Market Overview:

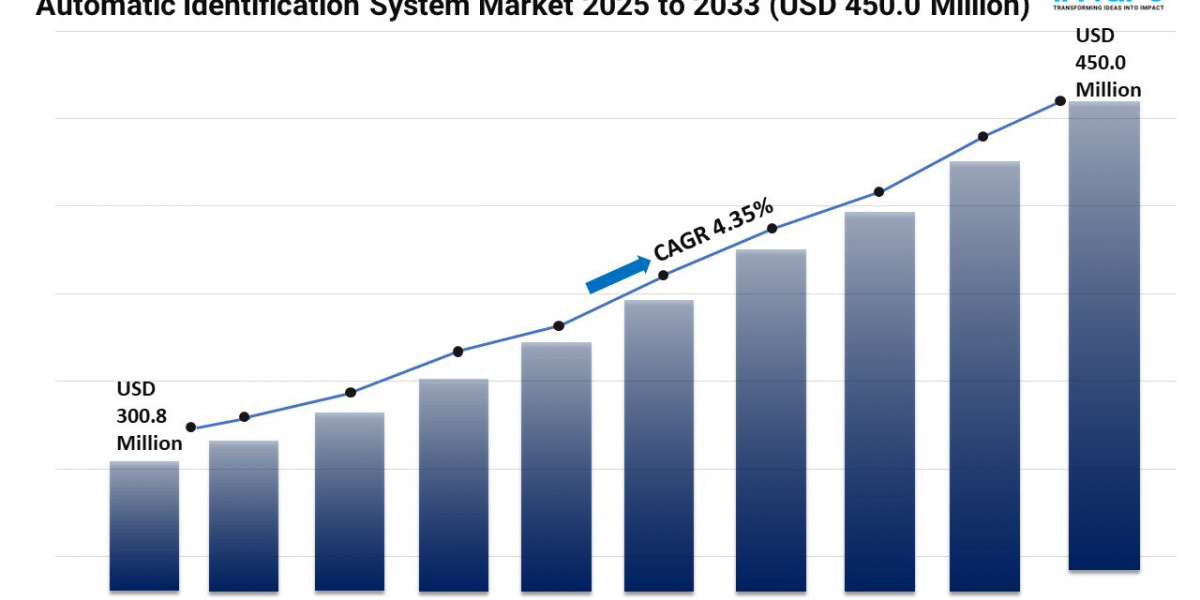

The Automatic Identification System Market is experiencing steady expansion, driven by Mandatory Regulatory Requirements, Collision Avoidance and Navigation Enhancement and Growing Maritime Trade. According to IMARC Group's latest research publication, "Automatic Identification System Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025–2033", The global automatic identification system market size reached USD 300.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 450.0 Million by 2033, exhibiting a growth rate (CAGR) of 4.35% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/automatic-identification-system-market/requestsample

Our Report Includes:

- Market Dynamics

- Market Trends and Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Automatic Identification System Industry:

- Mandatory Regulatory Requirements

The International Maritime Organization (IMO) remains the primary catalyst for AIS adoption, with 2025 marking a significant tightening of enforcement protocols under SOLAS Chapter V. Beyond the standard mandate for vessels over 300 gross tonnage, new 2025 amendments focus on "Digital Credentialing," requiring AIS to be integrated with electronic certificates to streamline Port State Control inspections. Furthermore, the European Union's FuelEU Maritime and the IMO’s new Net-Zero Framework have turned AIS from a safety tool into a critical compliance monitor. Vessels must now use AIS data to verify their "well-to-wake" greenhouse gas fuel intensity, making Type-approved Class A AIS transponders a mandatory requirement for any ship wishing to prove its carbon-intensity indicators (CII) and avoid heavy environmental levies.

- Collision Avoidance and Navigation Enhancement

In 2025, AIS has become the primary data feed for Intelligent Navigation Systems that utilize computer vision and machine learning. As shipping lanes become more congested due to a 12-billion-ton surge in global trade, AIS provides the real-time telemetry needed for "Predictive Anti-Collision" algorithms. These systems do not just alert crews to a nearby vessel; they calculate the probability of a "Close Quarters Situation" based on current sea states and traffic density. The rise of autonomous shipping trials in 2025 has further prioritized AIS, as these uncrewed vessels rely on high-fidelity AIS signals to "handshake" with traditional ships, ensuring safe passage through complex choke points like the Malacca Strait or the English Channel.

