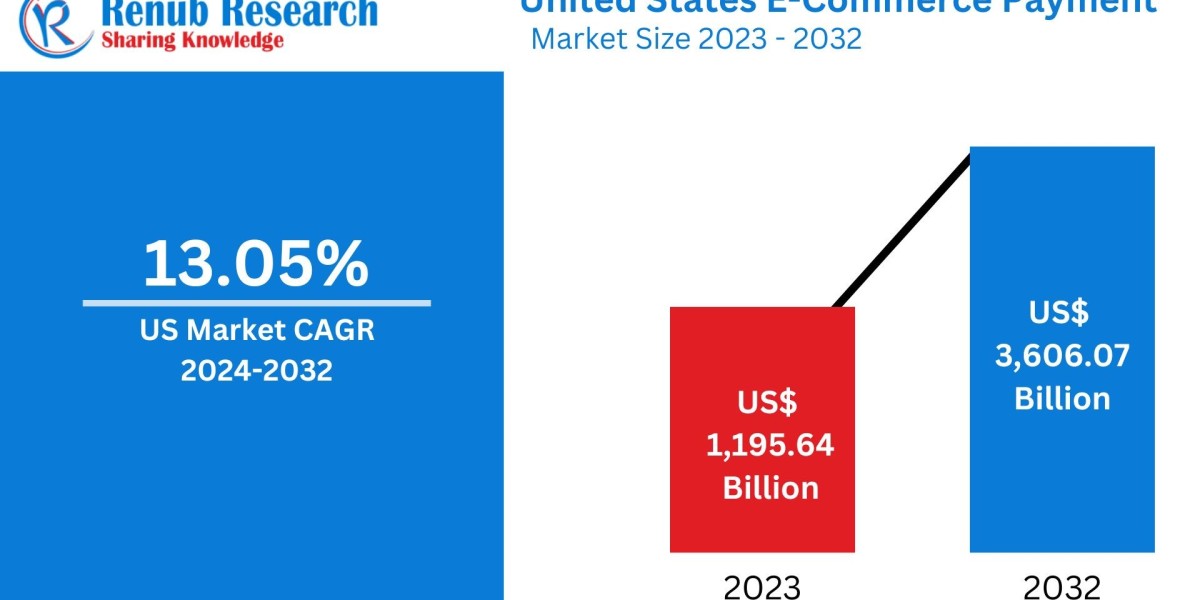

United States E-Commerce Payment Market to Surpass US$ 3,606 Billion by 2032, Driven by Mobile Commerce, BNPL, and Digital Wallet Adoption

According to the latest research by Renub Research, the United States E-Commerce Payment Market is projected to grow from US$ 1,195.64 Billion in 2023 to US$ 3,606.07 Billion by 2032, growing at a strong CAGR of 13.05% during the forecast period of 2024 to 2032.

The exponential growth of mobile commerce, coupled with increased smartphone usage and internet penetration, is reshaping how Americans shop and pay online. With nearly 80% of online shoppers using mobile apps for purchases, seamless digital payment systems are now a critical backbone for U.S. e-commerce platforms.

Key Market Trends:

1. Surge in Digital Wallet Use:

Platforms like PayPal, Apple Pay, and Google Pay are dominating the digital transaction space. In 2023, over 71% of adult U.S. consumers reported using PayPal, highlighting the shift toward contactless and frictionless payment experiences.

2. Rise of Buy Now, Pay Later (BNPL):

With providers like Klarna, Afterpay, Affirm, and even Walmart's fintech startup One entering the BNPL scene, consumers—especially Gen Z and Millennials—are enjoying greater financial flexibility while shopping online.

3. Cross-Border E-Commerce Expansion:

International transactions are fueling demand for secure, multi-currency payment processing. Companies such as PayPal and Shopify are innovating to meet growing expectations for global payment interoperability.

Market Challenges:

Despite the upward trend, the market grapples with cybersecurity risks and evolving regulatory compliance frameworks like PCI DSS, AML, and KYC, requiring robust fraud protection systems.

State-Level Insights:

- California leads in digital payment innovation, powered by Silicon Valley tech giants.

- New York excels due to its robust financial ecosystem.

- Florida shows fast growth driven by consumer diversity, tourism, and fintech innovation.

New Publish Reports

· Commercial Vehicle Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

· Commercial Greenhouse Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

· Hungary E-Commerce Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

· Romania E-Commerce Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Leading Companies Covered:

- Amazon.com Inc.

- PayPal Holdings Inc.

- Apple Inc.

- Mastercard Inc.

- Visa Inc.

- Fiserv Inc.

- American Express Co.

With continuous fintech advancements, strong consumer demand for convenience, and increasing trust in online financial systems, the U.S. e-commerce payment ecosystem is well-positioned to thrive and transform digital commerce globally.

Get the full report with segmented insights by Type, Application, States, and Company Analysis at Renub Research.

❓Frequently Asked Questions (FAQs)

1. What is the projected market size of the U.S. e-commerce payment market by 2032?

The market is expected to reach US$ 3,606.07 Billion by 2032.

2. What is the growth rate (CAGR) from 2024 to 2032?

The U.S. e-commerce payment market is expected to grow at a CAGR of 13.05% during the forecast period.

3. Which is the most widely used digital wallet in the U.S. as of 2023?

PayPal remains the most commonly used digital wallet, with a 71% usage rate among U.S. adults.

4. How is Buy Now, Pay Later (BNPL) reshaping the market?

BNPL solutions are attracting younger buyers by offering interest-free installment options, increasing average order values and enhancing customer acquisition.

5. What are the top challenges faced by the market?

Key challenges include cybersecurity threats, identity theft, fraud, and complex regulatory compliance requirements.

6. Which U.S. state is a hub for e-commerce payments and digital innovation?

California, driven by Silicon Valley’s tech ecosystem, is the epicenter for e-commerce payment innovations.

7. What impact does mobile commerce have on e-commerce payments?

Mobile commerce is a major growth driver, with most U.S. shoppers using mobile apps for purchases, prompting businesses to invest in mobile-first payment solutions.

8. Which sectors are major contributors to the market?

Sectors like Electronics & Media, Fashion Accessories, Food & Personal Care, and Furniture & Appliances are among the top contributors.

9. Who are the key players in the market?

Major companies include Amazon, PayPal, Apple, Mastercard, Visa, Fiserv, and American Express.

10. How are cross-border transactions influencing the industry?

They are driving demand for multi-currency processing, fraud prevention, and global payment infrastructure innovations.