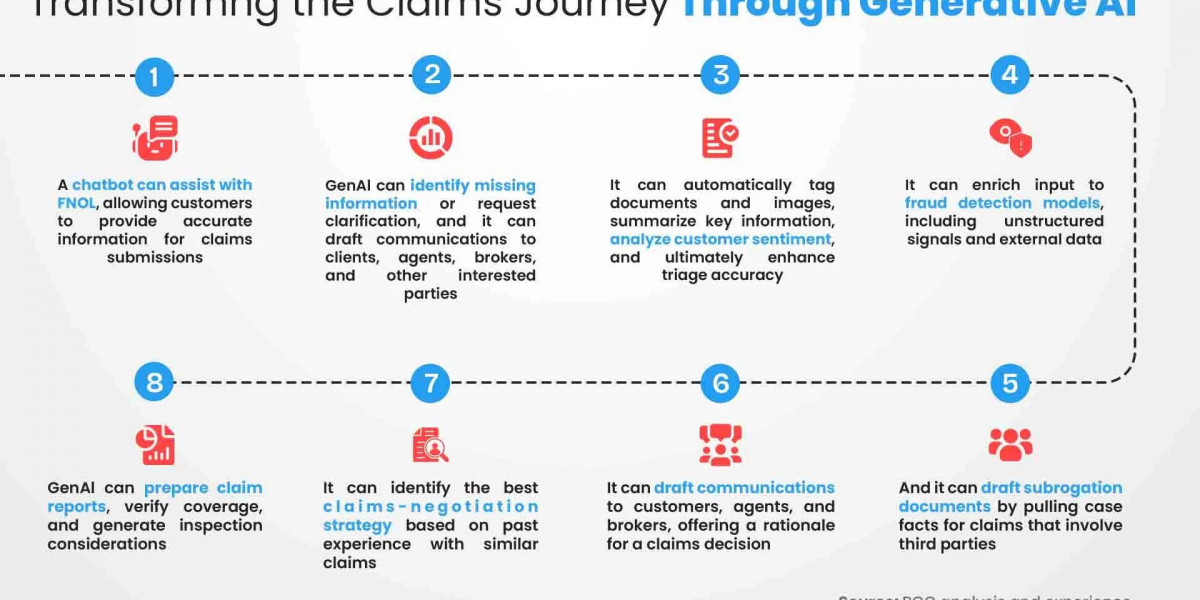

Claims processing has always been the heart of insurance operations. Yet, it’s also been the area most resistant to change. Traditional automation could only handle repetitive, rule-based tasks. GenAI, however, goes far beyond that—it understands context, analyzes intent, and generates insights in real time.

When a claim is filed, a GenAI system can immediately review documentation, extract critical information from scanned reports, evaluate photos of the damage, and even identify inconsistencies that may suggest fraud. These models don’t just follow pre-set rules—they learn from historical outcomes, improving accuracy with every claim they process.

A leading GenAI use case in claims management is the deployment of AI-powered virtual adjusters. These systems can provide claimants with immediate responses, initiate assessments, and even make payment recommendations—all within minutes. For example, Lemonade’s “AI Jim” has become a well-known example in the U.S., capable of settling straightforward claims in seconds. But newer models are expanding these capabilities—handling more complex scenarios like multi-vehicle accidents or medical injury assessments, areas that once required weeks of back-and-forth.

New GenAI Use Cases Emerging in U.S. Insurance

The power of GenAI doesn’t stop at claims automation. A wave of new GenAI use cases is emerging across the insurance value chain, creating measurable impact:

- Fraud Detection and Prevention

Fraud costs the American insurance industry more than $300 billion annually. Generative AI models are now cross-analyzing structured data (like claim histories) and unstructured inputs (like customer statements or social media content) to spot patterns humans might miss. By comparing claim narratives with historical fraud cases, GenAI can flag suspicious activity instantly—before payouts occur. - Customer Interaction and Personalization

With GenAI-driven chatbots and virtual assistants, insurers can now offer personalized conversations that sound genuinely human. These systems can recall previous interactions, detect emotion in customer messages, and provide empathetic, context-aware support. For American consumers—who value convenience and empathy—this represents a huge leap forward in customer satisfaction. - Predictive Risk Management

Perhaps the most innovative GenAI use case is predictive risk analysis. By combining GenAI with IoT and satellite data, insurers can forecast risks before they happen. For instance, property insurers can warn policyholders about upcoming severe weather that could damage their homes, while auto insurers can predict high-risk driving zones based on historical data and current traffic conditions. This shift from reactive to proactive insurance is redefining the industry’s role—from crisis responder to trusted advisor.

New Frontiers: Ethical and Explainable GenAI

As GenAI becomes embedded in core insurance functions, transparency and governance are top priorities. American regulators are increasingly focused on explainable AI—ensuring customers understand how automated systems make decisions that affect them. The best GenAI use cases are designed with fairness and auditability in mind. Leading insurers are implementing AI governance frameworks to monitor bias, data accuracy, and model performance—creating a foundation of trust in an era of intelligent automation.

Another emerging trend is the use of synthetic data in model training. By generating realistic but anonymized datasets, insurers can strengthen their AI models without risking exposure of sensitive policyholder information. This innovation allows U.S. insurers to meet strict data privacy standards while accelerating AI adoption.

The Future: A Smarter, More Human Insurance Experience

The true promise of GenAI isn’t replacing humans—it’s empowering them. Adjusters can now focus on complex cases that require empathy and judgment, while AI handles the administrative heavy lifting. Customers benefit from near-instant settlements and clearer communication. Insurers benefit from reduced costs, better fraud control, and higher loyalty.

In short, GenAI is not just enhancing claims—it’s reinventing the entire insurance experience. The most forward-thinking carriers are already implementing GenAI use cases that merge automation with intelligence, speed with empathy, and prediction with prevention.

As this technology continues to evolve, one thing is certain: the future of American insurance will be faster, fairer, and more customer-driven—powered by the limitless potential of Generative AI.