Market Overview

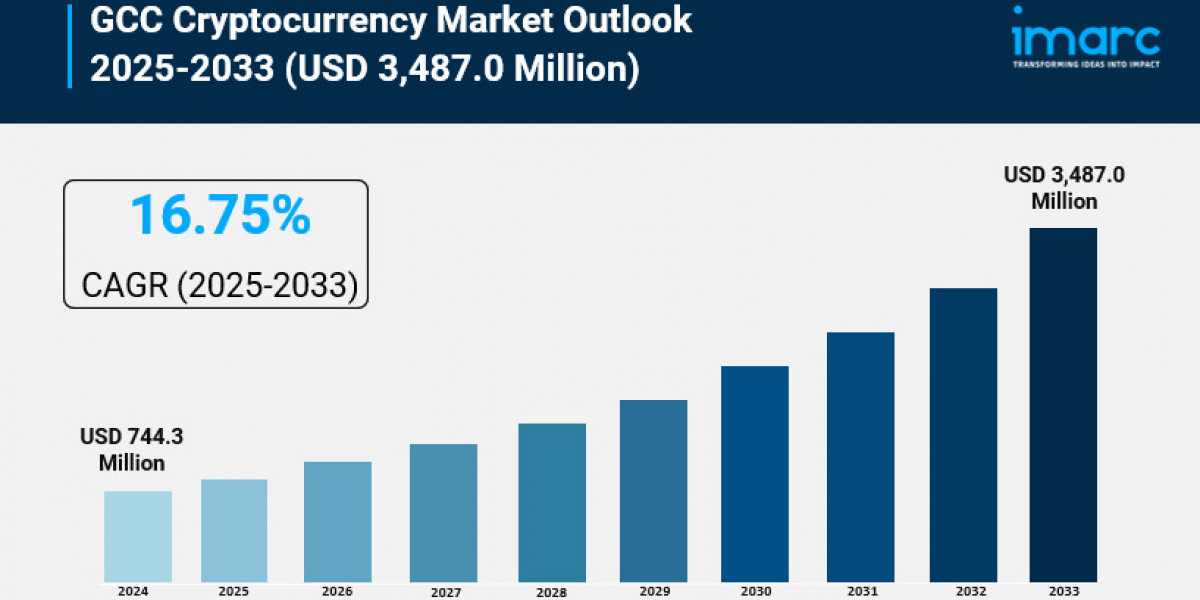

The GCC cryptocurrency market size was valued at USD 744.3 Million in 2024 and is forecasted to reach USD 3,487.0 Million by 2033. The market is poised for significant expansion during the forecast period 2025-2033, growing at a compound annual growth rate of 16.75%. Key drivers include increasing digital transformation initiatives, government blockchain projects, and a growing embrace of decentralized finance. Robust internet penetration and a tech-savvy population are aiding the GCC's emergence as a hub for cryptocurrency and blockchain technology.

How AI is Reshaping the Future of GCC Cryptocurrency Market:

- AI-powered algorithms enhance security and fraud detection in cryptocurrency transactions, increasing trust and adoption in the GCC.

- Governments in the GCC are deploying AI to improve regulatory compliance and streamline blockchain integration, facilitating smoother market operations.

- AI assists in optimizing mining hardware and software, improving efficiency and reducing operational costs within the GCC cryptocurrency mining sector.

- Machine learning-driven analytics empower traders and investors with better market prediction and risk assessment tools, expanding institutional involvement.

- Partnerships like Ripple's collaboration with DIFC Innovation Hub leverage AI to support fintech startups, boosting innovation and blockchain adoption in the region.

- AI supports scalable and privacy-focused blockchain solutions, exemplified by Aleph Zero's Sharia-certified offerings, enhancing product alignment with regional principles.

Grab a sample PDF of this report: https://www.imarcgroup.com/gcc-cryptocurrency-market/requestsample

Market Growth Factors

The proactive integration of blockchain technology across financial and non-financial sectors in the GCC is a major growth driver. Governments promote transparency and efficiency through blockchain strategies, enhancing confidence in cryptocurrency. For instance, Saudi Arabia reports an internet penetration rate of 99.0% and active mobile connections exceeding its population by 134.1%, providing a solid digital foundation. These infrastructure strengths accelerate adoption and usage of digital currencies across the region.

Economic diversification initiatives reduce GCC countries’ reliance on oil by investing in emerging technologies, including cryptocurrencies. The rise of decentralized finance platforms and blockchain partnerships with financial institutions fosters a nurturing ecosystem. An example is Aleph Zero's partnership with Shariyah Review Bureau for Sharia-compliant blockchain solutions, boosting regional trust and market participation.

Regulatory advancements are establishing safer, balanced environments encouraging institutional investment and global exchange operations. The UAE's Virtual Assets Regulatory Authority licenses crypto service providers like Binance, enhancing market credibility. Furthermore, BitOasis's expansion into Bahrain with a Crypto Asset Services License highlights the growing institutional interest and regulatory readiness fueling market growth.

Market Segmentation

Analysis by Type:

- Bitcoin

- Ethereum

- Bitcoin Cash

- Ripple

- Litecoin

- Dashcoin

- Others

Analysis by Component:

- Hardware

- Software

Analysis by Process:

- Mining

- Transaction

Analysis by Application:

- Trading

- Remittance

- Payment

- Others

Country Analysis:

- Saudi Arabia

- UAE

- Qatar

- Bahrain

- Kuwait

- Oman

Key Players

- Aleph Zero

- Binance

- BitOasis

- Crypto.com

- Ripple

Recent Developement & News

- October 2025: The National Bank of Bahrain launched the Gulf's first Bitcoin-linked structured product with ARP Digital, targeting accredited investors and combining digital asset appeal with downside protection, enhancing cryptocurrency investment security.

- August 2025: Bybit expanded its partnership with Dubai Multi Commodities Center, acting as an advisory partner to 20+ startups and organizing industry events, which boosts Dubai’s status as a global crypto hub.

- December 2025: Crypto.com announced a partnership with Mastercard to roll out prepaid crypto cards in GCC starting with Bahrain, offering users up to 8% rewards and improving crypto-to-fiat transaction accessibility.

Customization Note:

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302