Radiopharmaceuticals Market Size, Share, Industry Trends, Growth and Forecast 2025-2033

Radiopharmaceuticals Market Size, Trends, Key Players, Latest Insights and Forecast 2025-2033

Radiopharmaceuticals Market Size, Growth, Top Companies, Analysis and Forecast 2025-2033

IMARC Group, a leading market research company, has recently released a report titled "Radiopharmaceuticals Market Report by Product Type (Diagnostic Nuclear Medicine, Therapeutic Nuclear Medicine), Application (Oncology, Cardiology, Neurology, Endocrinology, and Others), End Use (Hospitals and Clinics, Research Institutes, Diagnostic Centers), and Region 2025-2033." The study provides a detailed analysis of the industry, including the global radiopharmaceuticals market growth, share, size, trends, and forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

MARKET OVERVIEW

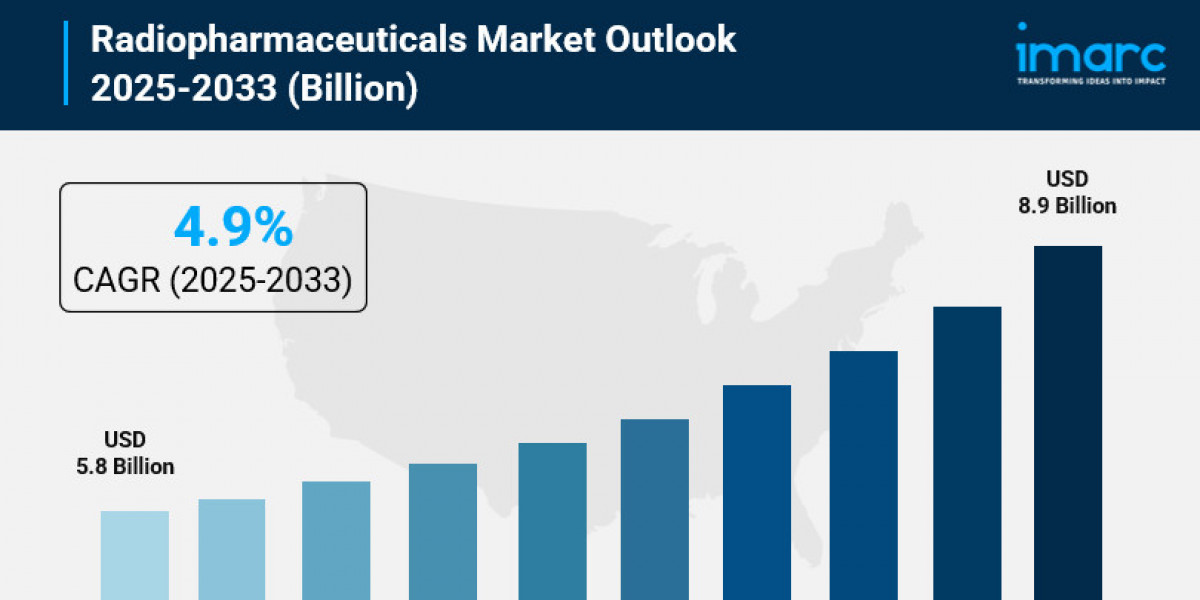

The global radiopharmaceuticals market was valued at USD 5.8 Billion in 2024 and is projected to reach USD 8.9 Billion by 2033, exhibiting a CAGR of 4.9% during 2025-2033. Growth is driven by technological advancements in imaging technology, rising chronic ailments incidence, and favorable regulatory frameworks implemented worldwide.

STUDY ASSUMPTION YEARS

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

RADIOLUMINARIES MARKET KEY TAKEAWAYS

- Current Market Size: USD 5.8 Billion in 2024

- CAGR: 4.9% (2025-2033)

- Forecast Period: 2025-2033

- The market is primarily driven by increasing chronic diseases like cancer and cardiovascular disorders.

- Advancements in PET and SPECT imaging enhance diagnostic capabilities and increase radiopharmaceutical adoption.

- Theranostics is a growing trend, using the same compound for diagnosis and therapy.

- North America leads the market due to strong healthcare infrastructure and expenditures; Asia-Pacific economies like China and India show rapid growth potential.

- Regulatory support from authorities such as FDA and EMA promotes innovation and development of new radiopharmaceuticals.

