In today’s global economy, many businesses are turning to offshore accounting services to optimize costs, improve efficiency, and gain access to specialized financial talent. For CFOs, the decision to offshore accounting functions can offer significant advantages—but it also comes with challenges that must be carefully considered.

1. Understand the Scope of Offshore Accounting Services

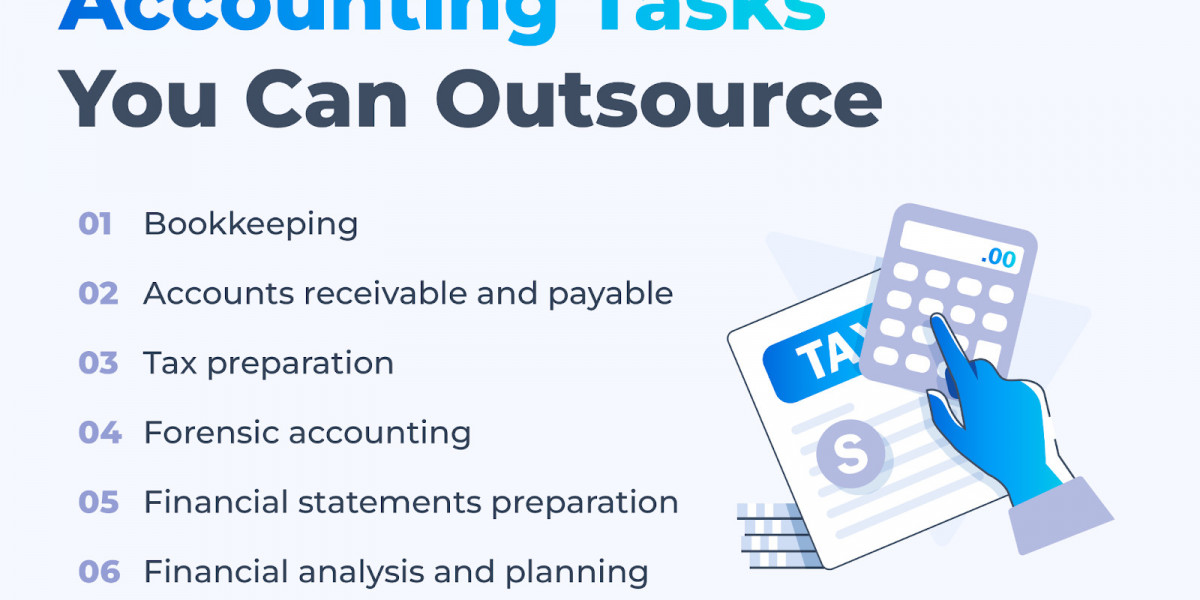

Offshore accounting services can cover a wide range of tasks, from basic bookkeeping to advanced financial reporting, tax compliance, and management accounting. Some of the most common services include:

Accounts payable and receivable management

General ledger maintenance

Bank reconciliations

Payroll processing

Tax preparation and compliance

Financial reporting and dashboards

Budgeting, forecasting, and analysis

CFOs should clearly define which processes they want to offshore. Not every task is suitable for offshoring, especially activities requiring frequent interaction with internal stakeholders or sensitive decision-making.

2. Evaluate Expertise and Industry Knowledge

A critical factor in choosing offshore accounting services is the level of expertise your team will bring. Generic outsourcing firms may have basic accounting skills, but they often lack experience in specialized software, regulatory requirements, or industry-specific workflows.

For example, companies using ERP platforms like NetSuite or SAP benefit from offshore accountants who are certified and experienced in those systems. Similarly, e-commerce businesses require offshore teams that understand multi-channel accounting, sales tax obligations, and marketplace reconciliation. The right offshore partner ensures financial data is accurate, timely, and actionable.

3. Prioritize Data Security and Compliance

Outsourcing accounting functions involves sharing sensitive financial and business information. CFOs must ensure their offshore partner has robust data security measures in place. This includes:

Secure cloud storage

Encrypted communication channels

Role-based access controls

Compliance with data protection regulations like GDPR or SOC 2

Additionally, the offshore provider should be well-versed in local and international accounting standards and tax compliance requirements to prevent errors or legal issues.

4. Communication and Time-Zone Considerations

Effective communication is vital when managing offshore accounting teams. Time-zone differences can create delays in reporting, approvals, or problem resolution if not managed proactively.

CFOs should consider:

Overlapping working hours for real-time collaboration

Clear reporting structures and escalation procedures

Regular video meetings or check-ins

Cloud-based project management and accounting tools

A transparent communication plan ensures that offshore accountants function as an extension of the in-house finance team, rather than as an isolated service.

5. Define Processes and Key Performance Indicators (KPIs)

To maximize the effectiveness of offshore accounting services, CFOs should establish clear processes and performance metrics from the outset. KPIs may include:

Accuracy of financial statements

Timeliness of month-end close

Number of reconciliations completed on time

Error rate in AP/AR transactions

Turnaround time for management reporting

By setting measurable expectations, CFOs can monitor performance and ensure that offshore accounting teams deliver consistent results.

6. Technology and Automation Integration

Modern offshore accounting services leverage automation and cloud-based tools to streamline workflows and reduce manual errors. CFOs should ensure their offshore partner can integrate seamlessly with existing ERP or accounting systems, providing real-time financial insights and reporting dashboards.

Automation benefits include:

Faster invoice processing and reconciliation

Improved accuracy in repetitive tasks

Real-time access to financial data

Scalability to handle growing transaction volumes

The combination of skilled offshore accountants and automation technology can significantly enhance operational efficiency.

7. Cost vs. Value Consideration

While cost savings is often the primary motivation for offshoring accounting, CFOs must consider the overall value, not just the price. Low-cost providers may compromise on expertise, communication, or reliability, which can lead to errors and inefficiencies.

High-quality offshore accounting services deliver a strong ROI by:

Reducing errors and rework

Accelerating month-end close

Providing accurate, timely financial insights

Freeing up in-house staff for strategic initiatives

CFOs should view offshoring as an investment in financial efficiency, not just a cost-cutting exercise.

8. Scalability and Long-Term Partnership

Business growth inevitably increases the volume and complexity of accounting tasks. Choosing an offshore partner with scalable resources ensures that your financial operations can grow without disruption.

Scalable offshore accounting services allow companies to:

Adjust team size based on seasonal or business cycle demands

Add specialized expertise as needed

Maintain continuity during employee turnover

Long-term partnerships also promote deeper understanding of business processes, reducing onboarding time and enhancing overall efficiency.

9. Cultural Fit and Work Ethic

Finally, CFOs should consider cultural alignment and work ethic when selecting an offshore accounting partner. Teams that understand your corporate values, priorities, and communication style are more likely to integrate smoothly with in-house finance staff.

Cultural fit influences:

Responsiveness to queries and issues

Commitment to deadlines and quality

Adaptability to company-specific workflows

A strong cultural fit fosters collaboration, trust, and higher performance.

Conclusion

Choosing offshore accounting services is a strategic decision that can transform a company’s finance function. For CFOs, the key is to look beyond cost savings and focus on expertise, reliability, compliance, and integration. By carefully evaluating providers, establishing clear processes, leveraging technology, and prioritizing communication, CFOs can harness the full potential of offshore accounting to streamline operations, improve accuracy, and support business growth.

Offshore accounting isn’t just an outsourcing solution—it’s a strategic partnership that strengthens the finance function, enables scalability, and provides the insights needed to make informed business decisions.