Market Overview

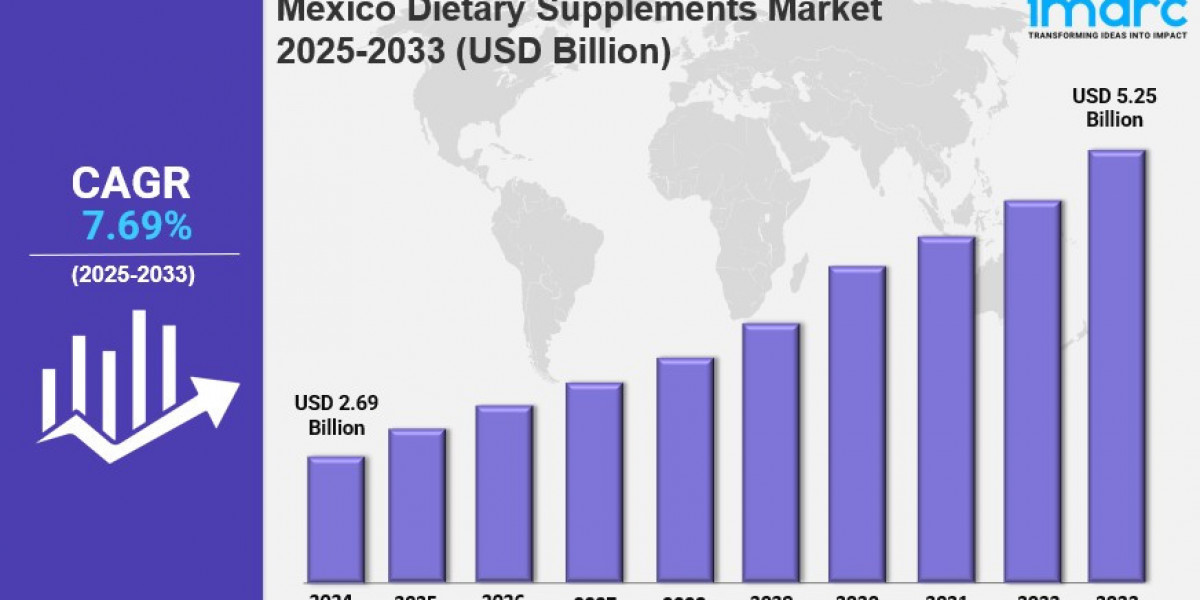

The Mexico dietary supplements market size reached USD 2.69 Billion in 2024 and is expected to grow to USD 5.25 Billion by 2033, exhibiting a CAGR of 7.69% during the forecast period from 2025 to 2033. Growth is driven by preventive health focus, rising lifestyle diseases, digital education, retail channel expansion including e-commerce and supermarkets, personalized delivery options, and omnichannel strategies. The market benefits from increasing consumer health awareness and evolving retail structures.

Study Assumption Years

● Base Year: 2024

● Historical Year/Period: 2019-2024

● Forecast Year/Period: 2025-2033

Mexico Dietary Supplements Market Key Takeaways

● Current Market Size: 2.69 Billion USD (2024)

● CAGR: 7.69% (2025-2033)

● Forecast Period: 2025-2033

● The market growth is propelled by preventive health orientation and rising incidence of lifestyle diseases such as obesity, type 2 diabetes, and cardiovascular diseases.

● Digital education, marketing campaigns by healthcare brands, and local influencers have increased consumer awareness.

● Retail transformation with dominance of pharmacies and increasing roles of supermarkets, convenience stores, and online channels supports market expansion.

● E-commerce growth facilitated by improved logistics and payment systems is driving sales, especially among younger demographics.

● Subscription-based delivery models and digital marketing strategies are boosting customer engagement and loyalty.