Claim Your Free “Radiopharmaceuticals Market” Insights Sample PDF: https://www.imarcgroup.com/radiopharmaceuticals-market/requestsample

MARKET GROWTH FACTORS

The radiopharmaceuticals market growth sees increased chronic diseases of cancer and cardiovascular disease. The CDC reports 1,603,844 new U.S. cancer cases and 602,347 cancer-related deaths in 2020. These health issues require accurate imaging, also targeted therapeutics. This leads to wide usage of radiopharmaceuticals in imaging, also treating diseases in the early stages.

Techniques to image using positron emission tomography (PET) and single photon emission computed tomography (SPECT) improved how sensitively doctors diagnose. In 2023, the global PET Imaging market size reached USD 1,196.1 Million and should reach USD 1.93 Billion around 2032. The growth is at a 5.33% CAGR during the forecast period. Such developments will aid the early diagnosis within oncology, neurology, and cardiology through increasing the market.

Another influence on the market growth is favorable regulation. The U.S. Food and Drug Administration FDA and the European Medicines Agency EMA regulate permitting new radiopharmaceuticals to enter the market with speed. Incentives such as Orphan Drug Designation status encourage pharmaceutical companies to invest in research and develop new radiopharmaceutical therapies for personalized medicine and targeted therapy.

MARKET SEGMENTATION

Breakup by Product Type:

- Diagnostic Nuclear Medicine: Constitutes the majority market share; involves administering various radiopharmaceuticals primarily used for imaging with modalities like PET and SPECT. It caters to rising prevalences of cancer, cardiac, and neurological disorders.

- Therapeutic Nuclear Medicine: Utilized for targeted therapy using radiopharmaceuticals designed to treat diseases.

Breakup by Application:

- Oncology: Holds the largest share; driven by demand for targeted cancer therapies and precision medicine using PET and SPECT scans for diagnosis and treatment evaluation.

- Cardiology: Utilizes radiopharmaceuticals for heart-related diagnostic and therapeutic purposes.

- Neurology: Applies radiopharmaceuticals for neurological disorder diagnosis and management.

- Endocrinology: Uses in hormone-related diagnostic and therapeutic applications.

- Others: Encompasses additional medical uses of radiopharmaceuticals not classified above.

Breakup by End Use:

- Hospitals and Clinics: Uses radiopharmaceuticals for patient diagnostics and therapy within medical institutions.

- Research Institutes: Employs radiopharmaceuticals for scientific and clinical research purposes.

- Diagnostic Centers: Largest market segment; offers advanced nuclear imaging procedures using PET, SPECT, and hybrid imaging for accurate diagnosis, driving technology adoption.

Breakup by Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America leads the global radiopharmaceuticals market, attributed to strong healthcare infrastructure, high spending, technological advancements, and the presence of established players with extensive product offerings. In 2022, U.S. healthcare spending reached $4.5 trillion with a 4.1% growth rate, and insurance coverage increased to 92%. This environment fosters innovation and accelerates product introduction, driving market growth.

RECENT DEVELOPMENTS & NEWS

- March 2023: The INTERNATIONAL ATOMIC ENERGY AGENCY (IAEA) launched the 'Rays of Hope' partnership with 11 Japanese universities to enhance cancer care across Asia-Pacific.

- February 2024: Bristol Myers Squibb completed the acquisition of RayzeBio, expanding its portfolio with an actinium-based radiopharmaceutical platform focused on radiopharmaceutical therapeutics (RPTs) targeting solid tumors.

- November 2023: SHINE Technologies entered a long-term supply agreement with Nucleus RadioPharma to supply lutetium-177 for cancer treatments including neuroendocrine tumors and prostate cancer.

KEY PLAYERS

- Advanced Accelerator Applications (Novartis AG)

- Bayer AG

- Bracco S.p.A.

- Cardinal Health Inc.

- Curium Pharma

- General Electric Company

- IBA RadioPharma Solutions

- Jubilant Pharma Limited

- Lantheus Medical Imaging Inc

- Nordion Inc. (Sotera Health)

- NTP Radioisotopes SOC Ltd

- PharmaLogic Holdings Corp.

- Siemens AG

Ask Analyst For Request Customization: https://www.imarcgroup.com/request?type=report&id=3906&flag=C

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

ABOUT US

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

CONTACT US

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302