IMARC Group has recently released a new research study titled “South Korea Wind Energy Market Report by Location of Deployment (Onshore, Offshore), and Region 2025-2033”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

South Korea Wind Energy Market Overview

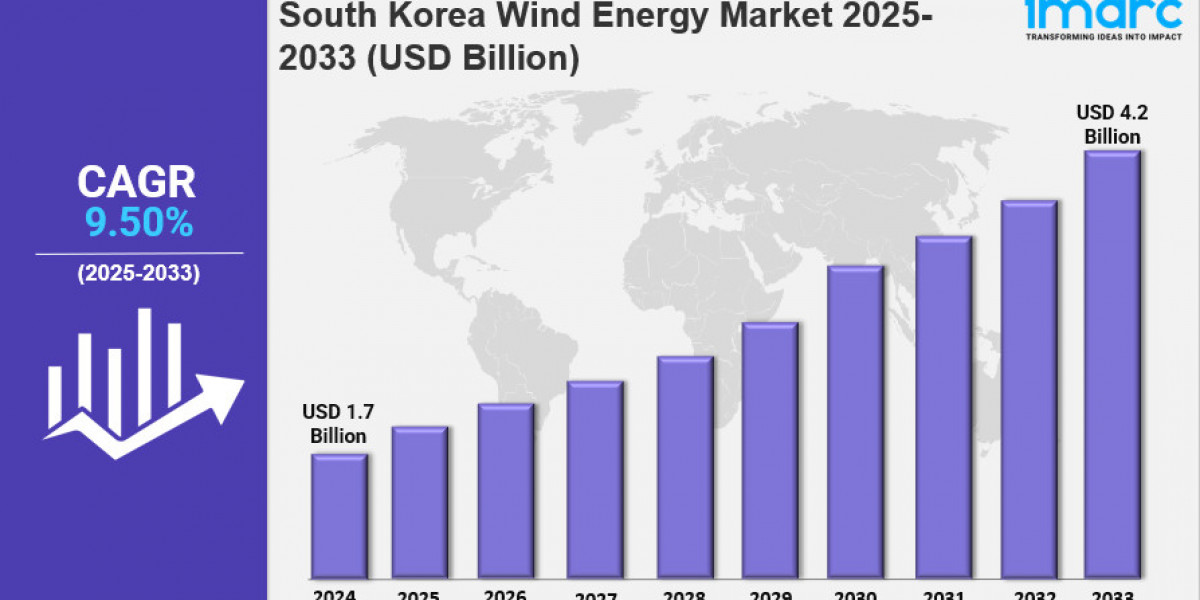

The South Korea Wind Energy Market size reached USD 1.7 Billion in 2024. IMARC Group projects the market to grow to USD 4.2 Billion by 2033, registering a CAGR of 9.50% over the forecast period 2025-2033. This growth is fueled by government emphasis on reducing greenhouse gas emissions and increasing wind projects, both onshore and offshore.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

South Korea Wind Energy Market Key Takeaways

- Current Market Size in 2024: USD 1.7 Billion

- CAGR for 2025-2033: 9.50%

- Forecast Period: 2025-2033

- The need for sustainable power sources to meet rising energy demands is a major driver.

- Onshore and offshore wind projects are increasing, significantly boosting market growth.

- South Korea’s geographic location and wide coastlines provide strong wind conditions, supporting market expansion.

- Social acceptance and energy security goals fuel the market in Seoul Capital Area and Yeongnam region.

- Advancements in wind turbine materials aid growth in Hoseo and other regions.

Sample Request Link: https://www.imarcgroup.com/south-korea-wind-energy-market/requestsample

Market Growth Factors

The growing need for sustainable energy sources to address rising national energy demands has become a critical driver for the South Korea wind energy market. With escalating concerns over environmental impact and greenhouse gas emissions, government initiatives increasingly favor renewable energy adoption. This demand shift supports the expansion of both onshore and offshore projects, which are being increasingly developed to diversify energy portfolios and reduce fossil fuel reliance.

South Korea's favorable geography, characterized by vast coastlines and consistent wind speeds, particularly in southwestern coastal areas, enables optimal conditions for wind energy projects. This geographic advantage is prompting significant investments in offshore developments, which offer steadier and stronger wind fluxes than onshore sites hindered by mountainous terrains. The government's strategic emphasis on offshore wind farms, often floating structures, highlights the sector's significant growth potential.

Private sector involvement has accelerated market expansion, with multinational corporations and domestic firms investing heavily in wind energy infrastructure as part of South Korea’s commitments to carbon neutrality by 2050. Partnerships, such as those between logistics companies and marine groups, facilitate specialized transport and installation solutions, enhancing project efficiency. Additionally, technical advancements in turbine materials and technology improve performance and scalability, further driving market growth.

Market Segmentation

Breakup by Location of Deployment:

- Onshore: South Korea's mountainous terrain limits onshore wind farm development. These projects face geographical constraints but are integral to the energy mix.

- Offshore: Offshore wind projects dominate growth potential, especially in southwestern coastal waters, due to stronger, more consistent winds. The government prioritizes large-scale offshore and floating wind farm deployments.

Breakup by Region:

- Seoul Capital Area: High population density drives demand for renewable energy solutions, boosting market growth.

- Yeongnam (Southeastern Region): An industrial hub with favorable coastal wind conditions, fostering offshore wind energy development.

- Honam (Southwestern Region): Increasing public awareness and energy security initiatives stimulate the wind energy market.

- Hoseo (Central Region): Moderate wind potential, augmented by advancements in turbine materials, despite land-use competition.

- Others: Includes islands and less populated coastal areas with strong offshore wind prospects contributing to national renewable goals.

Regional Insights

The Seoul Capital Area emerges as a dominant region in South Korea's wind energy market due to its high population density and social acceptance of renewable energy. This urban concentration, combined with governmental energy security goals, stimulates significant market demand. Similarly, Yeongnam in the southeastern region supports offshore wind projects, leveraging its coastal geography. These factors collectively reinforce the regional market growth dynamics.

Recent Developments & News

In September 2024, EDF Renewables acquired Shell’s entire stake in West Sea Energy, pursuing an offshore wind project in southwestern South Korea with a planned capacity of up to 1.5 GW. Also in September 2024, Mammoet, a Netherlands-based logistics company, partnered with Samyang Marine Group to provide transport solutions for offshore wind installations. Earlier in March 2024, Vestas secured a 77 MW order from GS E&R for the YD1 wind farm in Gyeongsang-do, involving installation oversight of 18 V136-4.2 MW turbines operated at 4.3 MW capacity. These developments highlight increasing investment and infrastructure expansion in the sector.

Key Players

- EDF Renewables

- Shell (stake acquired by EDF Renewables)

- Mammoet

- Samyang Marine Group

- Vestas

- GS E&R

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302