GCC Chocolate Market Overview

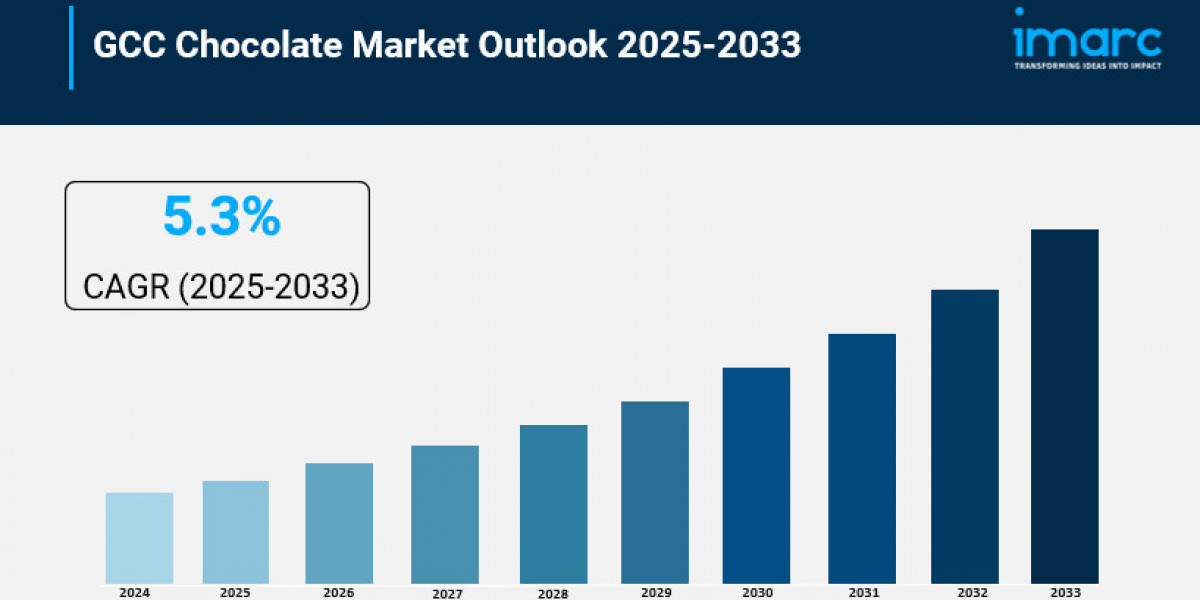

Market Growth Rate 2025-2033: 5.3%

According to IMARC Group's latest research publication, "GCC Chocolate Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", the GCC chocolate market size is projected to exhibit a growth rate (CAGR) of 5.3% during 2025-2033.

How AI is Reshaping the Future of GCC Chocolate Market

- AI-Personalized Flavor Profiles: AI platforms at Mars GCC analyze consumer taste data to create custom chocolate blends, boosting sales by 25% for premium bars in UAE's luxury retail amid Vision 2030's digital push.

- Predictive Supply Chain Optimization: Machine learning forecasts cocoa demand in Saudi Arabia, reducing waste by 20% and ensuring halal-compliant supply for seasonal Ramadan collections.

- Automated Quality Control: Computer vision inspects production lines in Qatar factories, minimizing defects by 15% and maintaining high standards for artisanal truffles in the $1.5 billion market.

- Sustainable Ingredient Sourcing: AI models eco-friendly cocoa alternatives, cutting emissions by 18% and aligning with UAE’s Green Agenda for plant-based chocolate innovations.

- Dynamic Marketing Analytics: AI-driven apps on Noon suggest personalized chocolate gifts, increasing e-commerce conversions by 30% among urban GCC consumers.

Download a sample PDF of this report: https://www.imarcgroup.com/gcc-chocolate-market/requestsample

GCC Chocolate Market Trends & Drivers

The surge in health-conscious consumerism across the GCC is propelling demand for dark chocolate variants, rich in antioxidants and lower in sugar, as consumers prioritize wellness amid rising lifestyle diseases. With heightened awareness fueled by social media and wellness campaigns, the dark chocolate segment is outpacing traditional milk chocolate, boasting a projected CAGR of over 7% through 2033, driven by innovations like low-sugar and plant-based options that cater to diabetic-friendly and vegan preferences in urban centers like Dubai and Riyadh.

Economic prosperity and increasing disposable incomes in oil-rich nations are fueling premiumization, where affluent GCC households splurge on luxury chocolates as status symbols and gifting staples during festivals like Eid. This trend is amplified by tourism booms, with expatriates and visitors introducing global flavors, pushing the premium segment toward a 6.6% annual growth rate and transforming retail landscapes with high-end boutiques and experiential stores that emphasize artisanal craftsmanship and exotic ingredients.

E-commerce expansion and digital adoption are key drivers reshaping distribution channels, with platforms like Amazon.ae and Noon enabling seamless access to diverse chocolate assortments and subscription models. Coupled with influencer marketing and AR try-before-buy features, this digital shift is accelerating market penetration in remote areas, contributing to a 4-5% overall CAGR while reducing reliance on traditional hypermarkets and empowering smaller brands to compete on a level playing field.

GCC Chocolate Industry Segmentation:

The report has segmented the market into the following categories:

Product Type Insights:

- White Chocolate

- Milk Chocolate

- Dark Chocolate

- Others

Product Form Insights:

- Molded

- Countlines

- Others

Application Insights:

- Food Products

- Bakery Products

- Sugar Confectionery

- Desserts

- Others

- Beverages

- Others

Pricing Insights:

- Everyday Chocolate

- Premium Chocolate

- Seasonal Chocolate

Distribution Insights:

- Direct Sales (B2B)

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

Country Insights:

- Saudi Arabia

- UAE

- Qatar

- Bahrain

- Kuwait

- Oman

Competitive Landscape:

The competitive landscape of the industry has also been examined, along with the profiles of the key players.

Recent News and Developments in the GCC Chocolate Market

- September 2025: Patchi opens an AI-customized chocolate boutique in Dubai Mall, allowing customers to design flavors via app and reporting a 20% sales increase during launch week.

- July 2025: Mars GCC launches a sustainable cocoa initiative in Riyadh, partnering with local farms for organic beans and boosting premium bar supply by 15% for Ramadan.

- May 2025: UAE Ministry of Economy funds a $20 million chocolate innovation lab in Abu Dhabi, focusing on AI for low-sugar recipes and creating 100 jobs.

- April 2025: Godiva introduces halal-certified truffle collections in Qatar malls, using AI marketing to drive a 25% rise in luxury gift sales ahead of Eid.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302