Market Overview

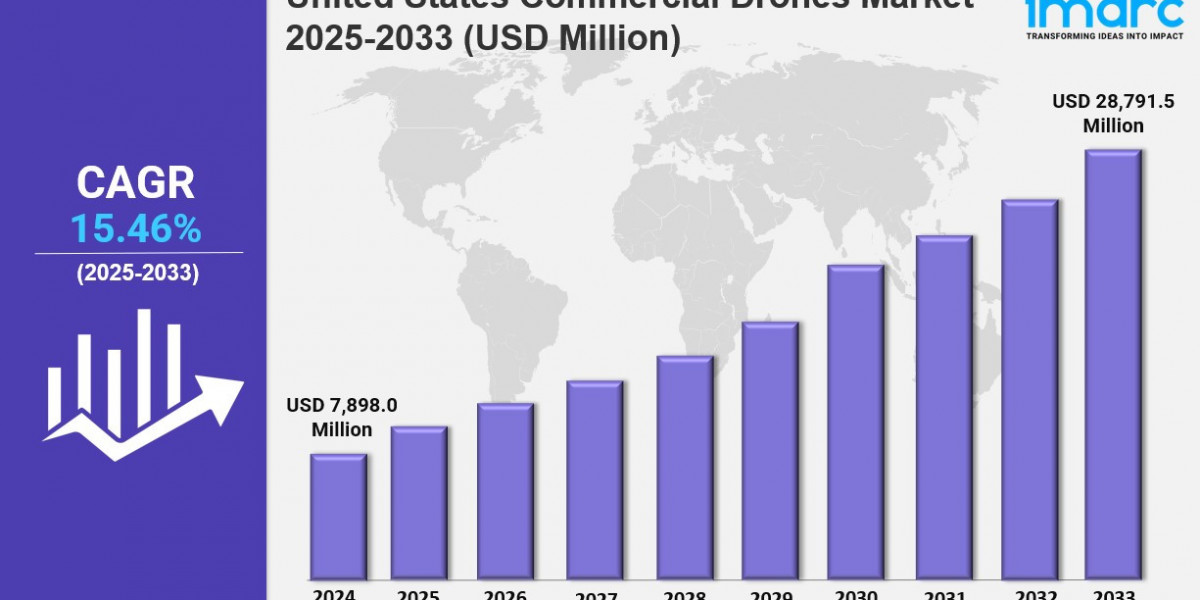

The United States commercial drones market size reached USD 7,898.0 Million in 2024. It is expected to grow to USD 28,791.5 Million by 2033, registering a CAGR of 15.46% during the forecast period of 2025-2033. Growth is primarily driven by government initiatives focusing on promoting drone operation safety protocols and risk mitigation. Commercial drones equipped with advanced sensors and GPS technology are extensively used across various industries for surveying, inspection, agriculture, surveillance, and delivery, underscoring their increasing adoption and market expansion.

Study Assumption Years

● Base Year: 2024

● Historical Year/Period: 2019-2024

● Forecast Year/Period: 2025-2033

United States Commercial Drones Market Key Takeaways

● Current Market Size: USD 7,898.0 Million in 2024

● CAGR: 15.46%

● Forecast Period: 2025-2033

● The rising focus of government bodies to promote safety by outlining protocols for drone operations is driving market growth.

● Commercial drones are used for aerial surveying, infrastructure monitoring, crop health assessment, and natural disaster surveying.

● The market is revolutionizing logistics and transportation by providing swift and cost-effective package delivery.

● Stringent regulations ensure responsible drone usage, addressing privacy, safety, and legal concerns to foster positive public perception.

● Ongoing technological advancements and increased adoption across industries are expected to boost regional market growth.

Sample Request Link: https://www.imarcgroup.com/united-states-commercial-drones-market/requestsample

Market Growth Factors

The United States commercial drones market growth is significantly propelled by government initiatives focusing on enhancing safety protocols and mitigating risks associated with drone operations. These regulatory measures promote the safe integration of drones into national airspace, thus encouraging wider adoption across sectors. The establishment of clear operational guidelines minimizes accidents and legal issues, creating a robust framework that supports market expansion. These safety protocols directly contribute to the confidence of commercial users and manufacturers, facilitating the progressive use of drones for various applications.

