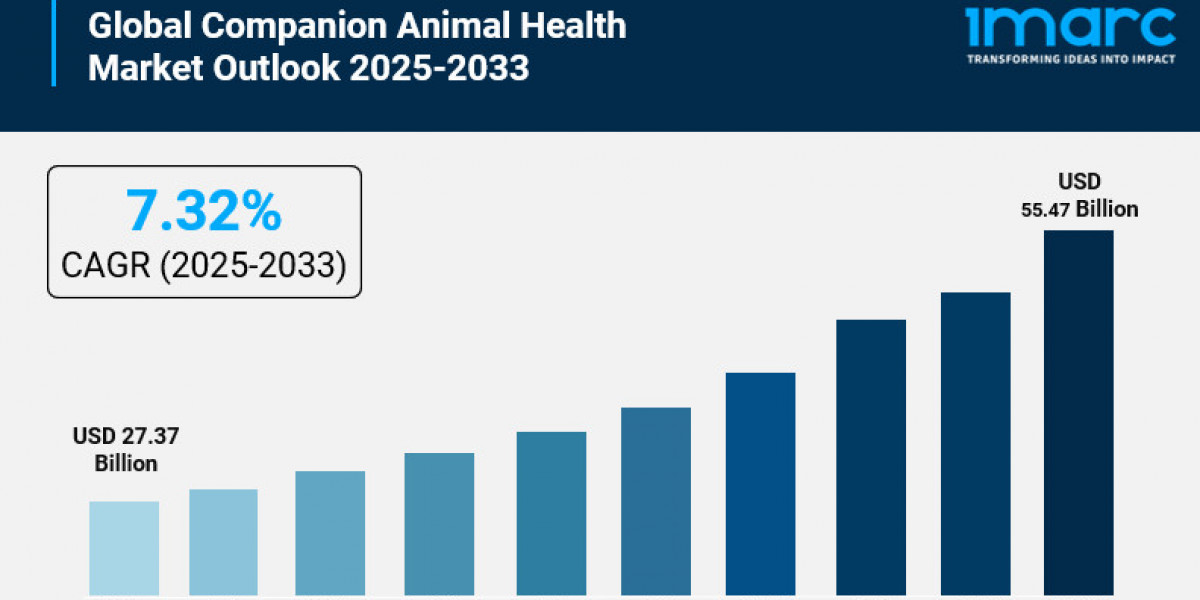

The global companion animal health market Size was valued at USD 27.37 Billion in 2024 and is projected to grow to USD 55.47 Billion by 2033, reflecting a CAGR of 7.32% during the forecast period of 2025-2033. Market growth is driven by increasing pet ownership rates worldwide, advancements in veterinary healthcare, and heightened awareness of zoonotic diseases.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

Companion Animal Health Market Key Takeaways

- Current Market Size: USD 27.37 Billion in 2024

- CAGR: 7.32%

- Forecast Period: 2025-2033

- North America holds the dominant market share with over 47.8% in 2024.

- Rising pet ownership globally, driven by urban adoption and emotional companionship, significantly contributes to market expansion.

- The increase in veterinary healthcare advancements including diagnostics, therapeutics, and preventive care supports market growth.

- Growing awareness and focus on zoonotic diseases bolster demand for vaccines and preventive therapies.

- Expansion of pet insurance and digital/telemedicine services improve accessibility and affordability of pet healthcare.

Request for a Free Sample Report: https://www.imarcgroup.com/companion-animal-health-market/requestsample

Market Growth Factors

Rising Pet Ownership and Humanization of Pets

An important factor that contributes to the growth of the companion animal health market is the worldwide rise in pet populations, especially in city households. The increasing trend of pet adoptions is mainly influenced by the transformation of social dynamics, the rise of disposable incomes, and the growing need for emotional companionship. Since owners are treating pets as children of the family, they are willing to spend on premium healthcare services, preventive care, and advanced medical treatments. This trend is also very favorable to demand in veterinary diagnostics, pharmaceuticals, and wellness products.

