IMARC Group has recently released a new research study titled “South Korea Alcoholic Beverages Market Report by Product Type (Beer, Wine, Spirits, and Others), Alcoholic Content (High, Medium, Low), Flavour (Unflavored, Flavored), Packaging Type (Glass Bottles, Tins, Plastic Bottles, and Others), Distribution Channel (Hypermarkets and Supermarkets, Convenience Stores, Speciality Stores, Department Stores, and Others), and Region 2025-2033”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

South Korea Alcoholic Beverages Market Overview

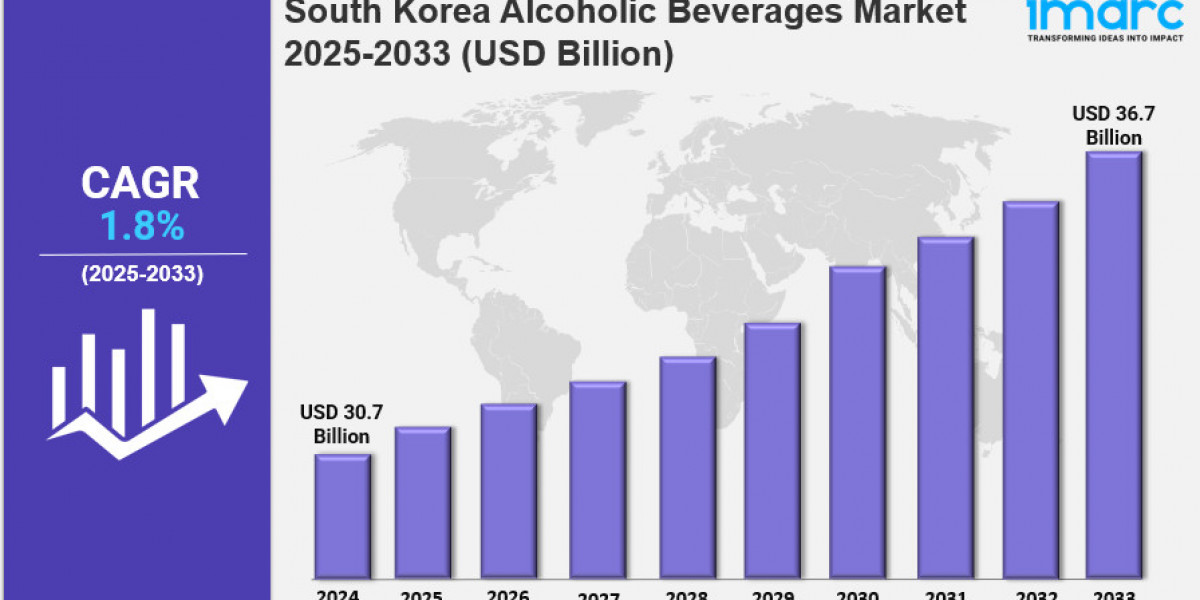

The South Korea Alcoholic Beverages Market size reached a size of USD 30.7 Billion in 2024 and is projected to grow to USD 36.7 Billion by 2033. The market is expected to expand at a CAGR of 1.8% during the forecast period of 2025-2033. Growth is driven by rising disposable incomes, an expanding social drinking culture, and innovative products such as flavored soju and craft beers.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

South Korea Alcoholic Beverages Market Key Takeaways

- Current Market Size: USD 30.7 Billion (2024)

- CAGR: 1.8% (2025-2033)

- Forecast Period: 2025-2033

- Rising disposable incomes are boosting demand for premium and imported alcoholic beverages.

- Expanding social drinking culture and vibrant nightlife significantly contribute to market growth.

- The rise of e-commerce platforms facilitates consumer access to a diverse alcoholic products range.

- Innovative products like flavored soju and craft beers are attracting broader consumer interest.

- High competition in the soju segment and health awareness are challenging market growth.

Sample Request Link: https://www.imarcgroup.com/south-korea-alcoholic-beverages-market/requestsample

Trends in the South Korea Alcoholic Beverages Market

Shift Towards Premium and Craft Products

The South Korea alcoholic beverages market is experiencing a notable shift towards premium and craft products as consumers seek higher quality and unique flavors. This trend is driven by a growing interest in artisanal and locally produced beverages, particularly in the beer and spirits segments. As consumers become more discerning, they are willing to pay a premium for craft beers, small-batch spirits, and innovative wine selections. This shift is significantly contributing to the South Korea alcoholic beverages market size, as premium products capture a larger share of consumer spending. The demand for authenticity and craftsmanship is reshaping the landscape of the alcoholic beverages market in South Korea.

Rise of Health-Conscious Drinking Trends

Another important trend influencing the South Korea alcoholic beverages market is the rise of health-conscious drinking trends. As consumers become more aware of health and wellness, there is a growing demand for low-alcohol, low-calorie, and organic alcoholic beverages. This shift is impacting the South Korea alcoholic beverages market share, as brands that offer healthier options are gaining popularity among health-conscious consumers. The introduction of low-alcohol cocktails and organic wines reflects this trend, catering to individuals who want to enjoy social drinking without compromising their health goals. As this trend continues to evolve, it is expected to drive further innovation in the market.

