Market Overview:

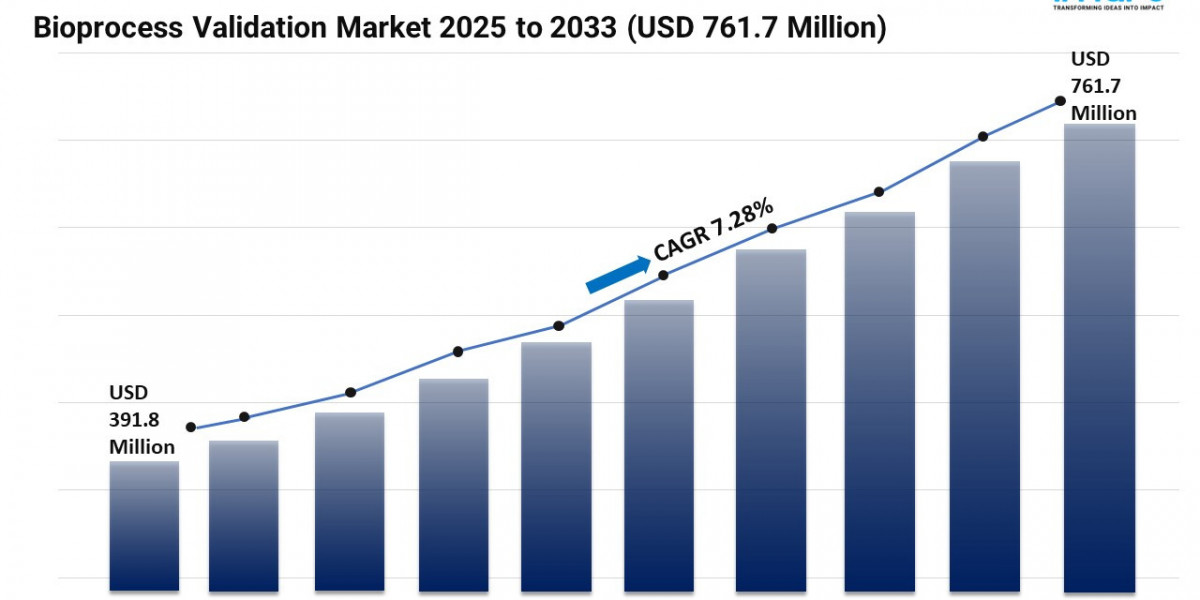

The Bioprocess Validation Market is experiencing steady expansion, driven by the Growing Production of Biopharmaceuticals, Implementation of Stricter Global Regulatory Frameworks and Rapid Technological Advancements in Analytics. According to IMARC Group's latest research publication, "Bioprocess Validation Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global bioprocess validation market size was valued at USD 391.83 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 761.67 Million by 2033, exhibiting a CAGR of 7.28% from 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/bioprocess-validation-market/requestsample

Our Report Includes:

- Market Dynamics

- Market Trends and Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Bioprocess Validation Market Industry:

- Growing Production of Biopharmaceuticals

The 2025 biopharmaceutical landscape is defined by a record-breaking volume of approvals for novel active substances. With the European Medicines Agency (EMA) and the FDA greenlighting an increasing number of personalized medicines and biosimilars, the complexity of manufacturing has escalated. Traditional validation models are being replaced by "Life Cycle Validation" approaches to accommodate the unique stability and purity requirements of advanced therapy medicinal products (ATMPs). This surge in production mandates rigorous process, analytical, and cleaning validation to ensure that high-potency biologics remain safe and efficacious throughout their multi-stage production cycles.

- Implementation of Stricter Global Regulatory Frameworks

Regulatory oversight in 2025 has moved toward a more integrated, risk-based approach. In early 2025, the FDA updated its "Computer Software Assurance (CSA) for Production and Quality System Software" guidance, encouraging manufacturers to utilize more efficient, data-centric validation for digital tools. Simultaneously, the global adoption of the ICH Q13 guidelines for continuous manufacturing has forced companies to implement real-time validation protocols. These stringent requirements, combined with the EMA’s intensified focus on Annex 1 (EU GMP) for contamination control, are compelling biopharma firms to invest heavily in comprehensive validation services to avoid costly batch rejections and regulatory delays.

