Market Overview

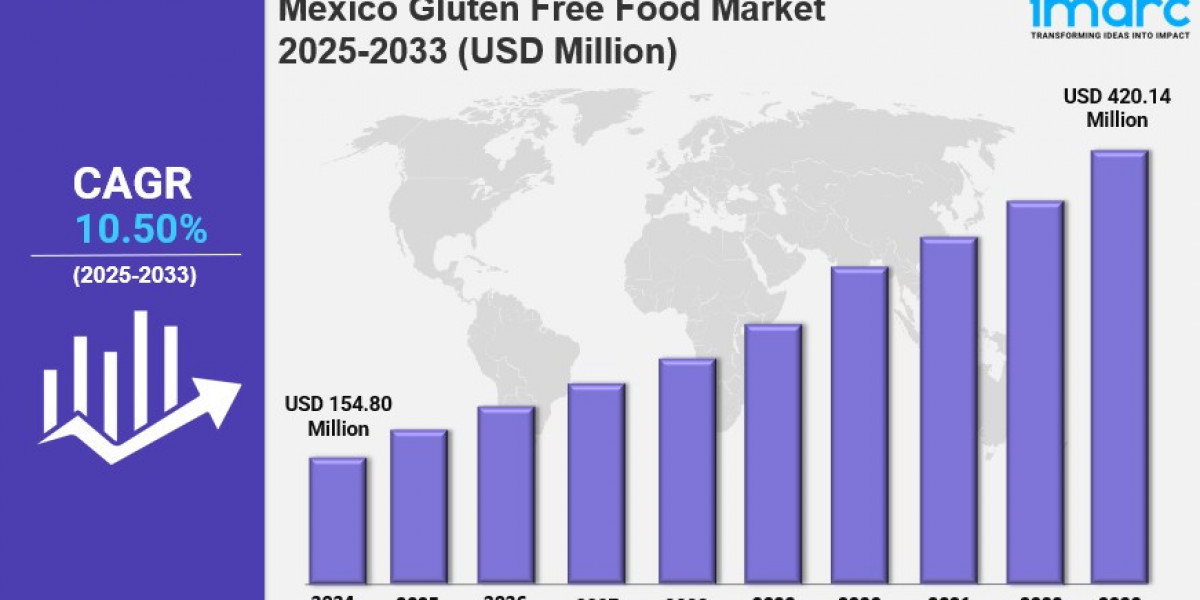

The Mexico gluten free food market was valued at USD 154.80 Million in 2024. It is projected to reach USD 420.14 Million by 2033, registering a CAGR of 10.50% during the forecast period of 2025-2033. The growth is driven by increased awareness about gluten intolerance, especially in individuals with celiac disease, and the expansion of retail channels, improving product availability.

Study Assumption Years

● Base Year: 2024

● Historical Year/Period: 2019-2024

● Forecast Year/Period: 2025-2033

Mexico Gluten Free Food Market Key Takeaways

● Current Market Size: USD 154.80 Million in 2024

● CAGR: 10.50% (2025-2033)

● Forecast Period: 2025-2033

● Rising awareness about gluten intolerance and celiac disease is positively influencing market growth.

● Research in Northwest Mexico showed that 83% of patients improved with a gluten-free diet as of October 2024.

● Retail trade recorded 2,514,611 economic units in Mexico in 2024, with Estado de México, Ciudad de México, and Puebla having the largest number.

● The expansion of supermarkets, hypermarkets, convenience stores, and online retail platforms enhances accessibility of gluten-free products.

● Food manufacturers and restaurants are expanding gluten-free offerings, encouraging consumer trials and adoption.

Sample Request Link: https://www.imarcgroup.com/mexico-gluten-free-food-market/requestsample

Market Growth Factors

The growing awareness of celiac disease and gluten intolerance, and increased awareness of the symptoms and dangers of gluten consumption among consumers is driving the gluten-free pasta market growth. A study in Northwest Mexico found that 83% of patients had improvement after going on a gluten-free diet, and medical practitioners frequently diagnose gluten-related disorders and recommend a gluten-free diet for their patients. Educational campaigns continue to spread through social media and consumers with gluten sensitivity seek out gluten-free products and services. The food industry is seeing growing numbers of gluten-free snacks and baked goods, gluten-free meal kit services, and some restaurants are beginning to provide services to guests who are gluten-sensitive.

DENUE 2024 says Mexico had 2,514,611 retail economic units. The number should grow more. Estado de México, Ciudad de México, and Puebla contain the metropolitan areas with more economic units in particular, specifically 396,325, 207,183, and 178,716. Major supermarkets, hypermarkets and convenience stores in urban and semi-urban areas expanded so they include separate aisles for health and special diet foods to conveniently serve consumers. Online retailers stock a wider variety of gluten-free foods for shipment to customers in remote locations. Online retailers also compete more in order to improve the quality, price, and availability of gluten-free snacks and meals.

Food manufacturers and retailers expand into gluten-free product lines of food. Retailers put money into gluten-free packaging in gluten-free sections in marketing strategies like advertising to health-conscious customers. Private label gluten-free products also help to stabilize price points and create a more inviting setting for consumers in the future to try gluten-free products. It appears that an informal movement exists in which even those without clinical gluten intolerance choose gluten-free versions of foods believing they will provide a health benefit.

Market Segmentation

Product Type:

● Bakery and Confectionary: Includes gluten-free baked goods and sweet treats catering to consumers seeking traditional bakery items without gluten.

● Snacks and RTE Products: Comprises ready-to-eat snacks and meals formulated without gluten, convenient for on-the-go consumption.

● Dairy Products: Involves gluten-free dairy-based foods, supporting dietary restrictions in lactose and gluten-sensitive consumers.

● Sauces and Dressings: Gluten-free condiments and sauces enhancing meals without gluten contamination.

● Meat and Meat Substitutes: Includes gluten-free processed meats and alternatives catering to protein needs.

● Others: Comprise all other gluten-free food types not classified above.

Source:

● Plant-Based: Gluten-free foods derived entirely from plant ingredients.

● Animal-Based: Gluten-free products originating from animal sources.

Sales Channel:

● Hypermarkets/Supermarkets: Large retail formats stocking a broad varieties of gluten-free products.

● Convenience Stores: Smaller urban outlets offering accessible gluten-free options.

● Specialty Store: Stores dedicated to health foods, including gluten-free ranges.

● Pharmacies: Retailers offering gluten-free food items alongside health products.

● Online Retail: E-commerce platforms providing home delivery of gluten-free foods.

● Others: Additional sales channels for gluten-free products.

Regional Insights

Northern Mexico, Central Mexico, Southern Mexico, and others constitute the regional segments. The report does not specify the dominant region or exact market shares. However, retail presence data shows high economic unit concentrations in Estado de México, Ciudad de México, and Puebla, indicating significant market activity in Central Mexico. This suggests a growing demand within these economic hubs supported by extensive retail infrastructure.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=35950&flag=C

Recent Developments & News

In February 2024, the BRCGS Global Standard for Gluten-Free, Issue 4, was released, offering heightened certification standards. This certification received approval across associations in the USA, Canada, and Mexico, allowing certified producers to use recognized trademarks such as the Acelmex gluten-free trademark in Mexico and Latin America. Additionally, Grupo Bimbo SAB de CV acquired Amaritta Food SL in February 2024, a company specializing in gluten-free bread research and production, aiming to leverage new technologies and capitalize on market growth opportunities.

Key Players

● Grupo Bimbo SAB de CV

● Amaritta Food SL

Customization Note

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302