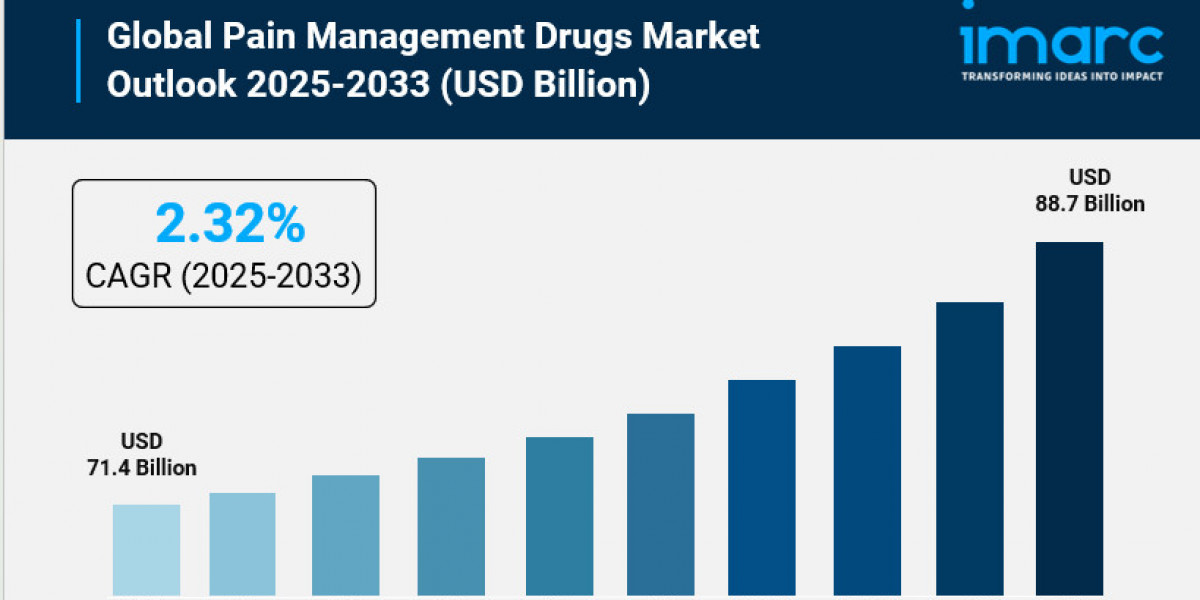

The global Pain Management Drugs Market reached USD 71.4 Billion in 2024 and is projected to grow to USD 88.7 Billion by 2033, at a CAGR of 2.32% during the forecast period 2025-2033. This growth is fueled by the rising prevalence of chronic diseases, advancements in pain management therapies, increased awareness, and government support, along with higher demand for effective post-operative pain control. The study provides a detailed analysis of the industry, including the Pain Management Drugs Market report, trends, growth, size, and industry growth forecast.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

Pain Management Drugs Market Key Takeaways

- Current Market Size: USD 71.4 Billion (2024)

- CAGR: 2.32%

- Forecast Period: 2025-2033

- The market experiences steady growth propelled by an increasing incidence of chronic diseases such as arthritis and cancer.

- There is a marked shift towards non-opioid medications due to global opioid concerns.

- North America holds the largest market share due to advanced healthcare and chronic pain prevalence.

- Technological advancements and personalized medicine are significant growth drivers.

- Hospital pharmacies dominate distribution channels, reflecting the need for monitored use of strong pain medications.

Request for a Free Sample Report: https://www.imarcgroup.com/pain-management-drugs-market/requestsample

Market Growth Factors

Increasing Prevalence of Chronic Diseases

The market grows from the chronic disorders rising in prevalence like arthritis, cancer, diabetes, and heart disease. These disorders require pain management drugs. The report indicates that an increase in older people at risk for continuing illness like osteoarthritis and neuropathic pain should move the pain management drugs market. Obesity and lack of activity increase risk factors for comorbidities and increase the need for multimodal pain management interventions.

