Market Overview:

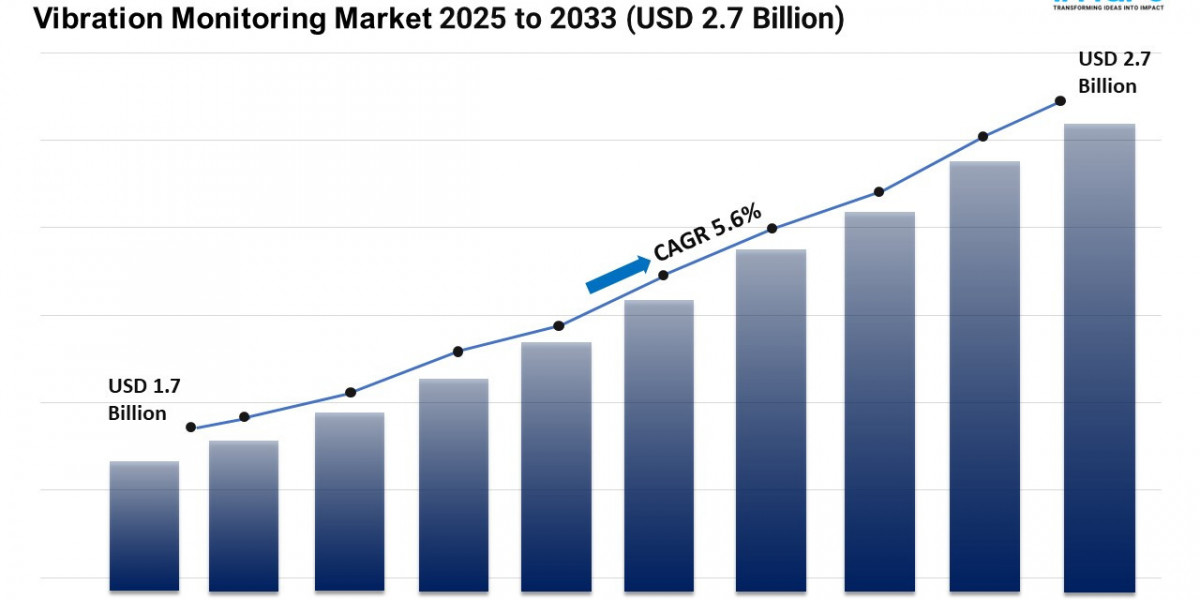

The Vibration Monitoring Market is experiencing steady expansion, driven by Increased Adoption of Predictive Maintenance, Advancements in Wireless Vibration Monitoring Technologies and Integration of IoT and AI in Vibration Monitoring. According to IMARC Group's latest research publication, "Vibration Monitoring Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025–2033", The global vibration monitoring market size reached USD 1.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.7 Billion by 2033, exhibiting a growth rate (CAGR) of 5.6% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Grab a sample PDF of this report: https://www.imarcgroup.com/vibration-monitoring-market/requestsample

Our Report Includes:

- Market Dynamics

- Market Trends and Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Vibration Monitoring Industry:

- Increased Adoption of Predictive Maintenance

According to the vibration monitoring market forecast, magnifying adoption of predictive maintenance in key sectors, such as energy, manufacturing, and automotive, is anticipated to dominantly contribute to the expansion of product applications. Vibration monitoring systems assist in identifying equipment anomalies early, preventing costly downtime and elevating machinery lifespan. Moreover, various companies are heavily investing in such technologies to improve operational efficacy and lower the costs of maintenance. As key sectors emphasize on reducing unplanned breakdowns, the need for advanced vibration monitoring solutions is projected to fuel, mainly driven by the demand for enhanced credibility and safety in complex processes and machinery. As per industry reports, the global market value for predictive maintenance solutions is projected to exceed USD 8 billion in 2024.

- Advancements in Wireless Vibration Monitoring Technologies

Technological advancements in wireless vibration monitoring systems are substantially steering the global market. Such systems offer real-time data and remote supervision abilities, making them highly effective for sectors with difficult-to-access equipment. Wireless sensors lower installation costs and provide better flexibility, enabling enterprises to inspect equipment without the need for comprehensive cabling. In addition, this trend is rapidly gaining momentum in industries such as manufacturing, oil and gas, and power generation, where operational efficacy and cost-efficiency are key aspects. In November 2023, Worldsensing launched the Vibration Meter, a new wireless sensor designed to measure vibration using a tri-axial accelerometer.