Commercial drones are being adopted extensively for tasks such as aerial surveying, infrastructure monitoring, and crop health assessment. Equipped with advanced sensors, cameras, and GPS technology, these UAVs capture high-resolution images and videos from multiple perspectives. This capability provides critical insights for industries like agriculture, construction, and environmental monitoring. Additionally, drones reduce human exposure to hazardous environments, a factor that boosts their desirability in risk-prone tasks such as natural disaster surveying and ecosystem tracking. Such versatile applications drive substantial demand for commercial drones in the country.

Moreover, the commercial drones market is revolutionizing delivery and logistics by offering a swift, reliable, and cost-efficient method for transporting small packages. This transformation is reshaping the logistics landscape by enabling faster deliveries and reducing operational costs. The market benefits from continuous advancements that improve drone autonomy and precision. Stringent regulations complement this by ensuring the responsible use of drones, addressing safety, privacy, and legal concerns. These combined factors stimulate robust growth in the commercial drones market across the United States.

Market Segmentation

IMARC Group provides comprehensive segmentation of the United States commercial drones market based on system, product, mode of operation, weight, application, and end user.

● **System Insights:**

● Hardware: Includes airframe, propulsion system, payloads, and others, covering all physical components essential for drone operation.

● Software: Comprises the digital programs and interfaces that control drone functions and data processing.

● **Product Insights:**

● Fixed Wing: Drones with a rigid wing design, suitable for long-distance flights and endurance.

● Rotary Blade: Drones equipped with rotors enabling vertical take-off, landing, and hovering capabilities.

● Hybrid: Combines features of fixed wing and rotary blade drones, optimizing versatility and flight performance.

● **Mode of Operation Insights:**

● Remotely Operated: Drones controlled directly by human operators in real time.

● Semi-Autonomous: Drones that perform some functions automatically while under partial human control.

● Autonomous: Fully automated drones capable of independent operations without human intervention.

● **Weight Insights:**

● <2 Kg: Lightweight drones ideal for small-scale applications and portability.

● 2 Kg-25 Kg: Medium weight drones balancing payload capacity with maneuverability.

● 25 Kg-150 Kg: Heavy drones designed for industrial and large-scale commercial uses.

● **Application Insights:**

● Filming and Photography: Use of drones to capture high-quality images and videos for media and entertainment.

● Inspection and Maintenance: Drones employed for visual checks and upkeep of infrastructure and equipment.

● Mapping and Surveying: Utilization of drones in geographic data collection and land analysis.

● Precision Agriculture: Application of drones to monitor crop health and optimize farming practices.

● Surveillance and Monitoring: Use of drones for security, environmental, and operational observation.

● Others: Includes miscellaneous commercial uses not covered in the main categories.

● **End User Insights:**

● Agriculture: Farmers and agribusinesses leveraging drones for crop and land management.

● Delivery and Logistics: Companies using drones to expedite parcel delivery and supply chain operations.

● Energy: Utilities and energy sectors utilizing drones for asset inspection and monitoring.

● Media and Entertainment: Content creators deploying drones for innovative visual productions.

● Real Estate and Construction: Industry players employing drones for site surveying and progress tracking.

● Security and Law Enforcement: Agencies using drones for surveillance, monitoring, and enforcement activities.

● Others: Additional industries utilizing drones for various commercial purposes.

Regional Insights

The major regional markets within the United States commercial drones industry include Northeast, Midwest, South, and West. The report highlights comprehensive analysis without specifying dominant regional share or CAGR figures. The regional segmentation facilitates understanding of market dynamics tailored to geographic preferences and industrial demands across these areas.

Ask an Analyst: https://www.imarcgroup.com/request?type=report&id=20346&flag=C

Competitive Landscape

The competitive landscape of the industry has also been examined along with the profiles of the key players.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302