Rapid Advancements in Pain Management Therapies

Technology improves to ease creation of newer and more powerful biologics or targeted molecules. The molecules reduce the side effect profile and improve efficacy. Pharmaceutical companies have invested meaningful resources to develop molecules with a better pain profile since the market expands due to personalized medicine and pharmacogenomics advancements. These improvements can lead toward safer and more tailored pain management.

Growing Awareness and Government Support

This market may be expanded through efforts to raise awareness among healthcare professionals and patients, timely approval of drugs, orphan drug designations, reimbursement policies regarding pain medications, increasing the involvement of health professionals in under-served areas, and funding research and development to foster innovation and address patient needs.

Market Segmentation

Breakup by Drug Class:

- NSAIDs

- Anesthetics

- Anticonvulsants

- Antimigraine Agents

- Antidepressants

- Opioids

- Others

Opioids comprise the largest category of sales, and are indicated for moderate to severe pain when other analgesics have failed. NSAIDs are indicated for pain and inflammation. This is particularly true of acute onset because of dual analgesic and anti-inflammatory effects. Local anesthetics and general anesthetics offer pain relief during surgery. Both continue to be refined to improve safety. Anticonvulsants are often used in treating neuropathic pain and antimigraine drugs treat migraine. Chronic pain antidepressants act on neurotransmitters.

Breakup by Indication:

- Musculoskeletal Pain

- Surgical and Trauma Pain

- Cancer Pain

- Neuropathic Pain

- Migraine Pain

- Obstetrical Pain

- Fibromyalgia Pain

- Burn Pain

- Dental/Facial Pain

- Pediatric Pain

- Others

Musculoskeletal pain was the primary type, with arthritis and osteoporosis being the leading causes, linked to an aging population. Surgical and trauma pain specialists focus on post-operative and post-injury pain management. Pain caused by cancer is treated with opioids. Neuropathic pain caused by nerve damage may be treated with anticonvulsants or antidepressants. Migraine pain targets the pain of headaches. Obstetrical pain targets the pain of the labor of childbirth. Complementary therapies are used for fibromyalgia. Burn pain is treated systemically, topically. Dental/facial pain is treated with NSAIDs and anesthetics. For children, a pediatric dose is used.

Breakup by Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Hospital pharmacies supply controlled drugs to treat acute pain in inpatient care. Retail pharmacies give over-the-counter drugs and prescription drugs to outpatients who have chronic pain, frequently from the same pharmacy. Online pharmacies are convenient, affordable, and private due to improvements in digital health.

Breakup by Region:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

Chronic pain prevails in North America, its healthcare infrastructure is mature, new drugs are available there, and its drug regulatory policies are strong, so North America shares the largest portion of the market. Europe is ranked second because the elderly population is growing. Asia Pacific's growth is due to improved infrastructure. Latin America in addition to the Middle East and Africa are expected to see growth due to better healthcare access and increased government support.

Regional Insights

North America dominates the pain management drugs market mainly for chronic pain's greater prevalence, healthcare infrastructure's improvement, and more pharmaceutical companies' engagement in research and development. The number of surgical procedures with post-operative pain relief, and the stringent regulatory environment, are also expected to drive the market.

Recent Developments & News

In November 2023, Par Pharmaceutical, Inc. a subsidiary of Endo International plc, began shipment of colchicine 0.6 mg capsules a generic version of Hikma's MITIGARE. Bausch Health Companies, Inc. announced positive topline results in December 2023. The results came from a global Phase 2 trial of Amiselimod for the treatment of UC. Amiselimod is a selective sphingosine 1-phosphate (S1P) antagonist. In early June 2021, Eli Lilly & Company and Incyte reported they reduced pain with the OLUMIANT (baricitinib) 4 mg tablet and eased morning stiffness in patients affected by moderate to severe rheumatoid arthritis.

Key Players

- Abbott Laboratories Inc.

- AbbVie Inc.

- Bausch + Lomb

- Bayer AG

- Eli Lilly & Company

- GSK plc

- Pfizer Inc.

- Purdue Pharma L.P.

- Sanofi S.A

- Viatris Inc

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302