IMARC Group, a leading market research company, has recently released a report titled "Steel Long Products Market by Type (Rebars, Wire Rods, Tubes, Sections), Application (Construction, Automotive and Aerospace, Railway and Highway, and Others), and Region 2025-2033." The study provides a detailed analysis of the industry, including the global steel long products market size, share, trends, growth and forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Steel Long Products Market Overview:

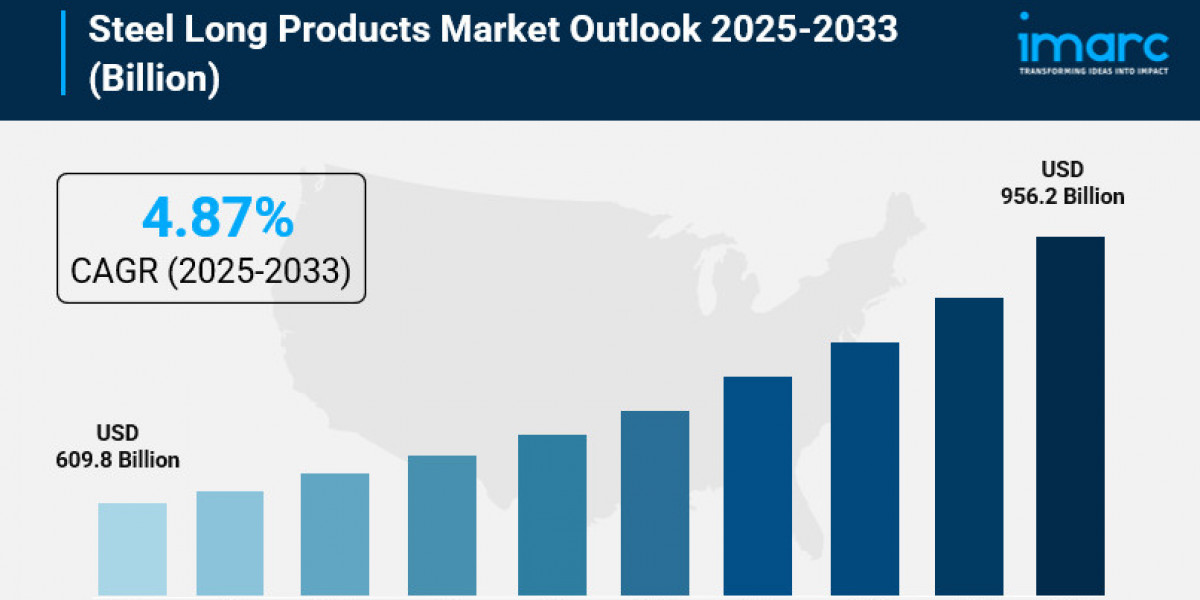

The global steel long products market size reached USD 609.8 Billion in 2024. It is expected to grow to USD 956.2 Billion by 2033, with a CAGR of 4.87% during the forecast period 2025-2033. The market growth is driven by rising adoption in the construction sector, extensive R&D activities, and increased infrastructural developments. These products are crucial in construction, automotive, aerospace, railway, and other industries requiring durable steel components.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

Steel Long Products Market Key Takeaways

- Current Market Size: USD 609.8 Billion in 2024

- CAGR: 4.87%

- Forecast Period: 2025-2033

- Rebars represent the largest market segment due to high demand in construction for reinforcing concrete.

- Asia Pacific is the dominant region owing to rapid economic growth, booming construction, and expanding automotive sector.

- Increasing shipbuilding activities propel demand as steel long products provide essential structural integrity.

- Growth in aerospace industry fuels demand for high-strength, lightweight steel components.

- Expansion of high-speed rail networks globally drives usage of durable steel long products in infrastructure.