Growth of E-Commerce and Online Sales

The growth of e-commerce is transforming the South Korea alcoholic beverages market, providing consumers with greater access to a wide range of products. With the increasing penetration of smartphones and online shopping platforms, consumers are turning to digital channels to purchase their favorite alcoholic beverages. This trend is significantly contributing to the South Korea alcoholic beverages market growth, as traditional retailers adapt to the changing landscape by enhancing their online presence. The convenience of online shopping, combined with targeted marketing strategies, allows brands to reach a broader audience and cater to diverse consumer preferences, further fueling market expansion.

Influence of Social Media and Influencer Marketing

The influence of social media and influencer marketing is playing a crucial role in shaping the South Korea alcoholic beverages market. Brands are leveraging social media platforms to engage with consumers, promote new products, and share lifestyle content that resonates with their target audience. This trend is enhancing brand visibility and driving consumer interest in various alcoholic beverages, ultimately impacting the South Korea alcoholic beverages market size. Influencer partnerships and creative digital campaigns are becoming essential tools for brands to connect with younger consumers, fostering a sense of community around their products. As social media continues to shape consumer behavior, its impact on the alcoholic beverages market is expected to grow, driving trends and preferences in the industry.

Market Segmentation

Breakup by Product Type:

- Beer: The rise in craft beer culture drives demand for artisanal beers with diverse flavors, fostering local craft breweries and specialty imports.

- Wine: Increased disposable incomes stimulate spending on premium and imported wines, fuelling market growth.

- Spirits: Demand for premium and imported spirits like whiskey, vodka, and rum is rising, attracting affluent consumers seeking quality and brand prestige.

Breakup by Alcoholic Content:

- High: Premium and imported high-alcohol spirits are linked to quality and status, driving the demand for high-end products.

- Medium: Moderate alcohol beverages like wine and standard-strength beers are favored by health-conscious consumers and perceived to have health benefits.

- Low: There is a growing trend towards low-alcohol and non-alcoholic options, catering to calorie-conscious consumers.

Breakup by Flavor:

- Unflavoured: Traditional beverages like soju and beer have strong cultural roots; unflavoured spirits such as vodka and whiskey are versatile and popular in cocktails.

- Flavoured: Flavoured alcoholic beverages offer novel tastes and experiences, appealing to consumers seeking variety and aligning with health-conscious trends.

Breakup by Packaging Type:

- Glass Bottles: Associated with premium products like wines, spirits, and craft beers where presentation and perceived value are key.

- Tins: Lightweight, durable, portable, and convenient for on-the-go consumption especially at outdoor events and casual settings.

- Plastic Bottles: Cost-effective packaging option, often cheaper than glass, allowing potential consumer cost savings.

- Others: Not provided in source.

Breakup by Distribution Channel:

- Hypermarkets and Supermarkets: Provide a broad range of alcoholic beverages for diverse preferences and bulk purchases.

- Convenience Stores: Cater to consumers seeking quick and easy access for on-the-go purchases.

- Speciality Stores: Curated selection of high-quality, unique, and premium alcoholic beverages, offering expert recommendations.

- Department Stores: Carry high-end and luxury beverages, attracting consumers seeking premium gifts or indulgences.

- Others: Not provided in source.

Breakup by Region:

- Seoul Capital Area: Large and diverse population with varied preferences drives demand for craft beers, premium spirits, and imported wines.

- Yeongnam (Southeastern Region): Strong tradition of soju and beer consumption with steady demand for traditional beverages.

- Honam (Southwestern Region): Local traditions favor traditional Korean alcoholic beverages like soju and makgeolli consumed in social and family settings.

Ask For an Analyst- https://www.imarcgroup.com/request?type=report&id=21673&flag=C

Regional Insights

The Seoul Capital Area dominates the South Korea alcoholic beverages market, driven by its large and diverse population with varied consumer preferences. This region exhibits significant demand for craft beers, premium spirits, and imported wines. The high-income population and strong consumer spending power support the growth of premium and craft beverage segments, making Seoul a key market contributor.

Recent Developments & News

In February 2024, Chuu, a former LOONA member and Korean soloist, launched a new canned beverage named 'Chuu-HI' available at liquor stores across South Korea, composed of diluted soju, carbonated water, and fruit juice. Also, in the same month, a South Korean balladeer introduced "Kyungtakju," a Korean rice wine under the new liquor brand Kyung, featuring a 12% alcohol content. In November 2023, Lotte Chilsung Beverage Co. unveiled Chum Churum X Pine Eye, a new ready-to-drink highball based on soju, combining Chum Churum soju with Pine Eye extract in a 500-milliliter canned beverage.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302