- Growing Maritime Trade and Port Performance

The expansion of global trade is driving a massive demand for AIS-driven Port Performance Optimization. In 2025, port authorities in hubs like Singapore and Rotterdam use AIS data to calculate "Vessel Dwell Time" with precision, allowing them to coordinate berthing schedules and reduce unnecessary loitering at anchorage. This "Just-In-Time" arrival model, powered by AIS, significantly lowers fuel consumption and port congestion. As maritime logistics becomes increasingly "Dark Store" and "E-commerce" focused, the ability to track a cargo's exact arrival time via AIS is now an essential service for supply chain managers, fueling the demand for shore-based AIS infrastructure and advanced data-subscription services.

Key Trends in the Automatic Identification System Market

- Integration of Satellite AIS and LEO Constellations

A defining trend of 2025 is the dominance of Satellite-based AIS (S-AIS), which has solved the "line-of-sight" limitations of terrestrial towers. The market is witnessing the deployment of hundreds of microsatellites into Low Earth Orbit (LEO) by companies like Spire and ORBCOMM, providing near-real-time global tracking even in the middle of the Pacific or the Arctic. This capability is essential for the 2025 "Blue Economy," enabling authorities to monitor remote Marine Protected Areas and combat Illegal, Unreported, and Unregulated (IUU) fishing. The transition to VDES (VHF Data Exchange System)—the next generation of AIS—is also gaining momentum, offering higher bandwidth for transmitting weather maps and ice charts directly to vessels via satellite links.

- Development of Big Data Analytics and "Maritime AI"

The 2025 AIS market is shifting its value from hardware to Behavioral Intelligence. Advanced platforms now ingest vast streams of AIS data to identify "Dark Flows"—vessels that turn off their transponders to engage in illicit activities. By layering AIS tracks with Synthetic Aperture Radar (SAR) and Radio Frequency (RF) detections, AI systems can spot location spoofing and "ghosting" in real-time. This trend is heavily driven by the surge in global sanctions, where financial institutions and insurers use AIS-derived "Risk Scoring" to ensure they are not inadvertently facilitating trade with blacklisted entities. This "Maritime AI" has effectively turned AIS into a global transparency tool for the finance and security sectors.

- Enhanced Maritime Domain Awareness and Multi-Sensor Fusion

In 2025, AIS is no longer a standalone system; it is the core of Multi-Sensor Data Fusion. Modern Maritime Domain Awareness (MDA) platforms integrate AIS feeds with thermal night-vision cameras, side-scan sonar, and drone surveillance to create a 360-degree security bubble around ports and offshore energy assets. A key sub-trend is the new 2025 regulation on Class M AIS-MOB (Man Overboard) devices, which now require integrated Digital Selective Calling (DSC). These smart beacons allow a fallen crew member to be tracked instantly by any nearby AIS-equipped vessel, drastically improving the success rate of Search and Rescue (SAR) missions. This convergence of tracking, security, and environmental monitoring is making AIS an essential component of the "Resilient Sea" strategy for 2025.

We explore the factors driving the growth of the market, including technological advancements, consumer behaviors, and regulatory changes, along with emerging automatic identification system market trends.

Leading Companies Operating in the Global Automatic Identification System Industry:

- CNS Systems

- Comar Systems Ltd.

- ComNav

- Furuno Maritime Training

- Hodges Marine

- Orbcomm

- Raymarine

- Saab AB

- Spire Global

- SRT Marine

Automatic Identification System Market Report Segmentation:

Breakup by Class:

- Class A

- Class B

- AIS Base Stations

Class A dominates the market as these devices offer higher performance, accuracy, and reporting frequency, and are mandated by regulatory bodies like the IMO for vessels exceeding certain tonnage.

Breakup by Component:

- Transmitter

- Receivers

- Central Processing Unit

- Display

- Others

Transmitters hold the largest share as they are at the core of AIS systems, responsible for broadcasting real-time data such as vessel identity, position, course, and speed to nearby vessels and coastal stations.

Breakup by Platform:

- Vessel-Based

- Onshore-Based

Vessel-based accounts for the majority of market share as these systems are directly integrated into individual ships, providing real-time data transmission, collision avoidance, and navigation enhancement.

Breakup by Application:

- Fleet Management

- Vessels Tracking

- Maritime Security

- Others

Vessels tracking holds the largest share as this application allows maritime authorities, ship operators, and coastal stations to monitor vessel movements, ensuring safe navigation and preventing potential accidents in congested waters.

Breakup by Region:

- North America (United States, Canada)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America exhibits clear dominance driven by extensive maritime activities, well-established maritime infrastructure, advanced technological capabilities, and stringent regulations imposed by organizations like the United States Coast Guard (USCG).

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1–201971–6302