Request Your Free “Steel Long Products Market” Insights Sample PDF: https://www.imarcgroup.com/steel-long-products-market/requestsample

Market Growth Factors

The growing demand in the construction industry is expected to drive the growth of the steel long products market during the forecast period. Rapid urbanization in developing as well as developed economies and the growing number of infrastructure projects across the globe are anticipated to drive demand. Furthermore, the automobile sector requires high strength steel material to manufacture automobile components subjected to high stresses. The growing demand for wind energy, along with the rising installation of wind turbines and transmission towers, is anticipated to increase the need for high strength, corrosion resistance, and improved strength optimized steel products.

The market is driven by new technology and innovations in the steel making processes that increase yield, quality and the rate of production improving productivity and profit in the steel industry. High-strength, low-alloy (HSLA) steels with high strength-to-weight ratios and corrosion resistance have a growing presence in aerospace and automotive applications to meet demanding industry requirements.

The prospects of rapid growth in shipbuilding and marine transport across the globe are expected to positively affect the global demand for steel long products. Steel long products are used for manufacturing strong, fuel-efficient, and environment-friendly ships that can withstand rough marine conditions. The recovery and expansion of the aerospace industry backed by rising defense spending and increasing demand for commercial aircraft are likely to augment the demand for high strength elongated steel parts. High-speed rail networks are also expected to drive the need for these products in infrastructure projects in Asia and Europe.

Market Segmentation

Breakup by Type:

- Rebars: The largest segment, used extensively for reinforcing concrete in construction, providing superior tensile strength.

- Wire Rods: Versatile in automotive, manufacturing, and construction for producing fasteners, wires, and cables.

- Tubes: Predominantly used in construction, automotive, and oil & gas industries due to demand from infrastructure, vehicles, and energy.

- Sections: Structural steel shapes crucial for commercial construction projects like bridges, warehouses, and towers due to high strength and flexibility.

Breakup by Application:

- Construction: Holds the majority market share; demand driven by rapid urbanization and need for robust infrastructure.

- Automotive and Aerospace: Demand fueled by requirements for lightweight, high-strength materials essential for vehicle and aircraft safety and performance.

- Railway and Highway: Demand from construction and maintenance of tracks and roads requiring durable, high-strength materials.

- Others

Breakup by Region:

- North America: Includes United States and Canada.

- Asia Pacific: Includes China, Japan, India, South Korea, Australia, Indonesia, and others; largest market share.

- Europe: Includes Germany, France, United Kingdom, Italy, Spain, Russia, and others.

- Latin America: Includes Brazil, Mexico, and others.

- Middle East and Africa

Asia Pacific dominates the global steel long products market due to rapid economic growth, thriving construction, and burgeoning automotive sectors. With extensive manufacturing capabilities and governmental policies supporting industrial growth and infrastructure development, Asia Pacific remains the hub of demand. Increasing urbanization and expanding middle-class populations further stimulate the region’s need for steel long products in diverse industries.

Recent Developments & News

- In June 2023, ArcelorMittal S.A. and John Cockerill announced plans to build the world's first industrial-scale low temperature iron electrolysis plant, producing 40,000 to 80,000 tonnes yearly starting in 2027.

- In May 2023, BaoSteel Co announced a joint venture with Saudi Aramco and the Public Investment Fund to establish a steel plate manufacturing base in Saudi Arabia, aiming for 2.5 million tonnes of direct reduced iron and 1.5 million tonnes of steel plate annually.

- In July 2023, HBIS Shisteel delivered high titanium alloy welding wires tested to 90Kg class strength for engineering machinery production.

Key Players

- ArcelorMittal S.A

- Baosteel Group

- Evraz plc

- Gerdau S/A

- Hbis Group Co. Ltd.

- Hyundai Steel

- JFE Steel Corporation

- Nippon Steel Corporation

- POSCO Holdings Inc.

- Tata Steel Long Products Limited

Ask Analyst For Request Customization: https://www.imarcgroup.com/request?type=report&id=7072&flag=C

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302