Advancements in Veterinary Healthcare and Technologies

The market growth is extremely supported by continuous innovations in veterinary healthcare. This includes the introduction of new vaccines, pharmaceuticals, and diagnostic devices that in turn lead to the efficient treatment of animal diseases. Besides, technological advances like telemedicine and mobile health apps improve service accessibility and quality. For instance, Florida's 2024 law allowing veterinarians to keep the Veterinary-Client-Patient Relationship (VCPR) via telemedicine is an example of regulation supporting such innovations.

Heightened Focus on Zoonotic Diseases

A major factor behind this market is the gradually increasing awareness of zoonotic diseases - diseases that are transmitted from animals to humans. According to WHO, 60% of the new infectious diseases worldwide are zoonoses, and 75% of the newly identified human pathogens are of animal origin. Such understanding is stimulating the investments in R&D for vaccines and therapies targeting zoonotic pathogens. Moreover, regulatory frameworks and animal health agencies everywhere are implementing restrictive norms that encourage the spread of preventive measures hence the companion animal health market is getting expanded.

Market Segmentation

By Animal Type:

- Dogs: Hold the largest share at 51.7%. Dogs are the most commonly kept pets worldwide, with strong emotional bonds driving expenditures on healthcare, nutrition, and wellness products. Owners increasingly seek preventive and advanced treatments, enhancing demand for pharmaceuticals and specialized diets.

- Cats

- Equine

- Others

By Product:

- Vaccines: Preventive against infectious diseases; market growth driven by vaccine technological advances like recombinant and DNA vaccines and strict vaccination legislations.

- Pharmaceuticals: Represent the largest market portion encompassing anti-infectives, anti-inflammatories, and chronic disease treatments; growth fueled by innovation and increased pet insurance adoption.

- Feed Additives: Includes vitamins, minerals, amino acids, and probiotics aiming to improve pet nutrition and health. Demand is propelled by awareness of nutrition’s role in animal health and emerging specialized additives.

- Diagnostics: Encompasses blood tests, imaging, and molecular diagnostics. Growth supported by technological advancements making diagnostics accessible and affordable, aided by telemedicine innovation.

- Others

By End User:

- Point-of-Care Testing/In-House Testing

- Veterinary Hospitals and Clinics: Account for 79.8% market share. These facilities provide comprehensive veterinary care including surgeries and urgent care, supported by skilled staff and advanced medical technologies.

- Others

Regional Insights

In 2024, North America was the leader with a market share of more than 47.8%. This position of dominance is attributed to the high rates of pet ownership, extraordinary expenditure on veterinary care, and a well-advanced infrastructure for veterinary medicine. The region is advantaged by R&D investments, adoption of pet humanization trends, and pet insurance uptake. These factors work together to keep North America at the forefront of the companion animal health market.

Recent Developments & News

In December 2024, Virbac took over the Turkish company Mopsan, thus reinforcing its position in the pet food and companion animal health products sector where a total of 47 employees are dedicated to this segment. Before that in August 2024, Boehringer Ingelheim India had set up a strategic distribution relationship with Vvaan Lifesciences for their Pet Parasiticide Range as a part of India's Animal Health Accelerated Growth Plan. In February 2024, Tata Trusts inaugurated India's first large-scale animal hospital with over 200 beds in Mumbai. Apart from that, in January 2025, Love Pet Health Care opened a flagship veterinary hospital in Chicago to provide comprehensive pet healthcare.

Key Players

- Agrolabo S.p.A.

- Boehringer Ingelheim International GmbH

- Ceva Sante Animale

- Dechra

- Elanco

- Greencross Vets

- IDEXX Laboratories, Inc.

- Indian Immunologicals Ltd.

- Norbrook

- Vetoquinol

- Virbac

- Zoetis Services LLC

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302