- Rapid Technological Advancements in Analytics

Technological innovation in 2025 has turned bioprocess validation into a precision science. The integration of high-resolution analytical tools, such as Advanced Mass Spectrometry and HPLC, has significantly enhanced the sensitivity of impurity detection. A major catalyst this year is the widespread adoption of the ICH M10 guideline, which harmonizes bioanalytical method validation across major markets. Furthermore, the FDA’s endorsement of updated ISO standards for sterilization validation—such as the first edition of ISO 17665—highlights a global shift toward standardized, high-tech validation techniques that guarantee the sterility of complex bioprocesses.

Key Trends in the Bioprocess Validation Market

- Rising Demand for Extractables and Leachables (E&L) Testing

E&L testing remains the dominant segment in 2025, driven by the intense regulatory scrutiny of drug-container interactions. As biopharmaceuticals become more sensitive to minute contaminants, specialized testing to identify "migrables" from filters, tubing, and storage bags is critical. Current trends show a move toward automated E&L profiling, where high-throughput systems can cross-reference findings against global toxicity databases in real-time. This ensures that the increasing variety of plastic and elastomer components used in modern manufacturing does not compromise the purity or safety of the final therapeutic product.

- Growing Adoption of Single-Use Bioprocessing Systems (SUT)

The transition to Single-Use Technologies (SUT) is a defining trend of 2025, with the SUT market alone projected to exceed $10 billion. These disposable systems—bioreactors, bags, and filtration units—significantly reduce the need for cleaning validation (CIP/SIP), thereby accelerating facility turnaround times. However, their use creates a new demand for sterility and integrity validation specific to plastic interfaces. Manufacturers are now utilizing modular SUT "pods" that come pre-validated from vendors, allowing for rapid scale-up and greater flexibility in producing small-batch personalized therapies without the cross-contamination risks inherent in traditional stainless-steel systems.

- Integration of Digital Technologies and "Bioprocessing 4.0"

In late 2025, the industry has fully embraced the "Digital Twin" concept for bioprocess validation. By creating virtual replicas of production lines, manufacturers can simulate thousands of validation scenarios before physical execution, identifying potential deviations with AI-driven predictive modeling. The adoption of Process Analytical Technology (PAT) enables real-time monitoring of critical quality attributes (CQAs), allowing for "Real-Time Release" (RTR) of batches. This digital transformation reduces the time-to-market for life-saving drugs by replacing retrospective testing with continuous, automated verification throughout the entire manufacturing lifecycle.

We explore the factors driving the growth of the market, including technological advancements, consumer behaviors, and regulatory changes, along with emerging bioprocess validation market trends.

Leading Companies Operating in the Global Bioprocess Validation Market Industry:

- Almac Group

- Biozeen

- Doc S.R.L.

- Eurofins Scientific

- Hangzhou Anow Microfiltration Co. Ltd.

- Hangzhou Cobetter Filtration Equipment Co. Ltd.

- Hangzhou Tianshan Precision Filter Material Co. Ltd.

- Meissner Filtration Products, Inc.

- Merck KGaA

- Sartorius AG

- SGS SA

- Thermo Fisher Scientific Inc.

Bioprocess Validation Market Report Segmentation:

Breakup by Test Type:

- Extractables Testing Services

- Microbiological Testing Services

- Physiochemical Testing Services

- Integrity Testing Services

- Compatibility Testing Services

- Others

Extractables Testing Services exhibited a clear dominance in the market due to favorable market conditions and strong regulatory demand.

Breakup by Process Component:

- Filter Elements

- Media Containers and Bags

- Freezing And Thawing Process Bags

- Mixing Systems

- Bioreactors

- Transfer Systems

- Others

Filter Elements exhibited a clear dominance in the market due to favorable market conditions and strong demand for ensuring product purity and sterility.

Breakup by End User:

- Pharmaceutical and Biotechnology Companies

- Contract Development and Manufacturing Organizations

- Others

Pharmaceutical and Biotechnology Companies exhibited a clear dominance in the market due to favorable market conditions and strong regulatory compliance requirements.

Breakup by Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America dominated the global market due to abundant resources, favorable government initiatives, and well-established biopharmaceutical infrastructure.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1–201971–6302