Market Overview:

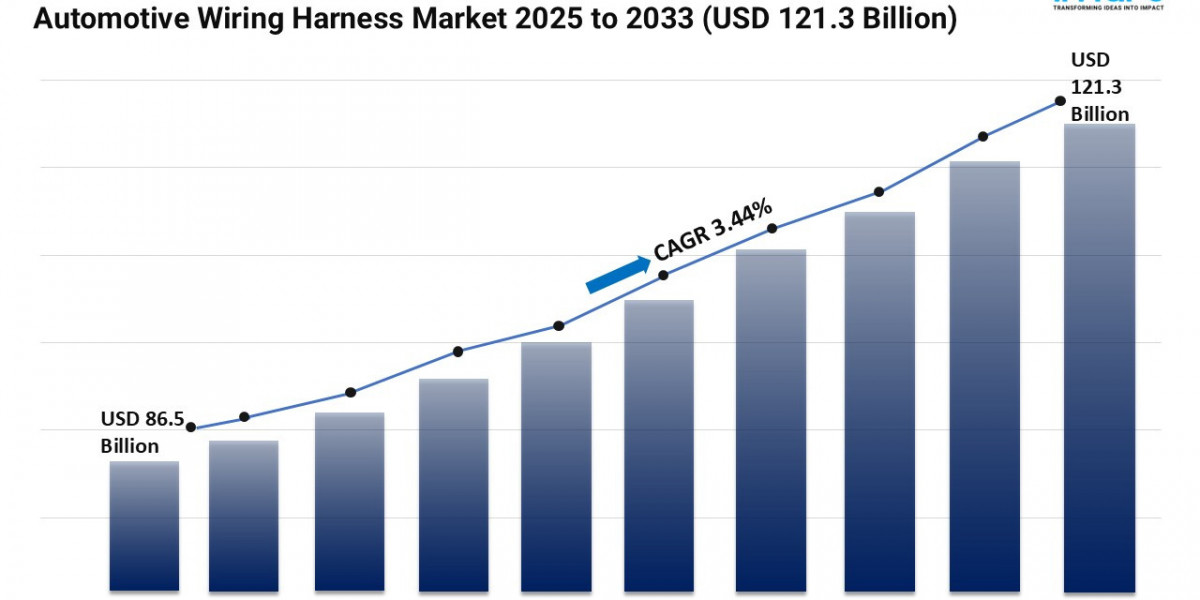

The automotive wiring harness market is experiencing rapid growth, driven by Electrification and E/E Architecture Adoption, Increasing Electronic Content and ADAS Integration and Supplier Consolidation and Localization. According to IMARC Group’s latest research publication, “Automotive Wiring Harness Market : Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global automotive wiring harness market size was valued at USD 86.5 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 121.3 Billion by 2033, exhibiting a CAGR of 3.44% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report https://www.imarcgroup.com/automotive-wiring-harness-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends And Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Automotive Wiring Harness Industry:

- Electrification and E/E Architecture Adoption

Developing E/E architectures to meet the challenges of electrification leads to increasing harness content, with more high-voltage cabling, connectors for battery management systems and sensor networks. Today's electrified powertrains include many dozens of high-voltage runs and new modular connections for batteries. Harness assemblies thus make up an important proportion of the expense and weight of a vehicle's electrical system: harness assemblies typically represent low double digit percentages of the bill of materials of a vehicle. With National EV incentives and fleet purchase quotas hastening platform launches and engineering changes, associated volumes to Harness OEMs Tier 1 suppliers are also rising. Major harness suppliers have a strong order book for high voltage and shielded harnesses. Production lines are being retooled to produce longer more complex assemblies per vehicle, increasing the per vehicle content and total industry volumes.

- Increasing Electronic Content and ADAS Integration

Advanced driver assistance systems, infotainment and connected services require networks of sensors, cameras, radar units, electronic control units (ECUs) and high speed data wiring. A mid-size passenger car with dozens of camera and sensor connections and several domain controllers means that such a harness would be heavily branched and the number of connectors, and thus shielding, may grow dramatically. More differentiable features (surround view cameras, USB ports and multi-zone climate controls) potentially increase average harness part counts, types of connectors and types of data links. This provides aftermarket service and warranty business for harness suppliers to diagnose and maintain more complex harnesses and data links.