Sample Request Link: https://www.imarcgroup.com/mexico-dietary-supplements-market/requestsample

Market Growth Factors

The Mexico dietary supplements market is driven by increasing preventive healthcare through lifestyle changes in Mexico. Obesity, type 2 diabetes, and cardiovascular diseases are lifestyle diseases that are becoming more common, and the people in Mexico want more dietary supplements for immunity, metabolism, and digestive health. Healthcare brands, local influencers, digital content marketing campaigns, and partnerships with pharmacies all acted as they educated the public about the benefits of using long-term supplements and as they made consumers more aware of supplements in the region.

Structural changes in Mexican retailing also provide opportunities for growth. Pharmacies and drug stores remain the largest retail outlets. Supermarkets, convenience stores, and e-commerce gradually gain importance. Retailer store aisles are commonly arranged with supplement products grouped by brand or in multi-item packs in promotional price displays to ease purchasing decisions. E-commerce grows in popularity as a venue for consumers to purchase supplements with improved logistics and through payment systems, especially for younger tech-savvy people. To encourage customer retention, companies may choose a subscription and auto-replenishment model.

Product innovation and domestic production also play a role in increasing demand. For example, someone could produce Moringa oleifera capsule supplements on a domestic scale, with a cost beneath 10 USD to produce them in order that it does not exceed that amount for 1,000 capsules and takes approximately 2 hours. Localized supply, personalized recommendations, and digital omnichannel grocery shopping capabilities should result in growth especially within urban and suburban markets. Last-mile delivery and targeted offers will help avail and build a reputation for convenience and value.

Market Segmentation

Product Type Insights:

● Vitamin and Mineral Dietary Supplements: Vitamins and minerals fulfilling essential nutrient requirements and addressing deficiencies.

● Herbal Dietary Supplements: Products based on traditional and herbal remedies with growing appeal through modern packaging.

● Protein Dietary Supplements: Supplements formulated to support muscle growth, recovery, and overall protein intake.

● Others

Form Insights:

● Tablets: Solid dosage form commonly used for convenience and dosage control.

● Capsules: Encapsulated supplements facilitating easier consumption and absorption.

● Powders: Bulk or portioned powder forms for customizable dosage or mixing.

● Liquids: Liquid supplements enabling quick absorption and ease of intake.

● Soft Gels: Gelatin-based soft capsules improving bioavailability.

● Gel Caps: Gelatin capsules similar to soft gels, offering ease of swallowing.

Distribution Channel Insights:

● Pharmacies and Drug Stores: Traditional and dominant retail points for dietary supplements.

● Supermarkets and Hypermarkets: Modern retail channels increasingly dedicating aisles to supplements.

● Online Channels: Growing segment supported by improved logistics and payment infrastructure.

● Others: Other distribution methods outside the main channels.

Application Insights:

● Additional Supplements: Supplements taken for general nutritional enhancement.

● Medicinal Supplement: Supplements used for health conditions and medical purposes.

● Sports Nutrition: Supplements formulated for athletic performance and recovery.

End-Use Insights:

● Infant: Dietary supplements designed for infant nutrition.

● Children: Supplements formulated for children's health requirements.

● Adults: Products targeting adult consumer health and wellness.

● Pregnant Women: Supplements catering to maternal and prenatal health.

● Old-Aged: Supplements supporting elderly nutrition and health.

Regional Insights

The report segments the market into Northern Mexico, Central Mexico, Southern Mexico, and Others, with no explicit dominant region or specific statistics provided. The market outlook reflects growth potential across major cities and suburban centers supported by local manufacturing and omnichannel retail access.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=33244&flag=C

Recent Developments & News

On October 23, 2024, ProBiotix Health announced a five-year exclusive distribution agreement with Mexico-based Raff to commercialize Lactobacillus plantarum LPLDL, a probiotic strain targeting cardiometabolic health. This partnership aims to address Mexico's high cardiovascular disease mortality, which accounts for nearly 24% of all deaths. The product launch is expected in the first half of 2025, with commercial sales commencing by late 2025 or early 2026.

Competitive Landscape

The market research report covers a comprehensive competitive landscape analysis including market structure, key player positioning, winning strategies, competitive dashboards, and company evaluation quadrants. Detailed profiles of all major companies have been provided.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302