Market Overview:

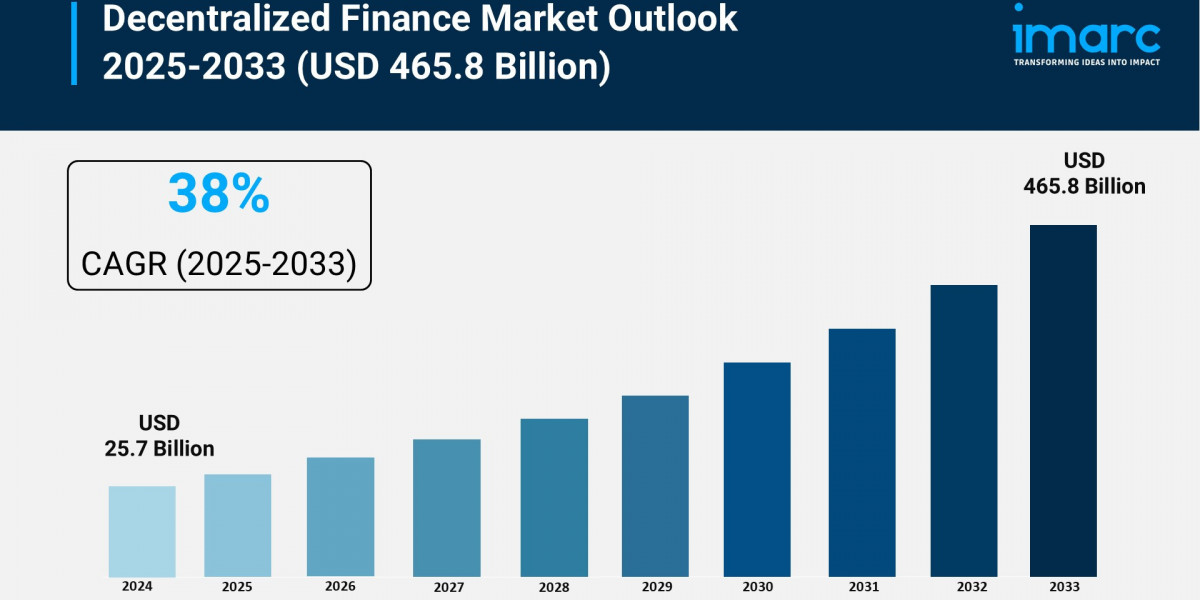

The Decentralized Finance Market is experiencing explosive growth, driven by Increasing Demand for Financial Inclusivity and Accessibility, Transparency and Security Through Blockchain Technology and Interoperability of DeFi Protocols. According to IMARC Group's latest research publication, "Decentralized Finance Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global decentralized finance market size reached USD 25.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 465.8 Billion by 2033, exhibiting a growth rate (CAGR) of 38% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/decentralized-finance-market/requestsample

Our Report Includes:

- Market Dynamics

- Market Trends and Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Decentralized Finance Industry:

- Increasing Demand for Financial Inclusivity and Accessibility

The global expansion of DeFi continues to provide a solution to the unbanked population, without the need to visit a bank, fill in forms or even have a credit history to establish an account on the blockchain. Low remittance costs allow workers to send funds to their home countries without expensive transfer fees. Digital identity solutions and decentralized credit scoring are allowing users access to lending products based on their on-chain reputation rather than customary credit scoring. Community DAOs are enabling cooperative savings and investments. DeFi offers new opportunities to those who have been denied the benefits of customary economic growth.

- Transparency and Security Through Blockchain Technology

The blockchain technology that supports DeFi applications offers a level of transparency that is not typically found in customary financial systems, as all blockchain transactions can be verified and audited in real time. This reduces reliance on intermediaries, lowering the potential for hidden fees, fraud, or funds being mismanaged or misappropriated. Financial regulations on these transactions can sometimes be enforced through smart contracts. Multi-signature wallets, advanced cryptography, and decentralized security systems can help protect against hacks and are already being used by several systems to protect against hacks through audited and upgradeable smart contract frameworks. As confidence builds via security improvements, this could lead to a more institutionalized marketplace ecosystem for DeFi.

- Interoperability of DeFi Protocols

DeFi applications on multiple chains are interoperable and improve the growth of the DeFi ecosystem because they ensure capital efficiency from the non-fragmentation of assets through trading, staking or collateralizing across multiple chains. Cross-chain communication layers are being used to move digital assets across different blockchains, to broaden access to different wallets, and to more easily transition to networks with greater throughput or more favorable economics (scalability, cost). As different networks are operated on the same underlying infrastructure, and end-to-end interoperability standards like IBC and trustless bridging mature, DeFi could potentially evolve into a globally connected finance system, removing the need for end users to choose blockchain networks.

Key Trends in the Decentralized Finance Market

- Rise of Multi-Chain and Cross-Chain Solutions

Many DeFi applications are also adopting a multi-chain architecture to help with scaling, with swaps across networks at low latencies being conducted on liquidity aggregation platforms. Cross-chain yield farming is an emerging form of yield farming that allows users to spread yield and price risk across markets. New ways to secure token bridges and ways to allow institutional users to participate are under development. With many chains focused on speed, privacy, and programmability, customizable financial products will allow DeFi to evolve from a fragmented infrastructure to a global liquidity engine that can enable high-volume financial innovation at scale.

- Integration of Traditional Finance with DeFi

Banks leverage DeFi technology for back-office operations, both internal and external, disparate asset classes including tokenized equities, bonds and real world assets (RWAs), fractional ownership and faster settlement for issuers and investors. Major payment processing networks explore blockchain-based transfers, which eliminate intermediaries and increase accessibility to the global economy. Compliance and regulatory infrastructure are being designed for these compliant DeFi models, opening the space for institutions like pension funds, private banks, and insurance companies to participate. This is an important moment, as it sees on-chain and off-chain finance working in concert.

- Emergence of Sustainable and ESG-Focused DeFi

Environmentalism is causing a second wave of DeFi using proof-of-stake and zero-knowledge scaling to reduce the prohibitive carbon footprint of the first wave. DeFi projects are introducing new climate-friendly financial instruments such as tokenized green bonds and pools for investment into renewable energy. Community governance allows protocol stakeholders to influence sustainability and ethical funding. Social impact drives the onboarding of underbanked populations to micro-lending and low-cost remittance services. As ESG metrics become a main determinant of capital allocation, DeFi is emerging as not just a disruptive model for finance but a vehicle for globally-equitable wealth creation and responsible innovation.

The decentralized finance market forecast offers insights into future opportunities and challenges, drawing on historical data and predictive modeling.

Leading Companies Operating in the Global Decentralized Finance Industry:

- BadgerDAO

- Balancer

- Bancor Network

- MakerDAO

- SushiSwap

- Synthetix

- Uniswap Labs

Decentralized Finance Market Report Segmentation:

Breakup by Component:

- Blockchain Technology

- Decentralized Applications (dApps)

- Smart Contracts

According to the report, blockchain technology represented the largest segment as it forms the foundational infrastructure for all DeFi applications and services.

Breakup by Application:

- Assets Tokenization

- Compliance and Identity

- Marketplaces and Liquidity

- Payments

- Data and Analytics

- Decentralized Exchanges

- Prediction Industry

- Stablecoins

- Others

According to the report, data and analytics accounted for the largest market share, focusing on providing tools to understand and track the performance of various DeFi assets and protocols.

Market Breakup by Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America exhibits a clear dominance, accounting for the largest decentralized finance market share due to supportive regulatory frameworks, institutional investment, and technological innovation.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1–201971–6302