- Integration of IoT and AI in Vibration Monitoring

The incorporation of artificial intelligence (AI) and the Internet of Things (IoT) in vibration monitoring systems is a crucial trend in the market. IoT-enabled devices acquire real-time data from machines, while AI algorithms evaluate the data to forecast equipment failures and upgrade performance. This combination allows for improved diagnostics and automated maintenance decisions, enhancing the precision and efficacy of vibration monitoring. In addition, sectors such as transportation, manufacturing, and energy are rapidly adopting IoT and AI-powered solutions to improve equipment credibility, lower operational risks, and bolster productivity. In April 2023, POLYN Technology launched VibroSense, an innovative small AI chip solution for vibration monitoring sensor nodes, effectively reducing power consumption and offering low latency.

Key Trends in the Vibration Monitoring Market

- Growing Demand for Condition-Based Monitoring

The market is experiencing increased emphasis on condition-based monitoring approaches that continuously assess equipment health rather than relying on scheduled maintenance intervals. This shift enables organizations to perform maintenance only when needed based on actual equipment condition, optimizing maintenance costs and reducing unnecessary interventions. Real-time vibration data collection and analysis allow for immediate response to emerging issues before they escalate into major failures.

- Expansion in Oil and Gas Industry Applications

The oil and gas industry represents the largest end-use segment for vibration monitoring systems due to the critical nature of equipment reliability in this sector. Rotating machinery including turbines, compressors, and pumps in oil and gas facilities require continuous monitoring to prevent catastrophic failures and ensure operational safety. The harsh operating environments and remote locations of many oil and gas installations make advanced vibration monitoring essential for maintaining equipment performance and preventing costly downtime.

- Development of Cloud-Based Monitoring Solutions

There is growing adoption of cloud-based vibration monitoring platforms that enable centralized data management, remote access, and advanced analytics capabilities. These solutions allow organizations to monitor equipment across multiple facilities from a single interface while leveraging cloud computing power for sophisticated data analysis. Cloud-based systems also facilitate easier integration with enterprise asset management systems and enable scalable monitoring solutions that can grow with organizational needs.

We explore the factors propelling the vibration monitoring market growth, including technological advancements, consumer behaviors, and regulatory changes.

Leading Companies Operating in the Global Vibration Monitoring Industry:

- Analog Devices Inc.

- Emerson Electric Company

- Erbessd Instruments Technologies Inc.

- General Electric Company

- Honeywell International Inc.

- Istec International

- Meggit SA

- National Instruments

- Parker-Hannifin Corp.

- Petasense Inc.

- Rockwell Automation Inc.

- Schaeffler AG

- SPM Instrument AB

Vibration Monitoring Market Report Segmentation:

Breakup by Component:

- Hardware

- Software

- Services

Hardware accounts for the majority of the market share as physical sensors and monitoring devices form the foundation of vibration monitoring systems requiring continuous deployment across industrial equipment.

Breakup by System Type:

- Embedded Systems

- Vibration Analyzers

- Vibration Meters

Embedded Systems holds the largest share of the industry as they provide continuous, integrated monitoring capabilities within machinery and equipment for real-time condition assessment.

Breakup by Monitoring Process:

- Online

- Portable

Online represents the leading market segment as continuous online monitoring enables real-time equipment health assessment and immediate anomaly detection for critical machinery.

Breakup by End Use Industry:

- Energy and Power

- Metals and Mining

- Oil and Gas

- Automotive

- Food and Beverages

- Others

Oil and Gas exhibits a clear dominance in the market due to the critical importance of equipment reliability and safety in this sector with extensive use of rotating machinery requiring continuous monitoring.

Breakup by Region:

- North America (United States, Canada)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America leads the market, accounting for the largest vibration monitoring market share driven by rapid industrialization, favorable government regulations, and continual technological advancements.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States:+1-201971-6302