- Supplier Consolidation and Localization

Tier 1 and Tier 2 suppliers are rationalizing their assembly capacity and investing in automated assembly, laser welding and modular plug-and-play unit components to meet OEM demands for better quality and shorter delivery times. They are also expanding capacity in major vehicle production markets to satisfy government localization policies and a preference for local sourcing. Automation brings variability of labor into a narrower range for complex builds, thus improving first pass yields, and allows suppliers to increase manufacturing run rates. The announced contract wins and capacity expansion plans at major harness manufacturers speak to the growing order books and the investments in inline test and traceability which increase throughput so that suppliers can convert major OEM programs to reliable volume production.

Key Trends in the Automotive Wiring Harness Market

- Modular, Pre-tested Harness Solutions for Faster Assembly

More and more OEMs are requiring modular harness assemblies and connectors to be delivered pre-tested and ready to be plugged together, thus shortening the final line build and guaranteeing quality. They would prefer zone based modules, such as; front module, cockpit module, rear module to long vehicle specific looms. Also, new factory layouts are increasingly proposing modular lines with pre-assembly stations and just-in-sequence delivery to minimize the risk of routing errors and provide shorter line cycle times. Modular harnesses allow a section within the entire loom assembly to be swapped out for repairs rather than the whole harness. As modular kits and digital traceability systems are implemented, suppliers win larger original equipment manufacturer contracts and warranty claims for electrical faults decline.

- Rise of Lightweight Materials and High-Voltage Insulation Innovation

Vehicle weight can be reduced by using finer gauge wire, thinner insulation, and redesigned high voltage wiring that maintains the electrical insulation quality. Another weight reduction technique is to use aluminum wiring on lower load circuits, new polymer wiring insulation, and optimized conductor cross sections to match resistivity and mechanical strength requirements. Improvements in insulation technology and reduced connector form factors may allow high voltage battery connections to be routed in a more safe and efficient manner, minimizing the weight of the vehicle and maximizing the range of electrified vehicles. This would mean potential for harness design to contribute further to vehicle energy efficiency, enabling original equipment manufacturers to design optimized vehicles.

- Integration of Diagnostics, Over-The-Air Readiness and Smart Connectors

Smart connectors and diagnostics are increasingly being added to harnesses, allowing features like over-the-air updates and domain controller replacement and fault isolation. Smart connectors may include sensing or encrypted pins to protect against software tampering or ECU physical tampering, and circuit monitoring may help localize faults during servicing. This reduces the time taken to diagnose a fault, and also enables remote diagnostics workflows for fleet customers, helping to increase uptime. Harness suppliers have also introduced traceability features such as serialized connectors and onboard test points which promise to help fault isolation and serviceability for large connected fleets and shared mobility operators.

Leading Companies Operating in the Global Automotive Wiring Harness Industry:

- Aptiv PLC

- Fujikura Ltd.

- Furukawa Electric Co., Ltd.

- Gebauer & Griller

- Lear Corporation

- Leoni AG

- Samvardhana Motherson International Ltd

- Spark Minda

- Sumitomo Electric Industries, Ltd.

- THB Group

- Yazaki Corporation

Automotive Wiring Harness Market Report Segmentation:

Analysis by Application:

- Body Wiring Harness

- Engine Wiring Harness

- Chassis Wiring Harness

- HVAC Wiring Harness

- Sensors Wiring Harness

- Others

Chassis wiring harnesses dominate (34.9% share) due to critical role in powering ABS, suspension, and steering systems, amplified by lightweight material adoption for fuel efficiency.

Analysis by Material Type:

- Copper

- Aluminum

- Others

Copper leads (86.2% share) for superior conductivity and recyclability, driven by EV demand for high-voltage systems and sustainability mandates.

Analysis by Transmission Type:

- Data Transmission

- Electrical Wiring

Electrical wiring holds 81.5% share as backbone for EVs and ADAS, supporting high-voltage power needs and smart connectivity integration.

Analysis by Vehicle Type:

- Two Wheelers

- Passenger Cars

- Commercial Vehicles

Passenger cars lead (52.2% share) via high production volumes, tech integration (ADAS, infotainment), and EV transition requiring complex harness architectures.

Analysis by Category:

- General Wires

- Heat Resistant Wires

- Shielded Wires

- Tubed Wires

General wires lead (40% share) for versatility in lighting/ignition systems, cost efficiency, and insulation advancements enhancing durability.

Analysis by Component:

- Connectors

- Wires

- Terminals

- Others

Wires dominate (42.2% share) as foundational elements for power/signal transmission, with innovations in aluminum alloys and heat-resistant materials.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia-Pacific leads (37%+ share) due to manufacturing hubs, EV incentives, and cost-efficient supply chains bolstered by rising middle-class demand.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1–201971–6302