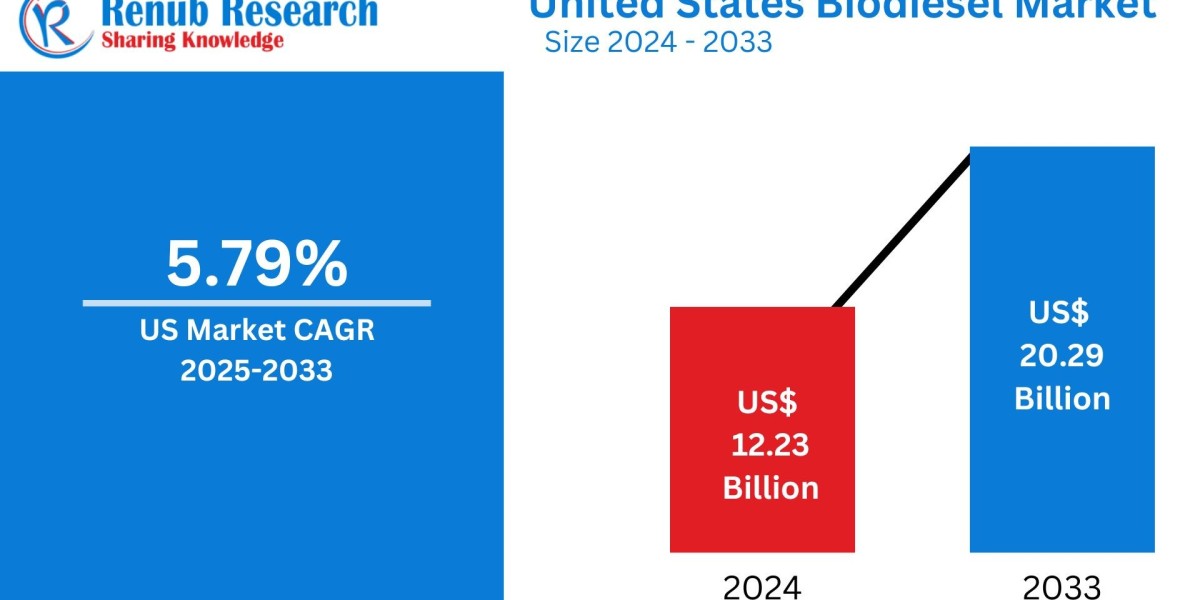

U.S. Biodiesel Market to Reach USD 20.29 Billion by 2033, Driven by Renewable Energy Demand and Government Incentives

According to the latest industry report by Renub Research, the United States biodiesel market is set to surge from USD 12.23 billion in 2024 to USD 20.29 billion by 2033, registering a CAGR of 5.79% during the forecast period 2025 to 2033. This remarkable growth is fueled by a confluence of factors such as rising renewable energy adoption, favorable federal policies, and innovations in biodiesel production technologies.

Key Drivers Boosting the U.S. Biodiesel Market:

- Renewable Fuel Standards (RFS) and tax credits are encouraging large-scale biodiesel blending.

- Corporate and government sustainability initiatives are increasing the demand for low-carbon fuels in transportation and agriculture.

- Technological advancements, such as hydrotreated vegetable oil (HVO) and algae-based biodiesel, are improving yield and cost efficiency.

- Rising feedstock availability from vegetable oils, animal fats, and recycled greases fuels market expansion.

“Biodiesel is no longer an alternative—it’s essential. With growing environmental concerns and federal backing, biodiesel is powering a cleaner energy future for America,” said a Renub Research analyst.

Regional Market Leaders:

- California remains the market leader with its Low Carbon Fuel Standard (LCFS) and aggressive emissions targets.

- New York and Washington are making strides through mandates on municipal fleets and heating oil.

- New Jersey and Midwest states are tapping into regional feedstock advantages and policy support.

Competitive Landscape:

The report profiles top companies including Archer Daniels Midland Company, Neste, Renewable Energy Group, Bunge Global SA, Wilmar, Shell, and FutureFuel, analyzing their strategies, recent developments, and revenue growth.

New Publish Reports

Market Segmentation:

- By Application: Fuel, Power Generation, Others

- By Feedstock: Vegetable Oil, Animal Fats

- By States: Including California, Texas, New York, Florida, and more

Industry Outlook:

Despite challenges such as feedstock price volatility and competition from EVs and renewable diesel, the U.S. biodiesel industry remains resilient. New federal initiatives like the "Pathways to Commercial Liftoff" for Sustainable Aviation Fuel (SAF) are expected to provide synergies for broader biofuel development.

📥 Download Free Sample | 📊 Buy Full Report or Chapters | 💬 Speak to Analyst

📘 Frequently Asked Questions (FAQs)

1. What is the expected size of the U.S. biodiesel market by 2033?

The market is projected to reach USD 20.29 billion by 2033, growing at a CAGR of 5.79% from 2025.

2. Which are the major feedstocks for biodiesel production in the U.S.?

Key feedstocks include vegetable oils (soybean, canola), animal fats, and recycled cooking oil.

3. How does government policy impact the U.S. biodiesel industry?

Policies like the Renewable Fuel Standard (RFS), Biodiesel Tax Credit (BTC), and state-level mandates significantly drive demand by encouraging blending and reducing carbon emissions.

4. Which U.S. states lead in biodiesel usage and production?

California, New York, Washington, Texas, and Illinois are leading markets due to environmental laws, agricultural output, and strong logistics networks.

5. What are the challenges faced by the U.S. biodiesel market?

Major challenges include volatile feedstock prices, supply chain disruptions, and competition from electric vehicles (EVs) and renewable diesel.

6. How is biodiesel used in different sectors?

Biodiesel is widely used in transportation, agriculture, municipal fleets, power generation, and residential heating (bioheat).

7. How does biodiesel compare with renewable diesel and EVs?

While biodiesel is less compatible than renewable diesel, it's easier to produce from waste materials. Unlike EVs, it requires no infrastructure overhaul and reduces emissions immediately.

8. What role do technology advancements play in the biodiesel market?

Technologies like transesterification, HVO, and algae-based fuel enhance production efficiency, reduce costs, and enable broader adoption.

9. Who are the major players in the U.S. biodiesel industry?

Key players include Archer Daniels Midland, Neste, Renewable Energy Group, Shell, Wilmar, among others.

10. Can this report be customized?

Yes, we offer 20% free customization, including additional companies, country-specific analysis, market entry strategies, and trade data.